In previous outlooks, I concluded that the fate of both major pairs once again largely depends on the news flow from the United States. And this isn't just about the events listed in the classic forex calendars, but also the developments surrounding the Trump vs. Fed standoff, the trade war, and the resolution of the conflict in Ukraine. Still, for now, these events are not having a strong direct impact on the FX market.

The key event will be the Federal Reserve meeting, even if the decision is already priced in. Nobody in the market doubts that the interest rate will be cut by 25 basis points for the first time since last year. However, labor market weakness is intensifying dovish expectations among traders—this time with good reason. According to CME FedWatch, the probability of three rate cuts before year-end is 74%. This means market participants fear serious labor market "cooling" and expect decisive action from the Fed. Personally, I find it unclear how the Fed will manage inflation, which will inevitably rise even further if there are three rate cuts. But that's precisely what Jerome Powell should clarify.

Powell may hint at two rounds of easing, something FOMC policymakers have spoken about for a while. That would signal the Fed remains focused on the labor market, but doesn't plan to let inflation get out of hand. The alternative scenario is that Powell emphasizes the labor market's weakness and importance, which the market could interpret as a signal for three cuts by year-end. What happens in 2026 is anyone's guess, since no one knows yet what the FOMC's composition will be.

All in all, three rate cuts would give the market a fresh reason to reduce demand for the US dollar—precisely what's expected according to the current wave count. Hints at only two rounds of easing could enable the dollar to stay in the same range it's traded for the past several months.

