In a situation of two-sided risks, there is no risk-free path. Treat the rate cut as a reduction in risk management. How should risky assets have reacted to Jerome Powell's rhetoric? Correct — with a roller coaster ride! Stocks initially surged, then plunged, but by the close of the trading session managed to recover their lost positions. The "bulls" lined up to buy the dip in the S&P 500 and were rewarded.

After a nine-month pause, the Fed resumed its cycle of monetary easing. Markets expected this, but the fact that the FOMC forecasts pointed to two more federal funds rate cuts by the end of the year became a rally catalyst. Then came the classic "sell the fact after buying the rumor," and the S&P 500 sank to a weekly low.

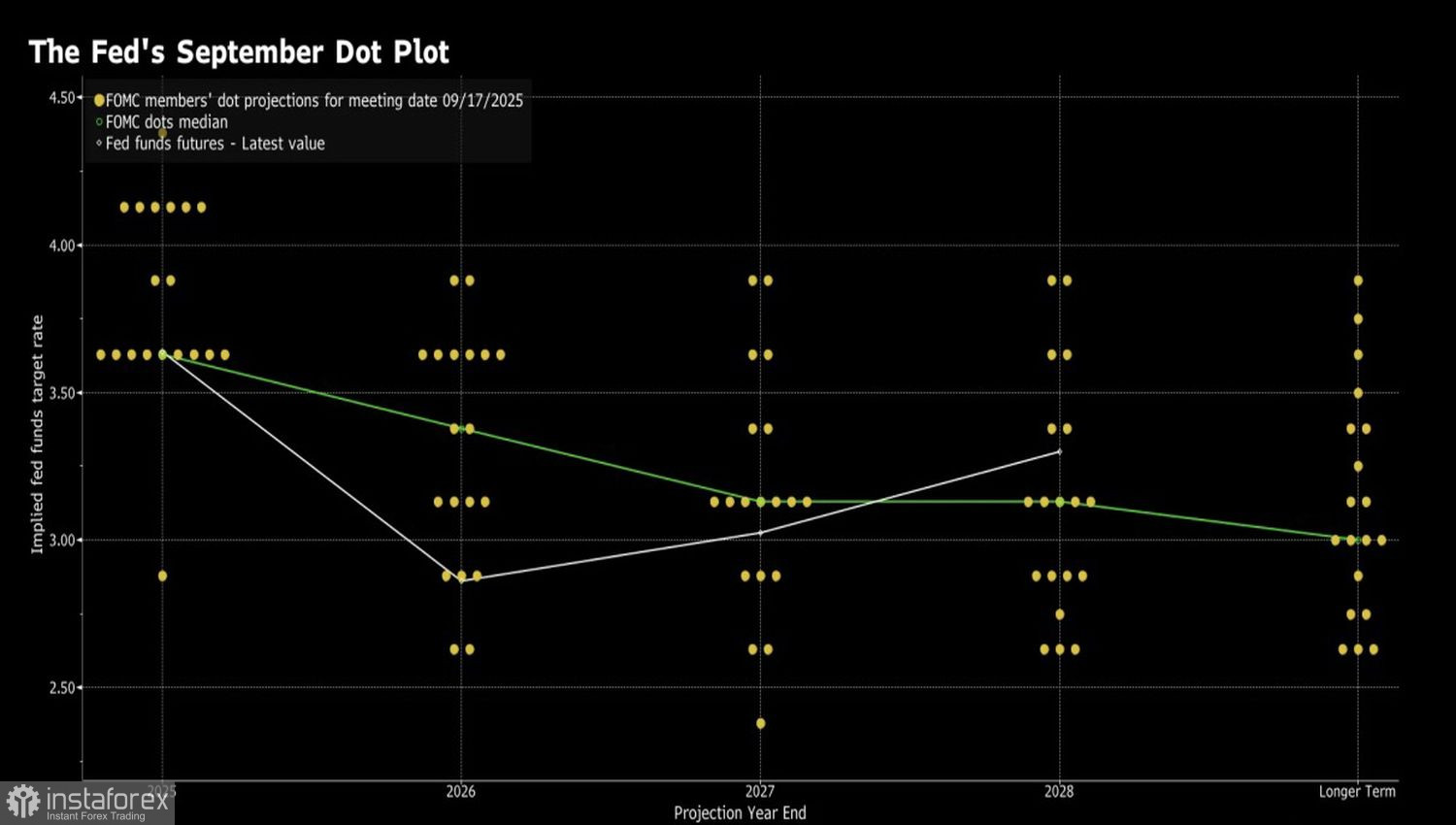

FOMC Rate Forecasts

The broad stock index was disappointed to see only one dissenter within the Committee — Stephen Mirran. What about Trump's earlier appointees, Christopher Waller and Michelle Bowman? Did they lose the beauty contest? The grand prize could have been the Fed chairmanship.

