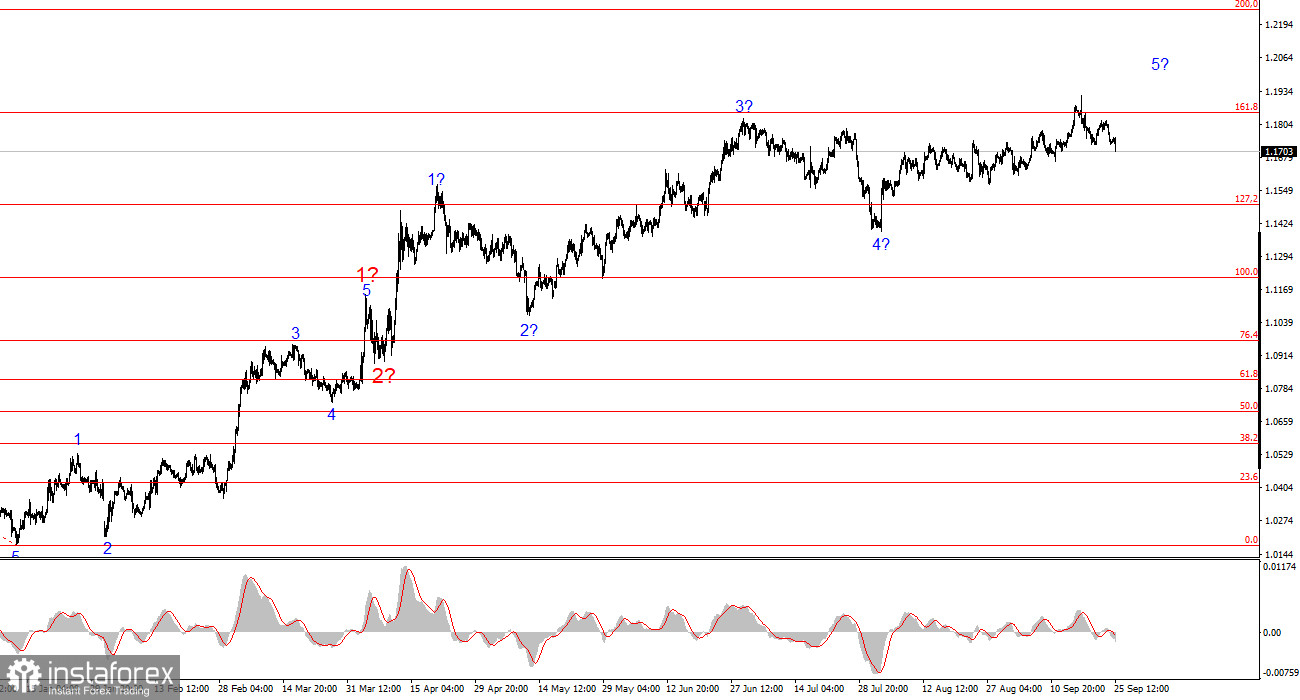

The wave pattern on the 4-hour chart for EUR/USD has not changed for several months, which is very encouraging. Even when corrective waves are forming, the structure remains intact. This allows for accurate forecasts. It is worth remembering that wave patterns do not always look like textbook examples. Right now, the structure still looks very good.

The upward trend section continues to build, while the news background mostly does not support the dollar. The trade war launched by Donald Trump continues. The confrontation with the Fed continues. Market "dovish" expectations for Fed rate policy are rising. The market is rating the results of Trump's first 6–7 months very poorly, even though economic growth in Q2 reached nearly 4%.

At present, we can assume that impulse wave 5 is still being built, with targets potentially extending as far as the 1.25 level. Inside this wave, the structure is rather complex and ambiguous, but on the larger scale it raises few questions. Three upward waves are visible, so at the end of last week the pair moved on to building wave 4 of 5, which may take a three-wave form.

The EUR/USD pair lost 75 basis points on Wednesday and another 50 today. If yesterday the market had no real reason to sell the euro, today it found them. Overall, this is one of the first times in the last 8–9 months that the dollar has looked at least somewhat attractive to traders for the longer term. We will discuss this in more detail later, but for now let's focus on the immediate developments.

