Trade review and advice on trading the euro

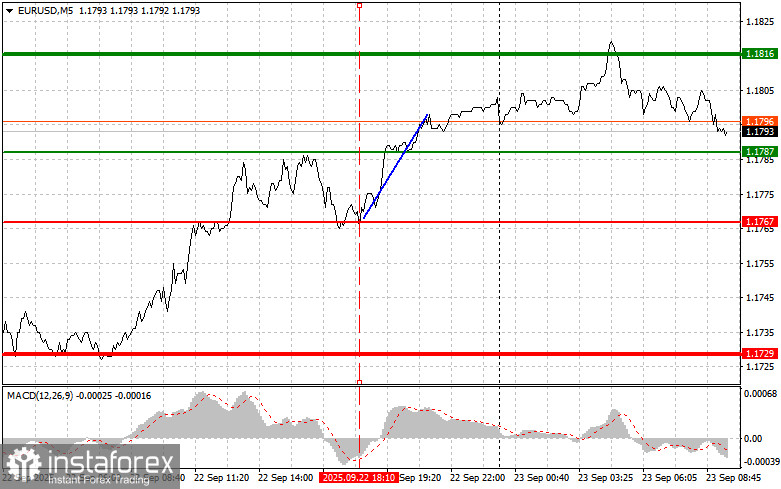

The price test of 1.1767 occurred when the MACD indicator had already moved far below the zero line, which limited the pair's downward potential. The second test of 1.1767 coincided with MACD being in the oversold zone, which allowed scenario #2 for a buy to play out, resulting in a 30-point rise in the pair.

Yesterday's attempt by sellers to pressure the euro led only to a minor correction in the exchange rate, which coincided with speeches from US Federal Reserve representatives. The ECB is expected to continue its course of raising interest rates in the coming months to curb inflationary pressure, while the Fed's more cautious stance creates an attractive rate differential in favor of the euro, stimulating capital inflows and supporting its rise. In addition, improving economic conditions in the eurozone, especially in the services sector, are providing the euro with additional resilience.

Today, in the first half of the day, eurozone PMI data will be published for manufacturing, services, and the composite index. If the data, particularly in manufacturing, show positive dynamics, further strengthening of the euro is likely. The market eagerly awaits these releases, as PMIs serve as a leading indicator of eurozone economic health. Special attention will be paid to the manufacturing sector, which in recent months has struggled with supply chain disruptions, rising energy prices, and weakening external demand. If the manufacturing PMI exceeds analysts' expectations and stays above 50, it will signal renewed growth in output and overall improvement in the economy. Positive data could boost investor confidence in the eurozone economy, attract capital inflows, and increase demand for the euro, likely leading to its appreciation against other currencies, especially the US dollar. Conversely, weaker-than-expected data could put pressure on the euro and lead to its depreciation. Given the current economic environment and global uncertainty, the PMI publication is particularly important in defining the euro's short-term prospects.

As for the intraday strategy, I will rely mainly on scenarios #1 and #2.

Buy scenarios

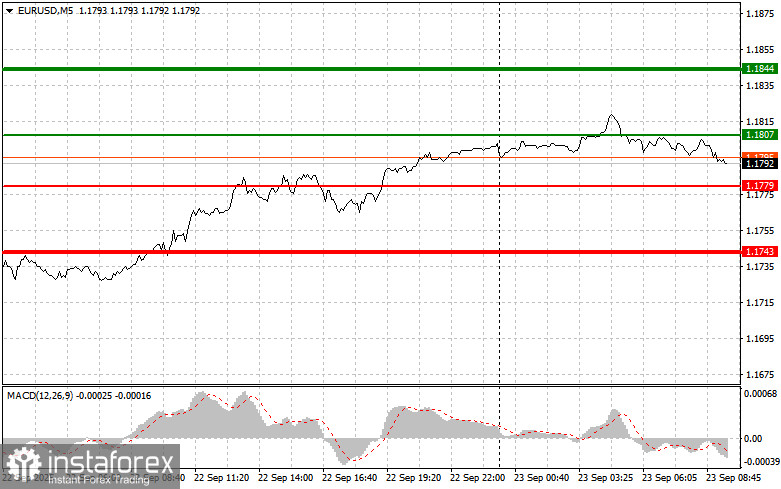

Scenario #1: Today, buying the euro is possible around 1.1807 (green line on the chart) with a target at 1.1844. At 1.1844, I plan to exit the market and also open short positions in the opposite direction, aiming for a 30–35 point move from the entry point. A rise in the euro should only be expected after strong statistics. Important! Before buying, ensure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of 1.1779, at the moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1807 and 1.1844 can be expected.

Sell scenarios

Scenario #1: I plan to sell the euro after reaching 1.1779 (red line on the chart). The target will be 1.1743, where I will exit the market and immediately open a buy in the opposite direction (expecting a 20–25 point move back from that level). Selling pressure will return if the data come in weak. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of 1.1807, at the moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1779 and 1.1743 can be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument.

- Thick green line – the assumed price for placing Take Profit or fixing profit manually, since further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – the assumed price for placing Take Profit or fixing profit manually, since further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to use overbought and oversold zones.

Important: Beginner traders in the Forex market must make entry decisions very carefully. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp volatility. If you choose to trade during news releases, always place stop orders to minimize losses. Without stop orders, you may quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.