Friday Trade Review:

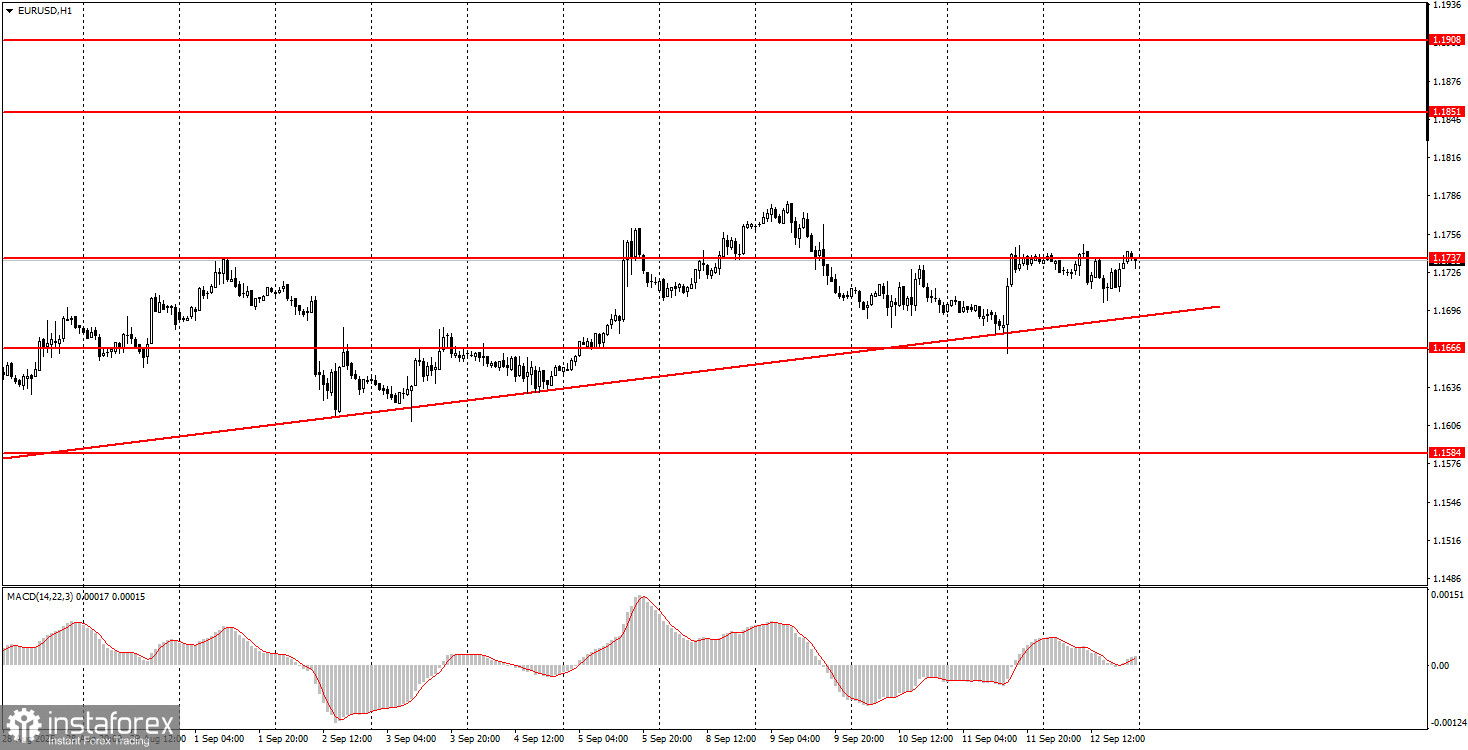

1H Chart of EUR/USD

The EUR/USD currency pair showed absolutely no interesting movements on Friday. Only two reports throughout the day could have theoretically attracted traders' attention. In the morning, Germany released the second estimate of the consumer price index for August. Unsurprisingly, the second estimate matched the first, prompting no market reaction. In the second half of the day, the US Consumer Sentiment Index was released, which declined noticeably compared to August, from 58.2 points to 55.4 points. This report could have triggered a drop in the dollar, but it didn't. The day's total volatility was 45 pips, which eloquently speaks to traders' current willingness to participate in the market. Recall that low volatility has now been observed for about a month. It can't be said that there were no movements during this period, but in most cases, they were extremely weak. Currently, the uptrend remains on the hourly timeframe, as indicated by the trendline, but the dollar, despite having reasons, is in no hurry to keep falling.

