Wednesday Trade Review:

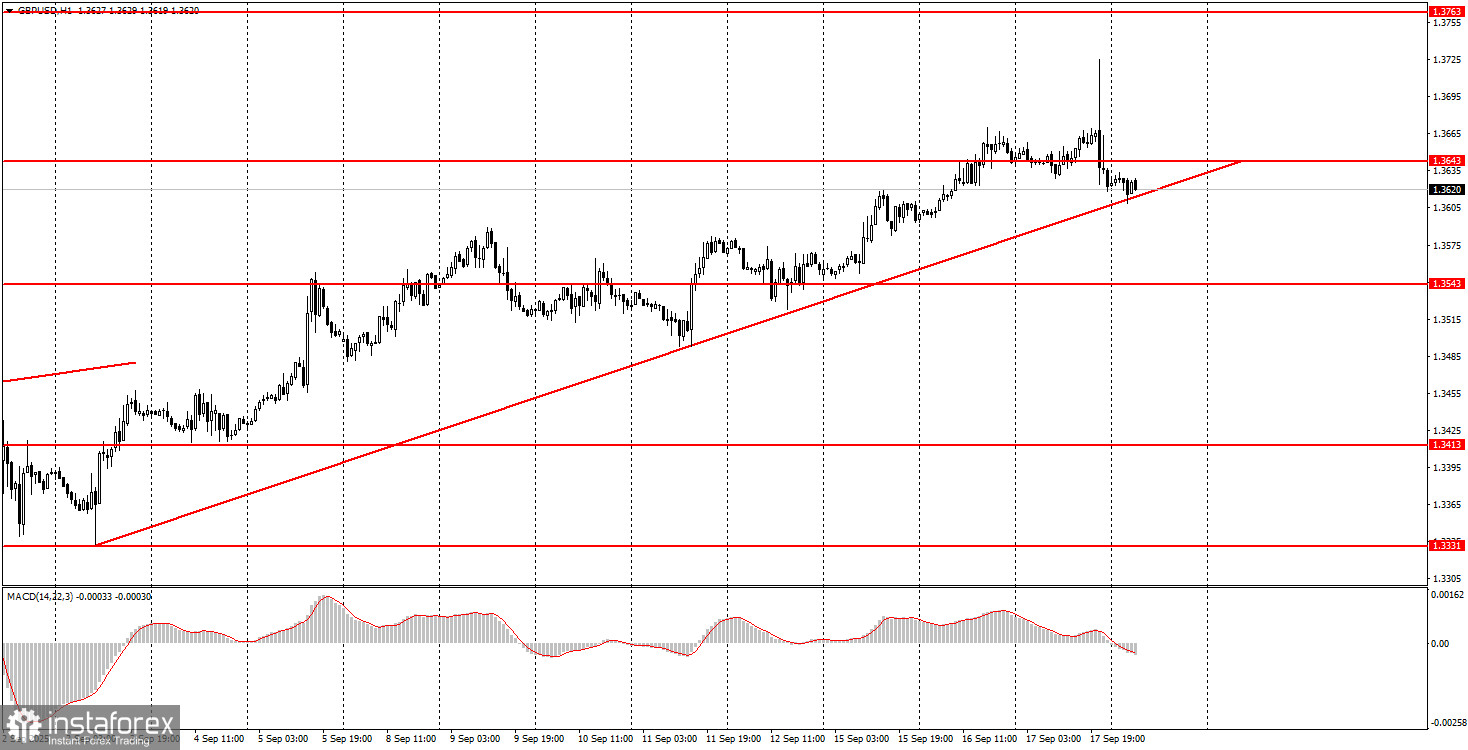

1H Chart of GBP/USD

The GBP/USD pair on Wednesday showed movements similar to those of the EUR/USD pair. In the morning, the U.K. released an important inflation report, but its significance turned out to be as "bland" as other reports this week. Traders barely noticed it. Inflation in the U.K. remained at 3.8%, which will not affect today's Bank of England decision in any way. The British central bank will, without question, keep monetary policy parameters unchanged, and the main intrigue lies in how the votes of Monetary Policy Committee members will be distributed in the rate decision. Even if the BoE meeting turns out more "dovish" than expected, the pound may fall slightly, but the global uptrend will not be cancelled. At present, the dollar has accumulated so many global fundamental negatives that it could continue to decline for several more years. Donald Trump is regularly adding to this negative background for the U.S. currency.

