Trade analysis and advice on trading the euro

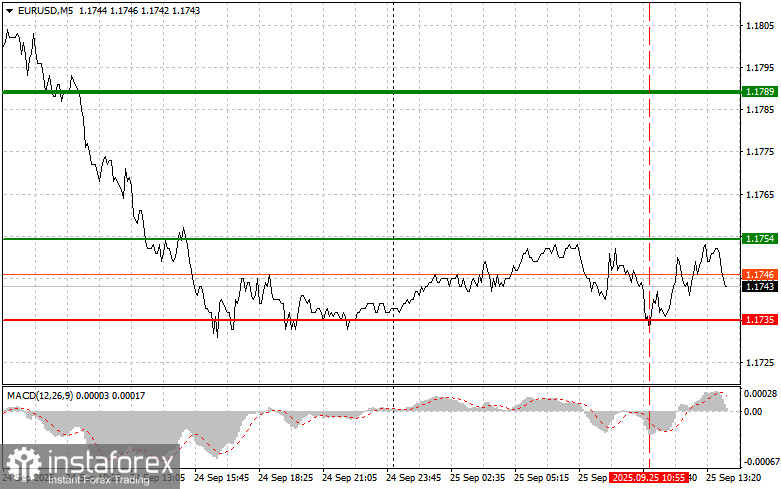

The price test of 1.1735 occurred at a moment when the MACD indicator had already moved far below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro. I did not see any other entry points into the market.

The growth of private sector lending in the eurozone was offset by a decline in M3 money supply. This contradiction may be explained by several factors. First, despite increased lending volumes, banks may be reducing interbank market operations, which leads to a decline in overall money supply. Second, the drop in M3 could be the result of capital outflows from the eurozone to other regions of the world with a more attractive investment climate. In any case, lending growth offset by a shrinking money supply indicates instability in the eurozone's financial system and heightened risks for economic growth.

On the horizon is the release of a series of key macroeconomic indicators, keeping markets in a state of anticipation. The main focus is on U.S. initial jobless claims data. This figure will serve as an indicator of the strength of the U.S. labor market, which has recently shown signs of weakness. A decline in claims would signal labor market resilience, while an increase would point to potential problems. Revised Q2 GDP data will provide a more precise assessment of the economy's current state and the extent of its slowdown. Markets will closely monitor whether the new estimate aligns with expectations and confirms the trend of slowing growth.

Equally important is the U.S. trade balance, which will reflect the state of international trade and its impact on the U.S. economy. A widening deficit may indicate declining competitiveness of U.S. products, while a narrowing one would support economic growth.

As for intraday strategy, I will rely more on implementing scenarios #1 and #2.

Buy signal

Scenario #1: Today, buying the euro is possible at around 1.1754 (green line on the chart), targeting growth toward 1.1789. At 1.1789, I plan to exit the market and also sell the euro in the opposite direction, counting on a 30–35 point move from the entry point. Euro growth today will be realistic if U.S. data comes out weak. Important! Before buying, make sure the MACD indicator is above the zero line and only beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive price tests of 1.1738, at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 1.1754 and 1.1789 can then be expected.

Sell signal

Scenario #1: I plan to sell the euro after the price reaches 1.1738 (red line on the chart). The target will be 1.1708, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move upward from this level). Pressure on the pair will return today if the data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and only beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive price tests of 1.1754, at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.1738 and 1.1708 can then be expected.

Chart guide

- Thin green line – entry price where the instrument can be bought.

- Thick green line – approximate price to set Take Profit or lock in profit manually, as further growth above this level is unlikely.

- Thin red line – entry price where the instrument can be sold.

- Thick red line – approximate price to set Take Profit or lock in profit manually, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when making market entry decisions. Ahead of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you may quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear plan, like the one outlined above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.