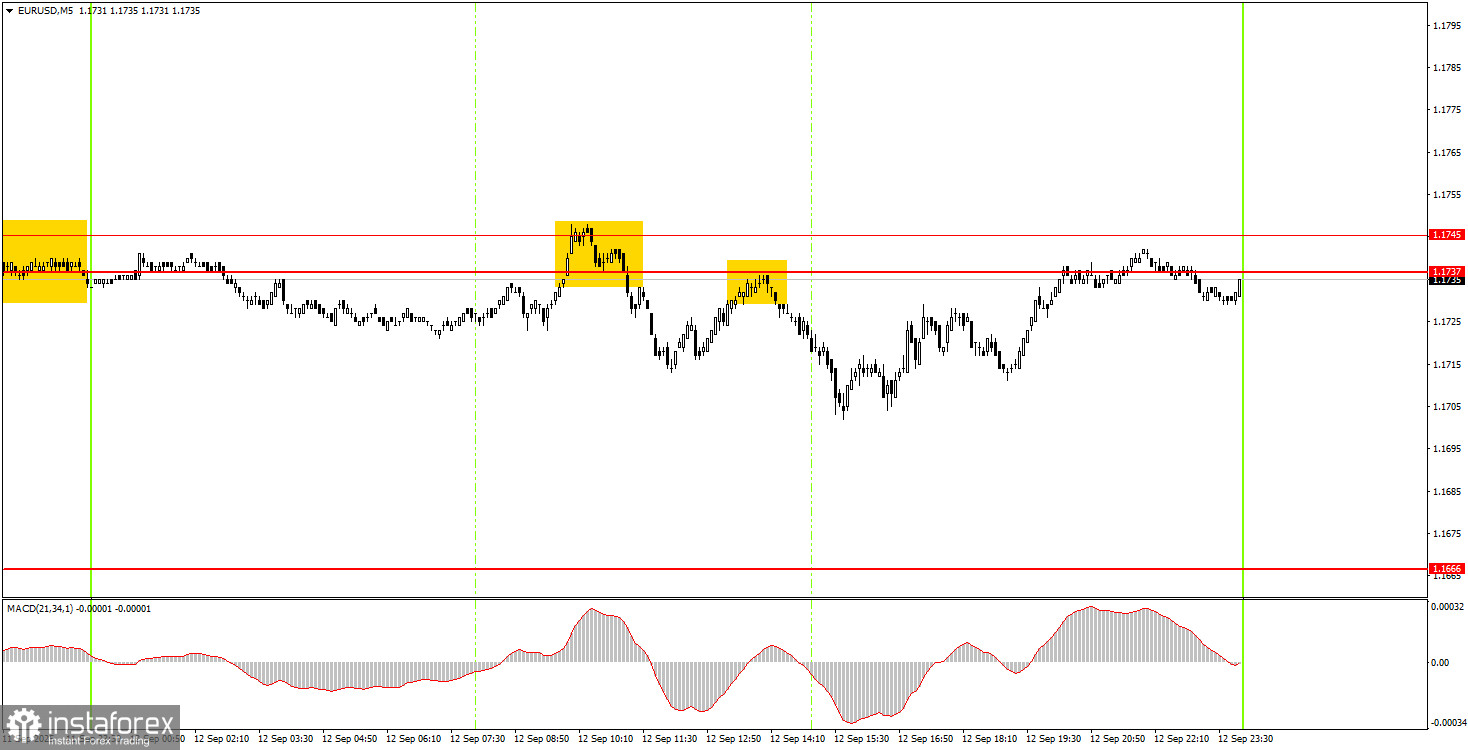

5M Chart of EUR/USD

On the 5-minute TF on Friday, two sell signals were formed, both bounces from the 1.1737-1.1745 area. Due to very low volatility, the target level of 1.1666 was not reached and did not even stand a chance of being fulfilled. Deals could only be closed at a profit manually. For both trades, you could have set the Stop Loss to breakeven to avoid any possible losses.

How to Trade on Monday:

On the hourly timeframe, the EUR/USD pair has every chance to resume the uptrend that has been forming since the start of this year. Both the fundamental and macroeconomic backgrounds remain bad for the US dollar, so we still do not expect a strengthening of the American currency. In our view, as before, the US currency can only count on technical corrections. However, a consolidation below the trendline could trigger a new wave of technical declines in the pair.

On Monday, the EUR/USD pair may continue a weak northward movement, as the trend remains upward. However, for new long positions, the 1.1737-1.1745 area must be overcome. The target is 1.1808.

On the 5-minute TF, consider the following levels: 1.1198-1.1218, 1.1267-1.1292, 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527, 1.1571-1.1584, 1.1655-1.1666, 1.1737-1.1745, 1.1808, 1.1851, 1.1908. On Monday, ECB President Christine Lagarde is scheduled to speak in the Eurozone, but we do not expect any significant statements from the head of the central bank. The ECB met just a couple of days ago, and Lagarde has already provided all the necessary information to the markets. Most likely, we are in for another "boring Monday."

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.