Was the S&P 500 also upset that the September forecasts from FOMC officials included just two acts of monetary easing in 2025, one in 2026, and another in 2027? That implies a federal funds rate cut of 100 bps to 3.25%, not below 3% as the market had hoped — and not as quickly.

In reality, there is no reason to despair. History shows that over the past 50 years, when the Fed lowered borrowing costs while the S&P 500 stood within 1% of a record high, in 13 out of 16 cases the broad index rose over the following six weeks.

Combined with a still-strong U.S. economy, the bulls' intent to buy the dip in the S&P 500 looks logical. In its updated projections, the Fed raised GDP growth estimates for 2025 from 1.4% to 1.6% and for 2026 from 1.6% to 1.8%. The forecast for core inflation at year-end remained unchanged at 3.1%.

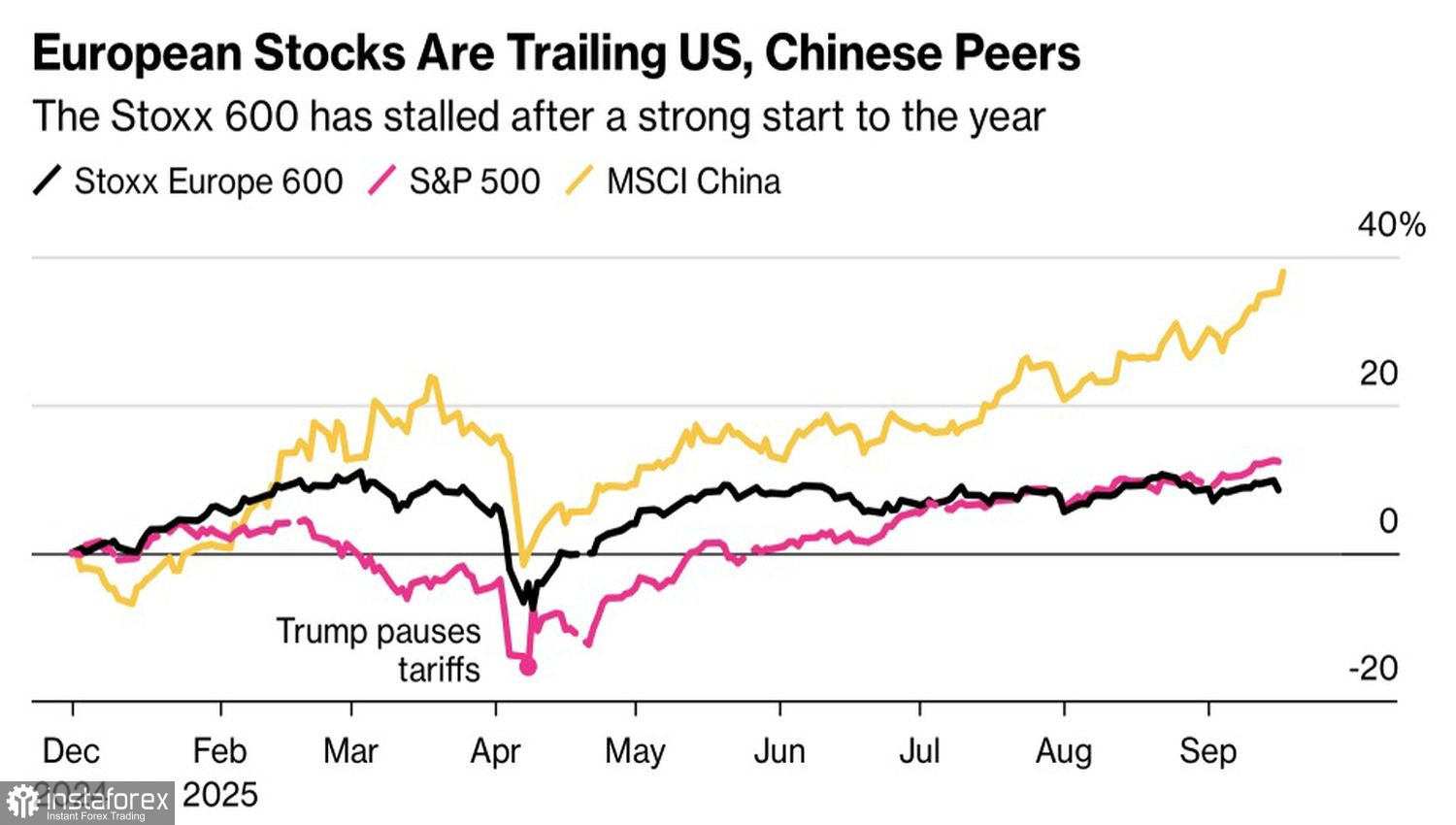

Performance of U.S., European, and Chinese Stock Indexes

The U.S. stock market looks solid and draws far more attention than its competitors. Despite gains in Chinese and European indexes, investors remain cautious on Asia due to the gradual effects of U.S. tariffs on exports and economies. In Europe, according to Goldman Sachs, there is skepticism regarding Germany's announced fiscal stimulus measures. Markets prefer to see implementation before committing.