Today, the U.S. released the final Q2 GDP report. Recall that the first estimate showed growth of 3%, the second – 3.3%, and the final – 3.8%. Interesting. Does Donald Trump now have no complaints against the Bureau of Statistics? No more dismissals? How to treat this figure is up to each market participant. Personally, after the dismissal of Erika McEntarfer, I will always have doubts about the honesty of the published numbers. The Bureau of Statistics is now headed by "Trump's man," so I would not be surprised if the real growth figures are much more modest.

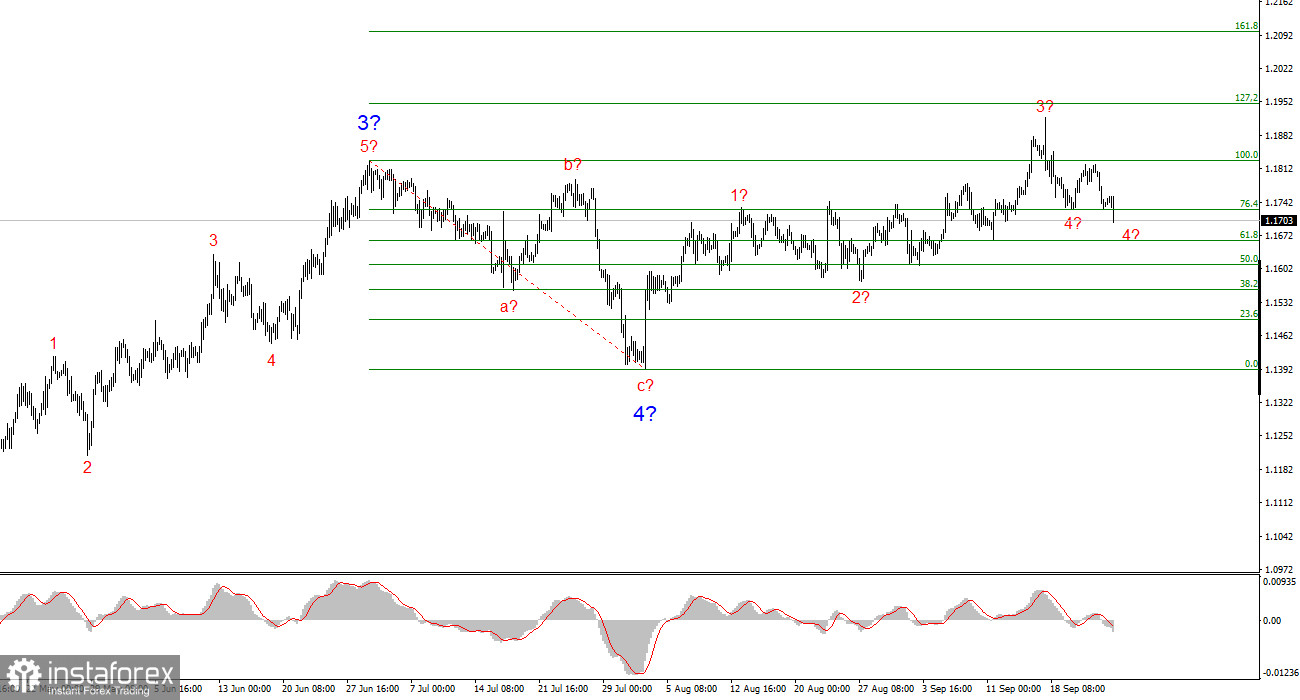

Still, that is just speculation. The fact remains that the U.S. economy grew by almost 4% in Q2. Naturally, this report supported dollar buyers. The durable goods orders report also came in higher than expected. The wave pattern has not been violated yet, but it continues to suggest growth for the instrument, not decline. If the decline continues (under the influence of news flow), the pattern will need adjustments.

General conclusions

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward trend section. The wave pattern still depends entirely on the news background linked to Trump's decisions and the internal and external policies of the new White House administration. The targets of the current trend section may extend as far as the 1.25 level. At present, the pair is declining within a corrective wave, but the upward wave structure remains valid. Therefore, I remain interested in buying in the near term. By the end of the year, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci level.

On the smaller scale, the entire upward trend section is visible. The wave pattern is not the most standard, as the corrective waves are of different sizes. For example, the larger wave 2 is smaller than the internal wave 2 of 3. But this also happens. I remind you that it is best to identify clear structures on the chart, rather than tie yourself to every wave. The upward structure now raises virtually no questions.

Main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often change.

- If you are not confident about what is happening in the market, it is better to stay out.

- Absolute certainty in market direction never exists. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.