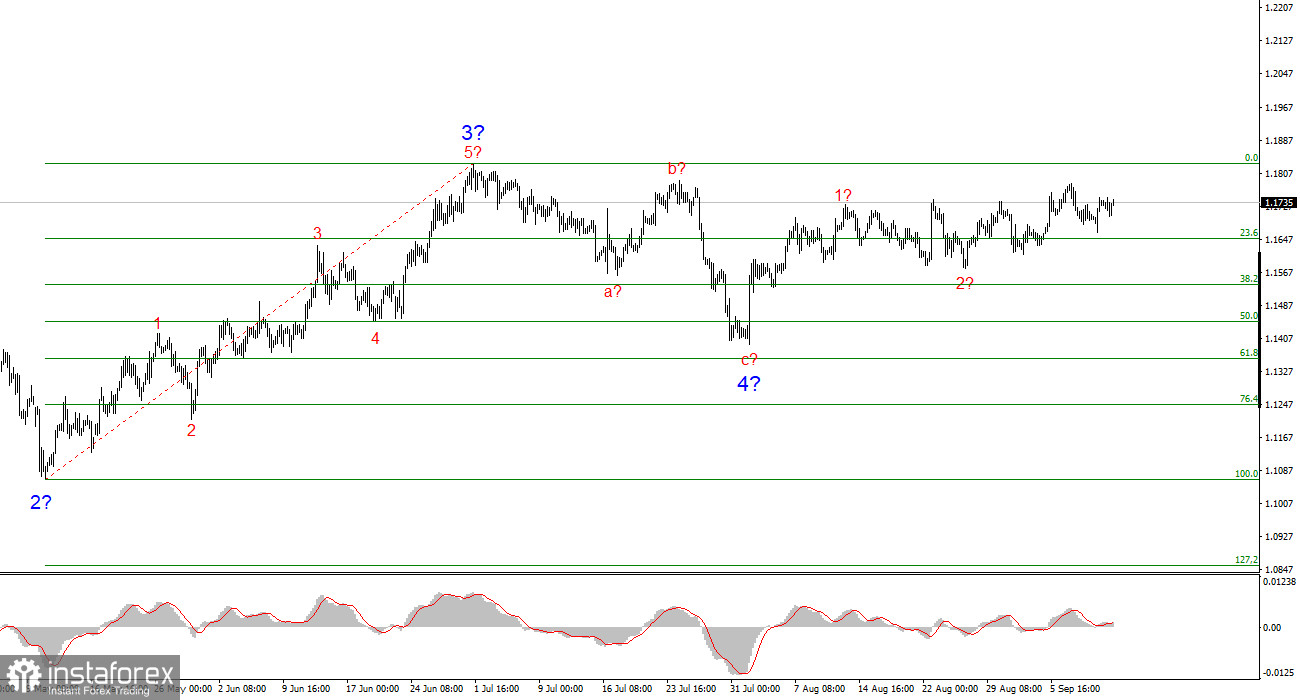

Wave Picture for EUR/USD

Based on my analysis, EUR/USD continues to develop its upward trend segment. The wave structure still completely depends on the news flow regarding Trump's decisions, as well as the external and internal politics of the new Administration. The wave's target may reach the 1.25 area. Given the consistent news environment, I continue to consider long positions, targeting levels near 1.1875 (the 161.8% Fibonacci level) and above.

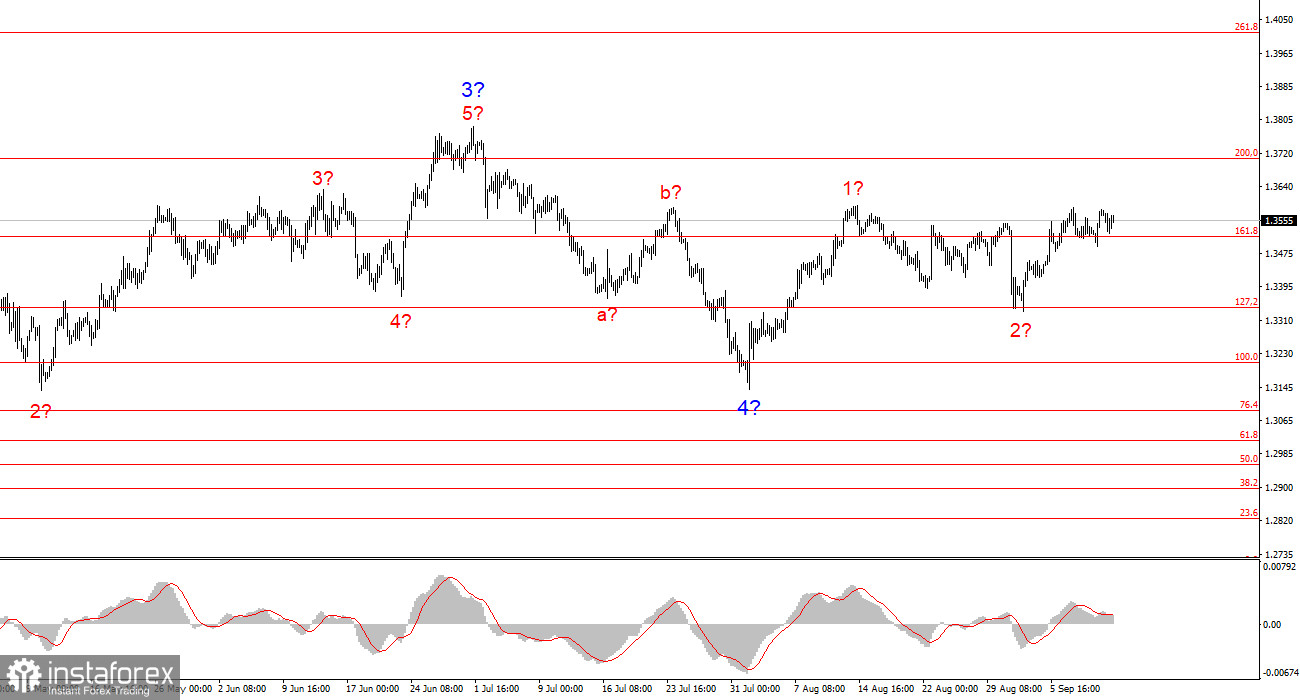

Wave Picture for GBP/USD

The wave structure for GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, markets may see plenty of shocks and reversals, which could notably impact the wave pattern, but for now, the working scenario remains intact, and Trump's policy remains unchanged. The upward trend segment's targets are near the 261.8% Fibonacci level. Currently, I expect continued growth within wave 3 of 5, aiming for 1.4017.

My Key Analytical Principles:

- Wave structures should be simple and clear. Complex structures are harder to trade and tend to change.

- If you are not confident about the market situation, it's better to stay out.

- There is never 100% certainty in market direction. Do not neglect protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.