Trade analysis and tips on trading the euro

Yesterday afternoon, the designated levels were not tested. For this reason, I had no entry points.

The weak U.S. business activity indices published yesterday negatively affected the American currency, which in turn contributed to a slight rise in the euro's quotes. However, volatility remained extremely low, which did not allow for proper trading.

Today, the euro may decline. The key data in the first half of the day will be Germany's IFO releases, which include the business climate index, the current conditions index, and the expectations index. Poor results may trigger a new wave of euro selling, while figures above forecasts may temporarily strengthen it. However, given the overall economic situation in the eurozone, even good data are unlikely to reverse the weakening trend of the euro. The expectations index is particularly important. As a leading indicator, it allows for assessing the outlook of the German economy in the coming months. A drop in this indicator would signal a potential slowdown in growth and increase investor concerns about a European recession. The euro will also be influenced by the actions of the European Central Bank. The market will closely monitor statements from ECB representatives regarding future monetary policy. A wait-and-see stance may slightly support the euro, but overall, its prospects remain uncertain.

As for intraday strategy, I will focus more on implementing scenarios No. 1 and No. 2.

Buy scenarios

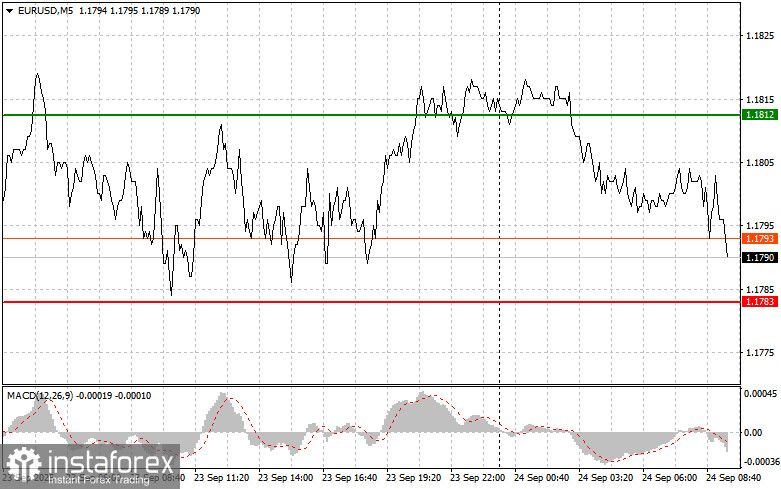

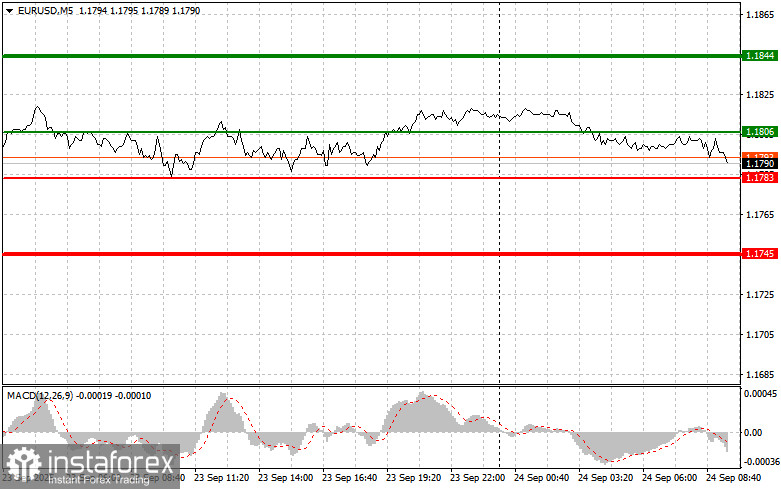

Scenario No. 1: Today, the euro can be bought around 1.1806 (green line on the chart) with a growth target at 1.1844. At 1.1844, I plan to exit the market and also sell the euro in the opposite direction, expecting a movement of 30–35 points from the entry point. Growth in the euro can only be counted on after good statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1783 price level at the moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Growth can be expected toward the opposite levels of 1.1806 and 1.1844.

Sell scenarios

Scenario No. 1: I plan to sell the euro after reaching the 1.1783 level (red line on the chart). The target will be 1.1745, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point movement in the opposite direction from the level). Pressure on the pair will return today if the data is weak. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1806 level at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.1783 and 1.1745.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – estimated price for setting Take Profit or fixing profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – estimated price for setting Take Profit or fixing profit manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to use overbought and oversold zones as guidance.

Important: Beginner forex traders should be very cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, such as the one I have outlined above. Spontaneous decisions based on the current market situation are an inherently losing strategy for an intraday trader.