Bitcoin is knocking on the $117,000 level, while Ethereum isn't feeling too confident, trading around the same levels as at the week's start.

While markets await a rate cut from the US Federal Reserve and another push toward all-time highs, analytics firm Santiment notes that ahead of the FOMC meeting, greed and bullish sentiment for BTC have reached a 10-week high, which historically is "bearish."

This fact should raise some concern among investors and analysts. Excessive optimism and belief in nonstop growth usually precede a correction or, worse, a deeper drop. Financial history is full of examples where euphoria turned into disappointment. Growing greed, amplified by falling rates, can potentially overheat the market. Investors, driven by the fear of missing out (FOMO), begin to buy assets without regard to fundamentals. Eventually, this bubble can burst, leaving many market participants at a loss.

On the other hand, it's important to remember that market sentiment is just one factor influencing prices. Fundamentals and central bank actions play a crucial role. So, rushing to conclusions based solely on sentiment analysis can be a mistake.

Intraday crypto strategy: I'll continue to focus on buying into any major dips in Bitcoin and Ethereum, betting on the still-intact medium-term bull trend.

Short-term trading strategy and conditions are outlined below.

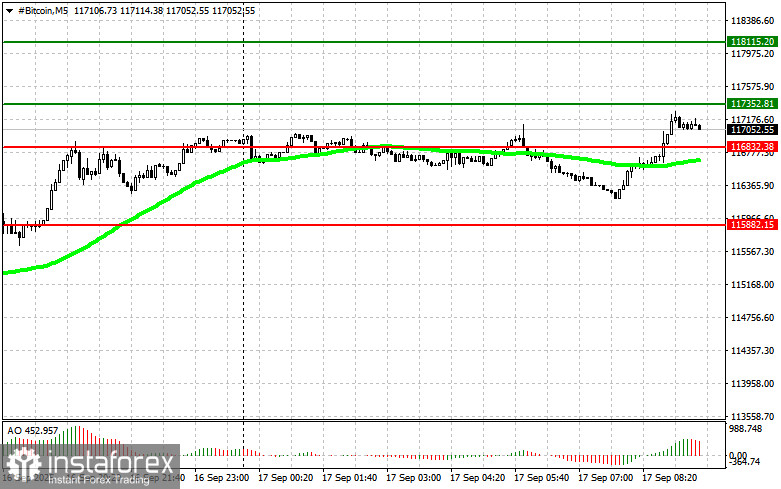

Bitcoin

Buy Scenario

- Scenario #1: Buy Bitcoin today if it reaches an entry point around $117,300, targeting a rise to $118,100. Around $118,100, exit longs and sell on the bounce. Before buying a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Bitcoin from the lower boundary at $116,800 if there's no bearish reaction, aiming for a reversal up to $117,300 and $118,100.

Sell Scenario

- Scenario #1: Sell Bitcoin today if it hits $116,800, targeting a fall to $115,800. Around $115,800, exit shorts and buy on the bounce. Before entering a breakout short, check that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Bitcoin from the upper boundary at $117,300 if the breakout fails, aiming for a drop to $116,800 and $115,800.

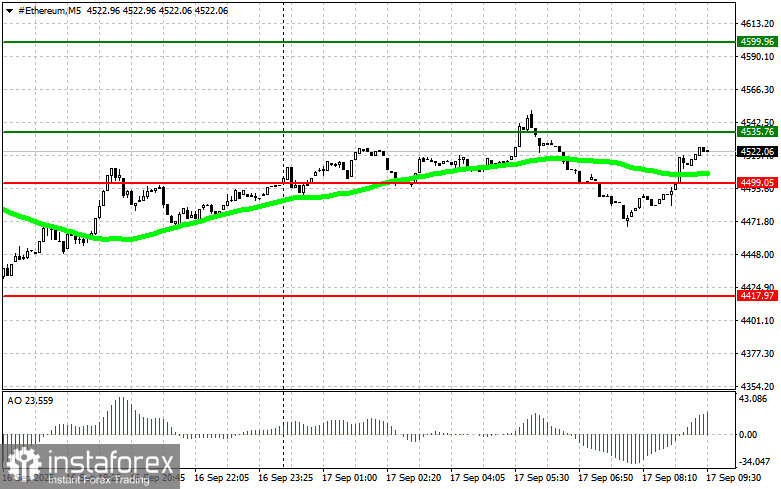

Ethereum

Buy Scenario

- Scenario #1: Buy Ethereum today if it reaches an entry near $4,535, targeting a rise to $4,599. Around $4,599, exit longs and sell on the bounce. Before entering a breakout long, check that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Ethereum from the lower boundary at $4,499 if there's no bearish reaction, targeting $4,535 and $4,599.

Sell Scenario

- Scenario #1: Sell Ethereum at $4,499, targeting a drop to $4,417. Around $4,417, exit shorts and buy on the bounce. Before entering a breakout short, verify the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Ethereum from the upper boundary at $4,535 if the breakout fails, targeting $4,499 and $4,417.