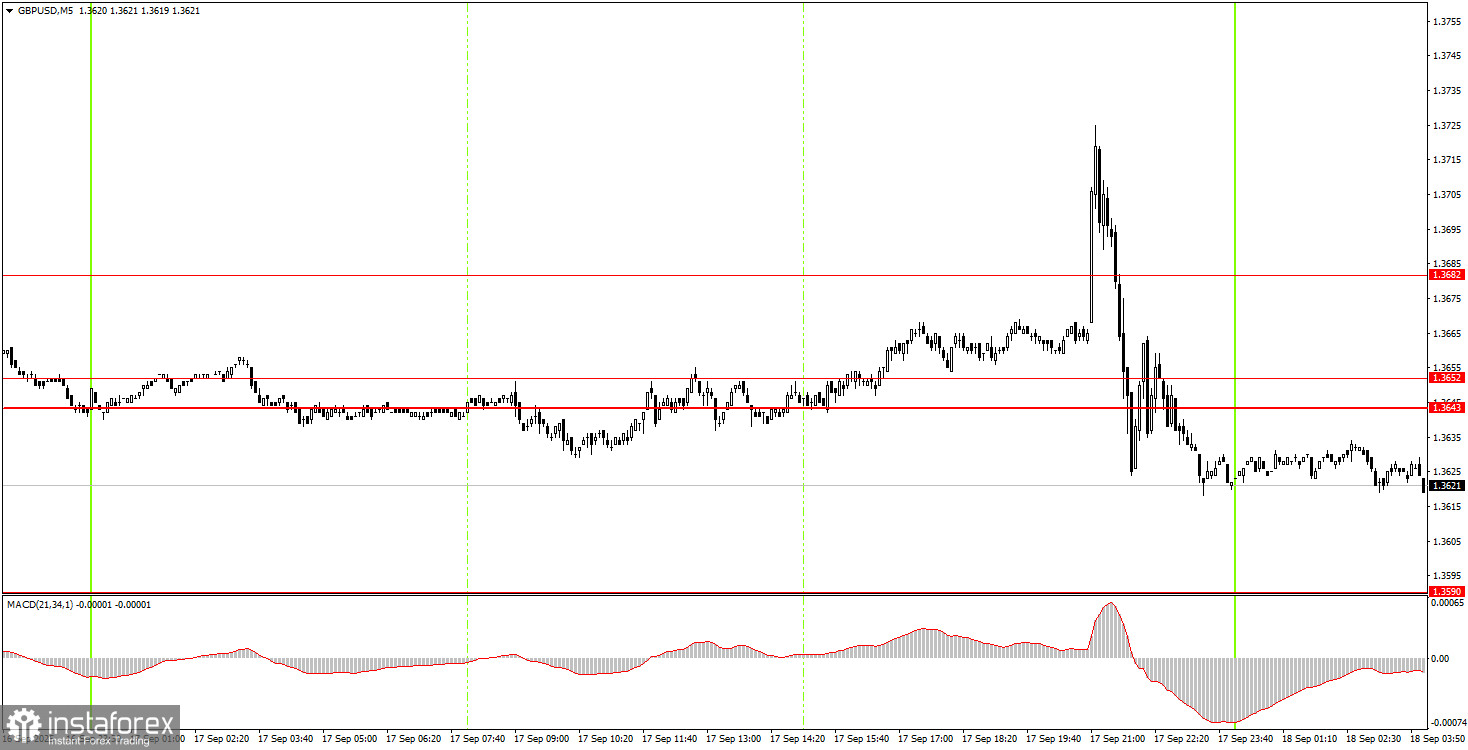

5M Chart of GBP/USD

On the 5-minute TF on Wednesday, several trading signals were formed. First, the pair either bounced from or broke through the 1.3643–1.3652 area from top to bottom, and then moved back in the opposite direction. The first signal was false, while the second could have generated profit if novice traders managed to close long positions in the 10 minutes after the Fed's announcement, during which the pair rallied sharply.

How to Trade on Thursday:

On the hourly TF, GBP/USD continues its uptrend, while on higher TFs it shows signs of resuming the "2025 trend." As mentioned before, we see no grounds for medium-term dollar growth, so we expect further strengthening of the British currency. In the next 24 hours, market movements may be volatile and erratic. While the price remains above the trendline, the uptrend is intact.

On Thursday, the GBP/USD pair may well resume its upward advance, as the price remains above the trendline. However, for the second day in a row, the fundamental background will exert a strong influence on market sentiment.

On the 5-minute TF, trading can be based on the following levels: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. On Thursday, the BoE will announce its policy decision, which could impact both the pound and the euro. From a technical standpoint, the pair's growth may resume, but a more "dovish" vote on rates could trigger another decline in the British pound.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.