Trade Review and Advice on Trading the Euro

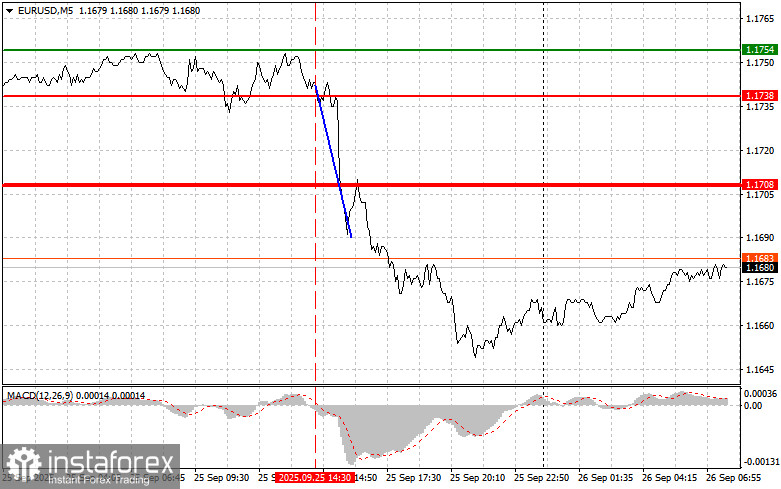

A test of the 1.1738 level occurred just as the MACD indicator was starting to move down from the zero line, confirming a suitable entry point for a euro short. As a result, the pair moved down to the 1.1708 target area.

Yesterday's upward GDP revision for the US (Q2) to an impressive 3.8% triggered strong buying of the US dollar. The U.S. economy displayed unexpected resilience, despite the Federal Reserve's aggressive monetary policy. This, in turn, boosts investor confidence that the US economy can continue to grow after rate cuts, which already began in September this year.

Today, there is no significant fundamental news from the Eurozone—only the Spanish GDP report is likely to attract real attention. Positive surprises from Spain may be welcomed, but they are unlikely to alter the broader picture. More important is the speech by ECB President Christine Lagarde. Investors will scrutinize every statement she makes. Nonetheless, given the current inflation level and slowing eurozone growth, the ECB has scope for flexible action. Most likely, Lagarde will stick to cautious language, avoiding bold remarks that could destabilize the markets—something that won't help the euro rise.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

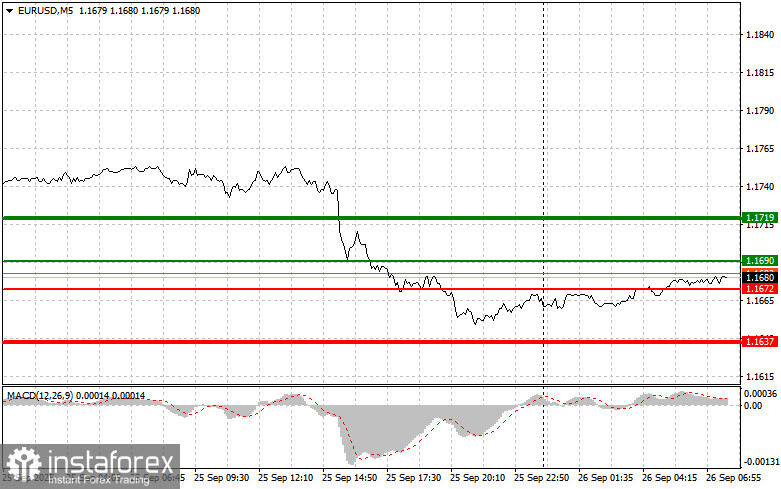

Scenario #1: Buy EUR today if the price reaches around 1.1690 (green line on the chart), targeting a rise to 1.1719. At 1.1719, I'll exit long trades and immediately sell for a potential 30–35 pip move from entry. You should only expect euro growth after strong data. Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: Also, plan to buy euros today in case of two consecutive tests of the 1.1672 price level while the MACD is in the oversold area. This should limit the downside potential and prompt a reversal upwards. You can look for a move up to 1.1690 and 1.1719.

Sell Scenario

Scenario #1: I plan to sell the euro after reaching 1.1672 (red line on chart), targeting a move down to 1.1637, where I'll exit and immediately buy for a 20–25 pip reversal off the level. Downward pressure will return if the data is weak. Important! Before selling, ensure the MACD is below zero and is only just starting to decline from this level.

Scenario #2: Additionally, plan to sell the euro today in case of two consecutive tests of 1.1690, while the MACD remains in the overbought area. This will limit further upside and could trigger a reversal down. You can look for a decline to 1.1672 and 1.1637.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.