Macroeconomic Report Analysis:

There are plenty of macroeconomic releases scheduled for Tuesday. None of these is extremely important, but each carries some weight and may impact the market. The U.K. unemployment rate is on the rise. The higher it goes, the more the Bank of England will need to cut rates. But inflation, which is also rising, prevents it from doing so. Inflation remains the more critical metric. Jobless claims and wage data are less important.

In the Eurozone today, industrial production will be published; in Germany, the ZEW economic expectations index; in the U.S., industrial production and retail sales. All of these may provoke reactions if actual figures deviate from forecasts.

Fundamental Events Analysis:

There are no notable fundamental events on Tuesday. Fed officials currently cannot give interviews or make policy statements. The same applies to BoE representatives. The ECB meeting was held just last week, providing all necessary information about the European economy and monetary policy outlook. Today, the focus will be on macro data.

General Conclusions:

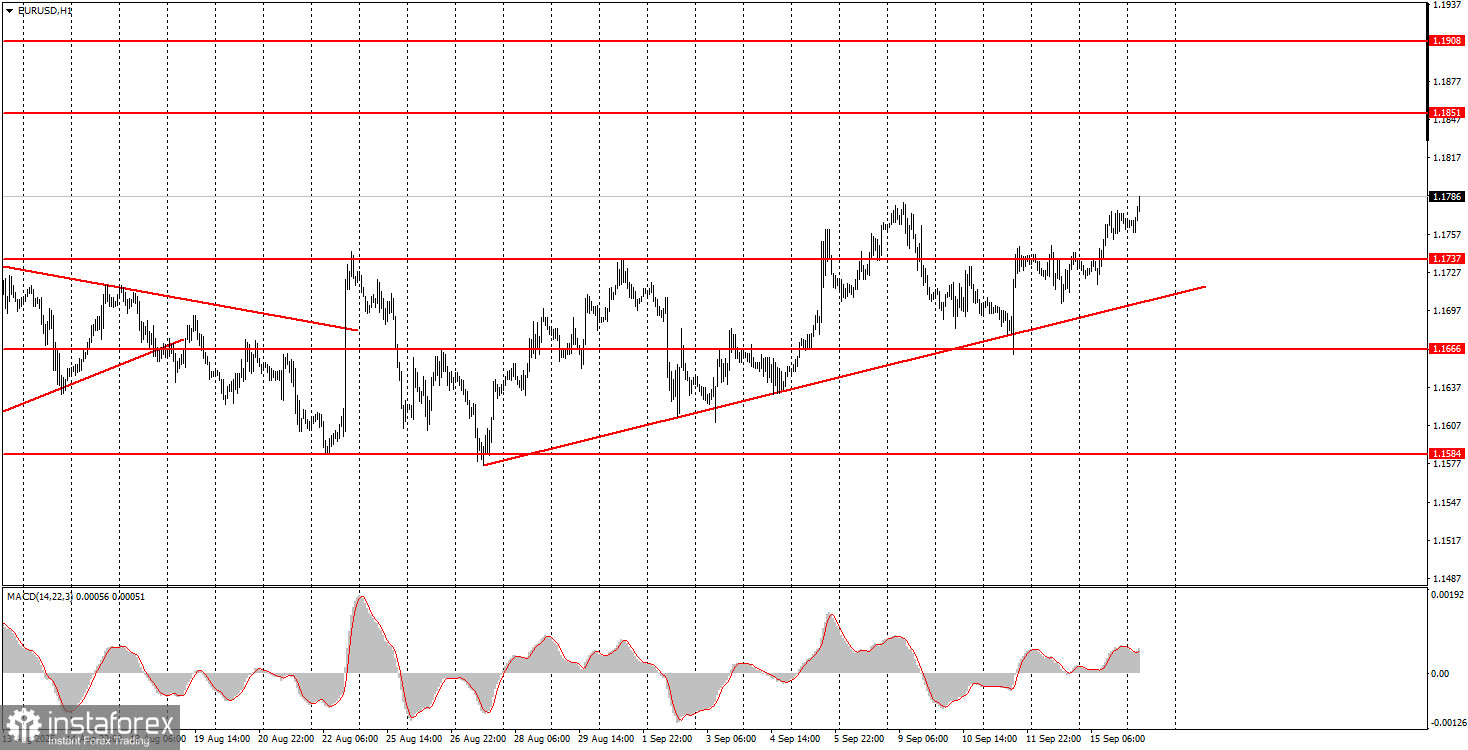

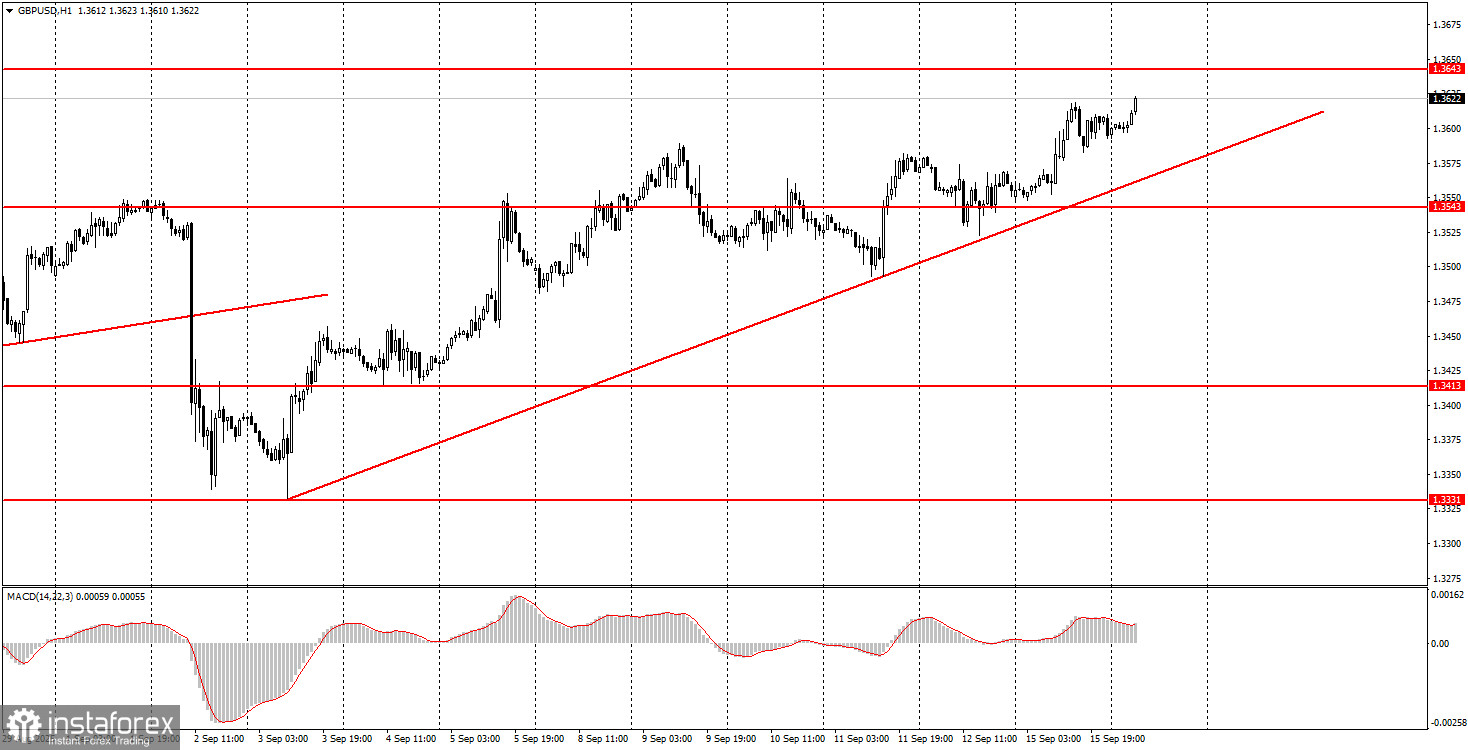

On the second trading day of the week, both pairs may continue upward, but new buy signals are needed. Both the euro and the pound have broken through key resistance areas and may advance toward their respective targets. For the euro, the target is 1.1808; for the pound, the 1.3643–1.3652 area. Macro data may trigger several intraday reversals.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.