Trade analysis and tips for trading the Japanese yen

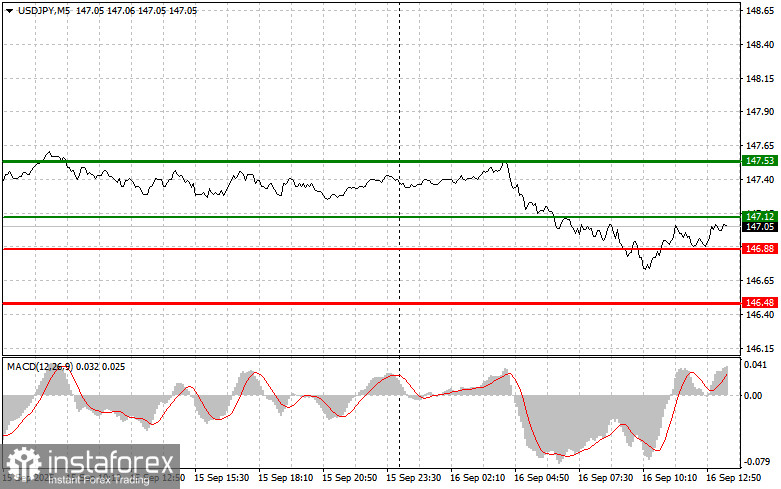

The test of 146.88 in the first half of the day occurred when the MACD indicator had already moved well below the zero line, which limited the pair's downward potential. A second test of 146.88, at the moment when MACD was in the oversold area, led to the implementation of Buy Scenario #2 and a 15-point rise in the yen.

In the second half of the day, U.S. data will be released on August retail sales, industrial production, and manufacturing output. Weak figures would trigger another wave of yen strength, as the currency has recently shown signs of stabilization after a period of high volatility.

A decline in U.S. retail sales would clearly signal weakening consumer demand, which in turn would reinforce concerns about slowing economic growth. Reduced industrial and manufacturing output would confirm this trend, putting additional pressure on the dollar. In this context, the yen — viewed as a safe-haven asset — could strengthen significantly as investors seek to reduce risk. The Bank of Japan, despite its cautious wait-and-see policy, has recently signaled the possibility of revising its strategy in the future. Expectations of such changes, combined with potential dollar weakness due to soft data, create a favorable environment for yen appreciation. Investors will closely watch the releases and market response to assess the potential for further strengthening of the Japanese currency.

As for intraday strategy, I will rely more on Scenarios #1 and #2.

Buy signal

Scenario #1: I plan to buy USD/JPY today at the entry point around 147.12 (green line on the chart), targeting 147.53 (thicker green line on the chart). Around 147.53, I will exit buys and open sales in the opposite direction, aiming for a 30–35-point pullback. A rise in the pair can only be expected after strong U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of 146.88, at the moment when the MACD indicator is in the oversold area. This would limit the pair's downward potential and trigger a reversal upward. Growth toward 147.12 and 147.53 can be expected.

Sell signal

Scenario #1: I plan to sell USD/JPY today after a break below 146.88 (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 146.48, where I will exit sales and immediately open buys in the opposite direction, aiming for a 20–25-point pullback. Pressure on the pair will return today if U.S. data is weak. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of 147.12, at the moment when the MACD indicator is in the overbought area. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 146.88 and 146.48 can be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – expected price for placing Take Profit or manually fixing profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – expected price for placing Take Profit or manually fixing profit, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to use overbought and oversold areas as guidance.

Important. Beginner traders in the Forex market should be very cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you don't use money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are, by definition, a losing strategy for intraday traders.