Trade review and tips for trading the euro

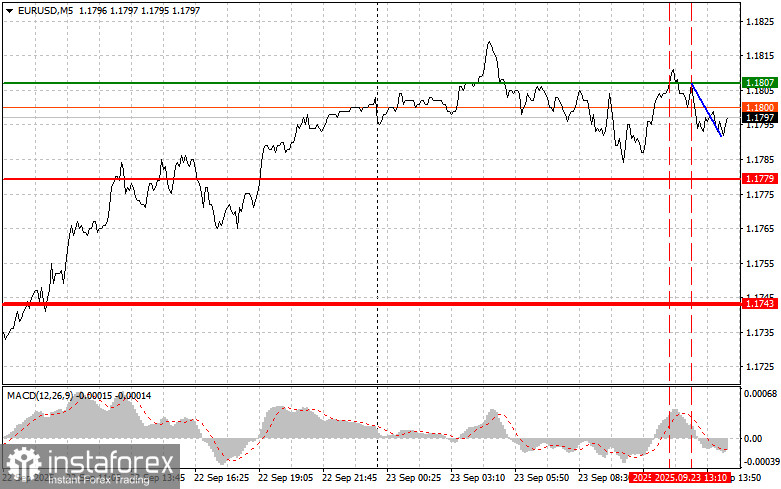

The first test of 1.1807 occurred when the MACD indicator had already moved significantly upward from the zero mark, which limited the pair's bullish potential. For this reason, I did not buy euros. The second test of 1.1807 coincided with the MACD being in overbought territory, which allowed scenario #2 for selling euros to play out, resulting in a 15-point decline.

Weak PMI data in the eurozone manufacturing sector, which fell back below the 50 mark, constrained EUR/USD's gains in the first half of trading, putting pressure on the pair. In the near term, the movement of EUR/USD will likely depend on upcoming macroeconomic data and central bank rhetoric. Market participants should closely monitor PMI, inflation, and employment indicators, as well as statements from ECB and Fed officials.

In the second half of the day, several key reports will be released: US manufacturing, services, and composite PMI indices. Additionally, Fed Chair Jerome Powell's speech will be a major event. If PMI readings exceed forecasts, it could be interpreted as a sign of resilience in the US economy, supporting the dollar. Conversely, weak data could fuel concerns about slowing growth and undermine the US currency. Powell's speech will be decisive. Should he indicate that the Fed is ready for further rate cuts, the dollar may lose ground significantly. However, if he adopts a cautious stance, warning of risks of economic overheating, the dollar could strengthen.

As for intraday strategy, I will focus mainly on scenarios #1 and #2.

Buy signal

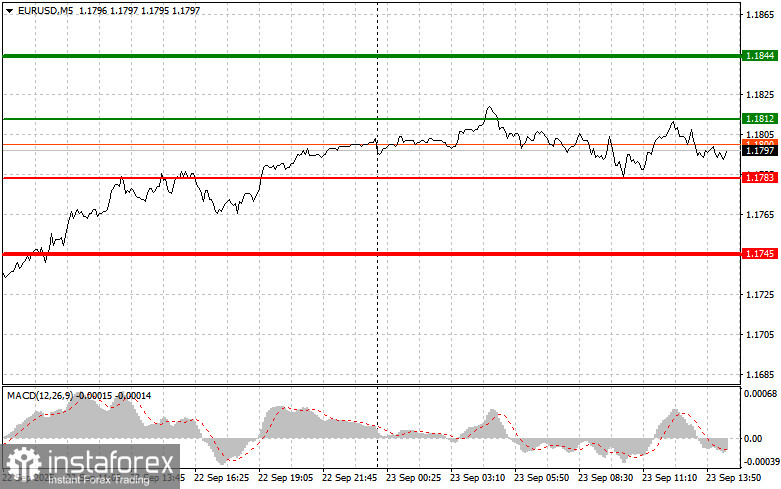

Scenario #1: Today, euro purchases are possible at 1.1812 (green line on the chart) with a target at 1.1844. At 1.1844, I plan to exit the market and also sell euros in the opposite direction, aiming for a 30–35-point move from the entry level. Expecting euro growth today is possible only after dovish statements from policymakers. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy euros if there are two consecutive tests of 1.1783, at a time when MACD is in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. A rise toward 1.1812 and 1.1844 can then be expected.

Sell signal

Scenario #1: I plan to sell euros after reaching 1.1783 (red line on the chart). The target will be 1.1745, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25-point move in the opposite direction). Pressure on the pair will return today if US data are strong. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell euros in case of two consecutive tests of 1.1812 when the MACD is in overbought territory. This will cap the pair's upward potential and lead to a reversal downward. A decline toward 1.1783 and 1.1745 can then be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – projected level for setting Take Profit or fixing profits manually, as further growth is unlikely above this level;

- Thin red line – entry price for selling the instrument;

- Thick red line – projected level for setting Take Profit or fixing profits manually, as further declines are unlikely below this level;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you may quickly lose your deposit, especially if you do not use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one I presented above. Making spontaneous trading decisions based only on current market conditions is an inherently losing strategy for an intraday trader.