It's sheer chaos! Instead of continuing its rally after the Federal Funds rate cut and the FOMC's "dovish" forecasts, EUR/USD confidently moved south. Investors decided that Donald Trump would fail in dictating terms to the central bank and stripping it of its independence. A serious split within the ranks of the Fed raises doubts about the central bank's commitment to its chosen path. Statistics on jobless claims further fueled bearish pressure.

The September FOMC meeting revealed how Trump's people intend to act. Stephen Miran not only voted for a 50-basis-point cut in the Federal Funds rate, but also projected in the dot plot its reduction by 150 basis points! Given the White House occupant's statement that borrowing costs should be closer to 1%, his actions appear logical. The governor is dancing to the president's tune. Trump wants everyone else to do the same. They aren't.

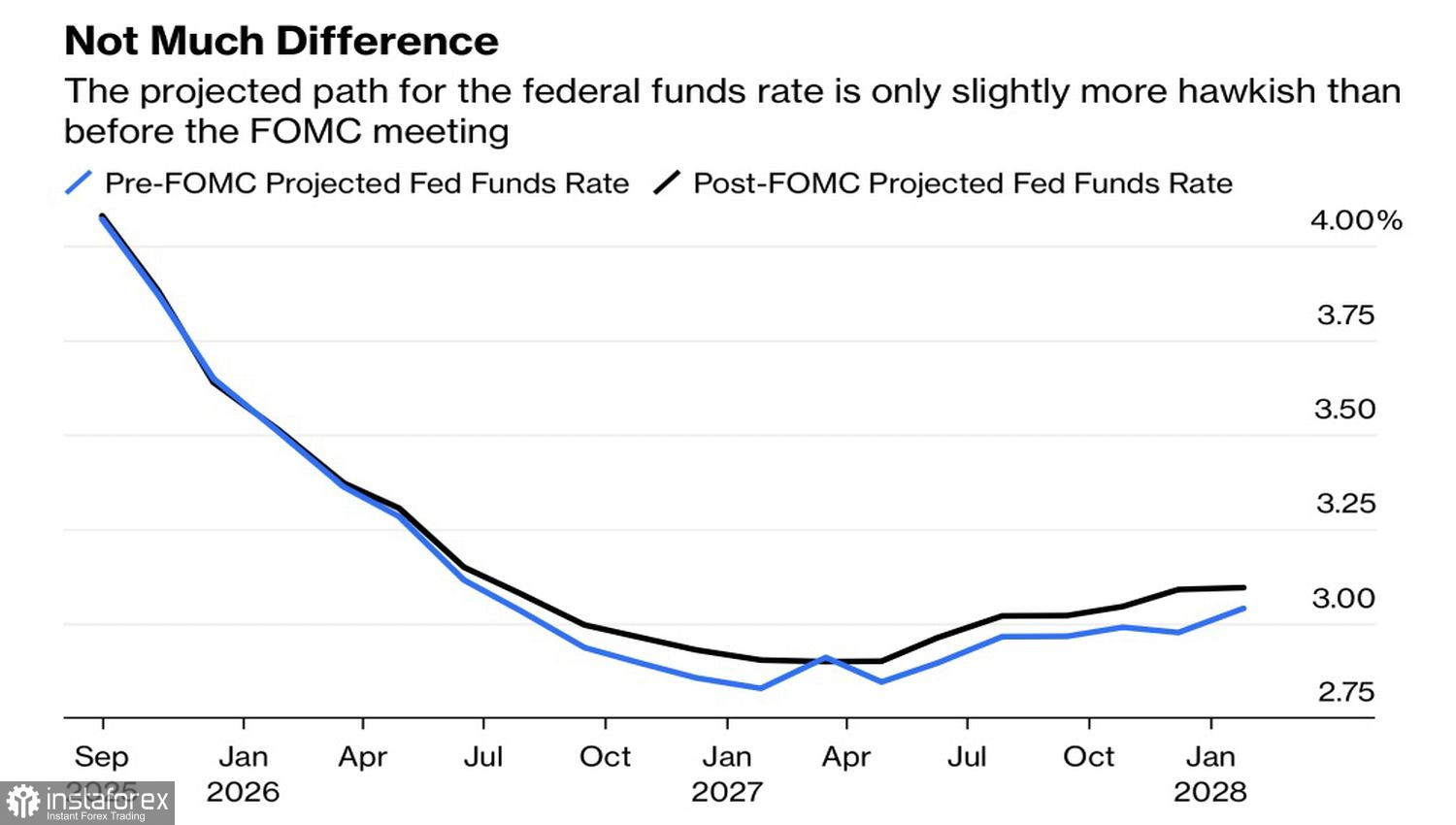

Expected Fed Rate Path

Miran turned out to be in a clear minority. Other Trump appointees—Christopher Waller and Michelle Bowman—sided with the majority. This means not all officials appointed by the Republican president will follow his instructions. The Fed's independence has stood the test. This emboldened EUR/USD bears to act. In the end, the difference between two and three rounds of monetary expansion in 2025 is not enough for the U.S. dollar to throw in the towel.