Thus, the continuation of the Fed's monetary easing cycle and weaker rivals allow the S&P 500 to look forward to an extended rally.

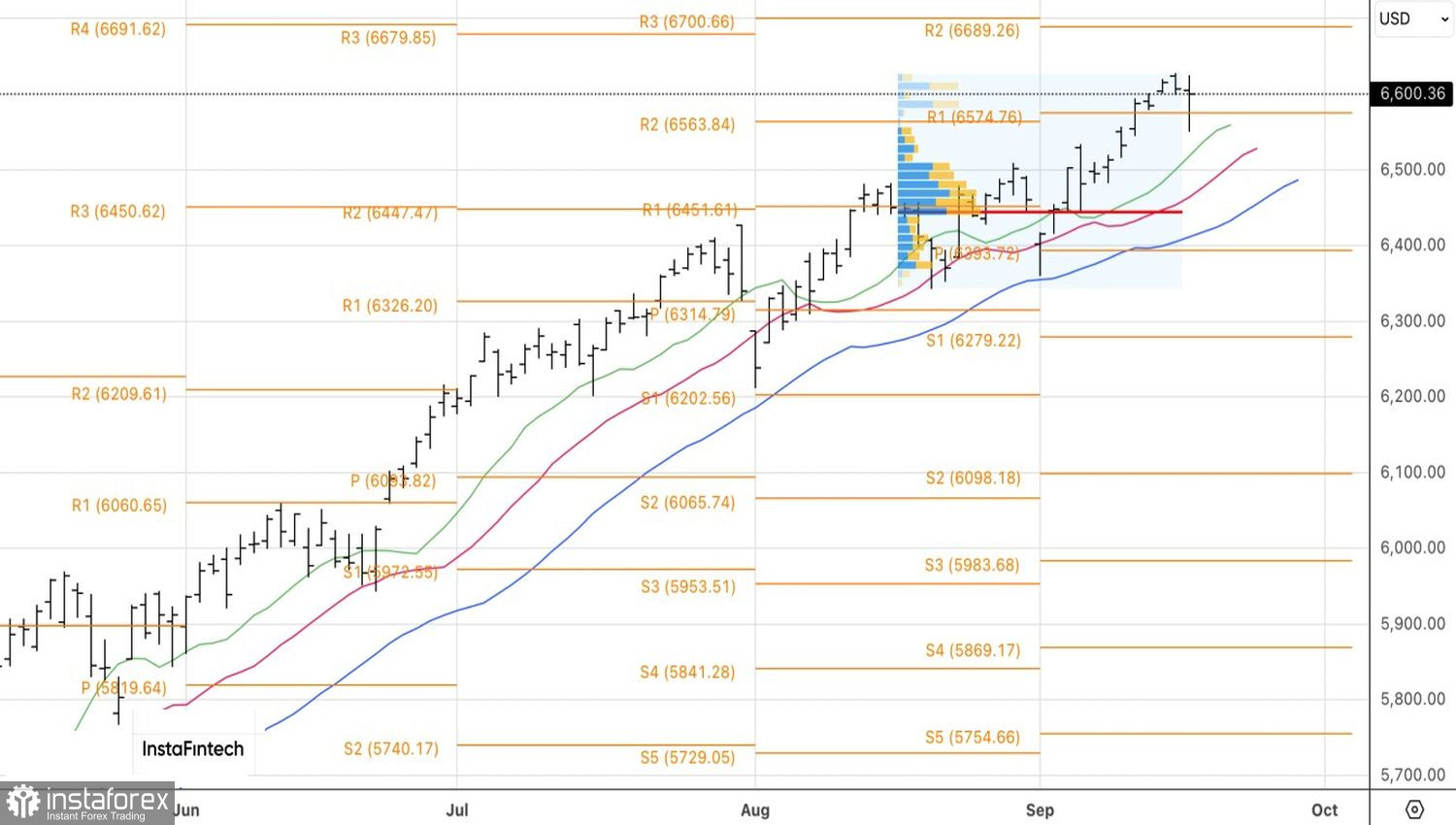

Technically, on the daily chart, a doji bar with a long lower shadow was formed. More likely than not, the S&P 500 will move in the opposite direction of that shadow — upward. Therefore, a breakout above the doji bar's high near 6,625 will serve as a signal to increase previously established long positions from 6,570.