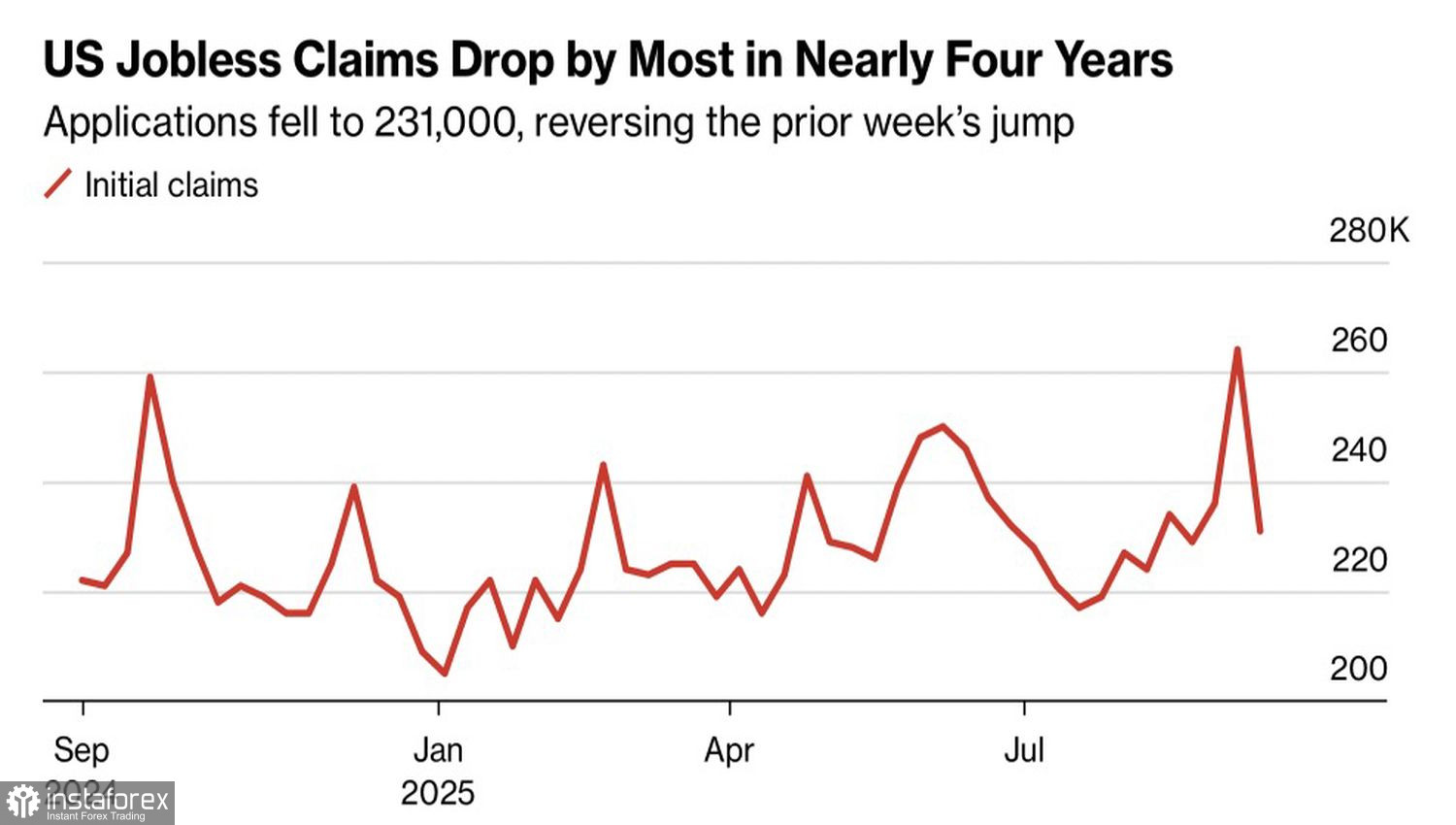

The greenback was supported by news of the fastest decline in initial jobless claims in almost four years. They fell by 33,000 to 231,000, returning to the low levels seen for much of the year.

Dynamics of U.S. Jobless Claims

No sooner had Jerome Powell said that the Fed is shifting its focus from inflation to the labor market, as the latter is cooling, when indicators started sending signals to the contrary. If the employment situation is fine, what's the point in cutting rates at all in 2025? Seven out of nineteen FOMC officials see no such point. Two more voted for a single cut. The Committee is divided, which could benefit the U.S. dollar.

The latest jobless claims statistics are a story in themselves. Could the sharp drop in the indicator be the new head of the BLS trying to please Trump? The President must be clear about what he wants: turbocharging the economy or lower rates? These goals are at odds with one another. Strong data will keep the Fed from easing monetary policy. Weak data will hurt the President's ratings.

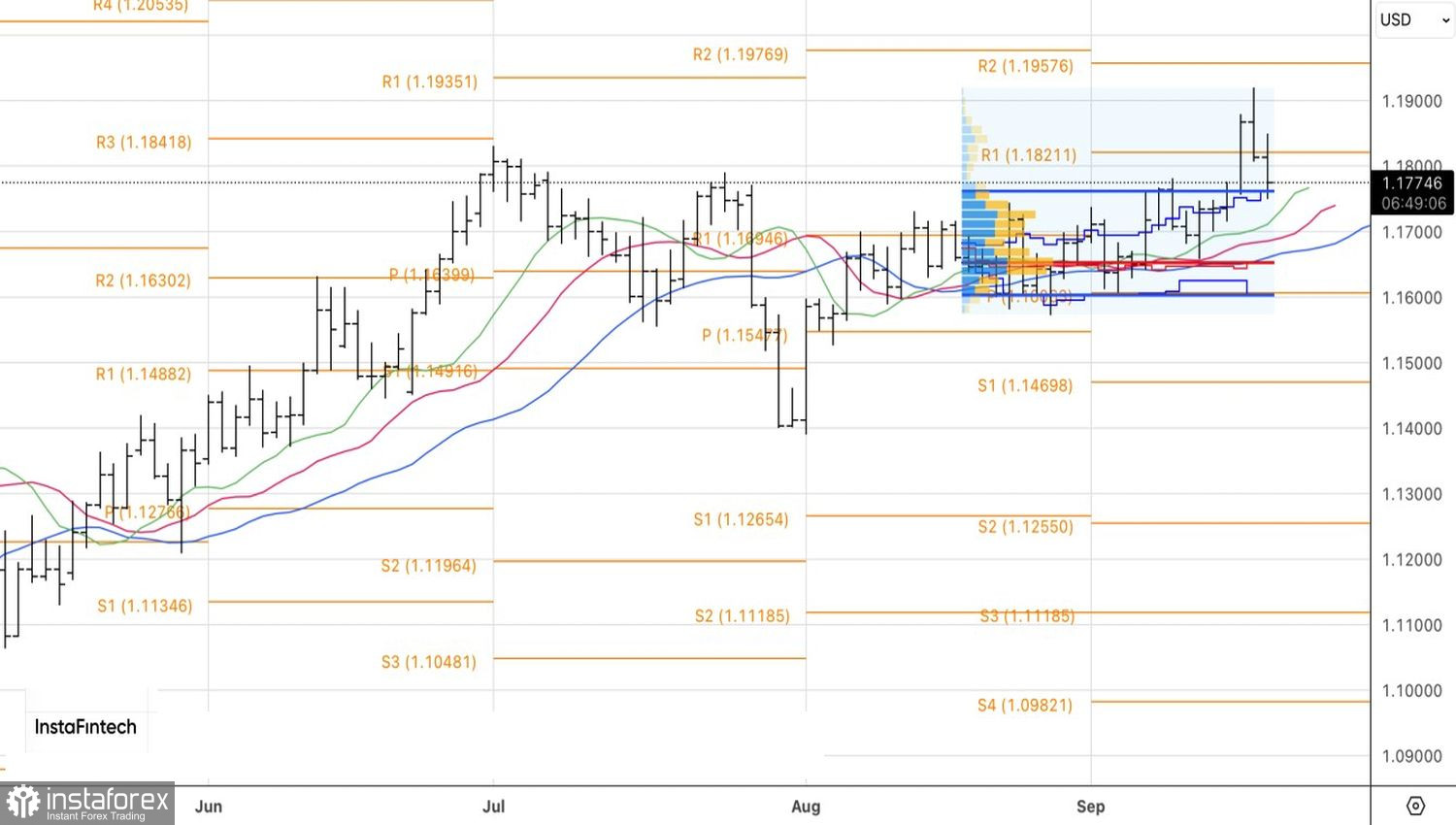

Technically, on the daily EUR/USD chart, bears are attempting to return to the fair value range of 1.1600–1.1760. A bounce from support at 1.1760 or a return of the main currency pair's quotes above the pivot level at 1.1825 will provide a basis for forming long positions.