Trade Review and Advice on Trading the British Pound

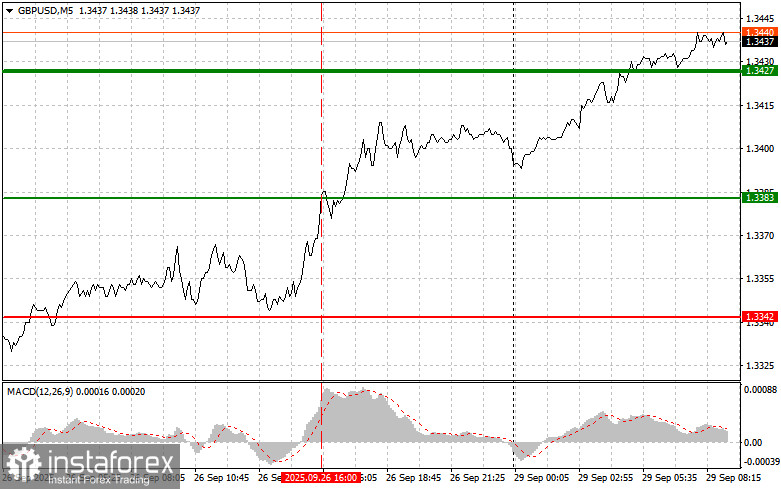

The test of the 1.3383 level coincided with the moment when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For this reason, I did not buy the pound and skipped the pair's small upward move.

The pound reacted positively against the dollar on news that the US Personal Consumption Expenditures (PCE) index rose by only 0.2%, in line with economists' forecasts. This modest increase, predicted by analysts, served as a signal of a possible further easing of the Federal Reserve's monetary policy. The market interpreted this as a sign of a softer stance by the central bank in the future, which immediately weighed on the dollar. The British pound, in turn, took advantage of the weakness of the US currency.

Today will bring the release of data on mortgage approvals in the United Kingdom, net lending to individuals, and changes in the M4 money supply. These indicators are typically regarded as barometers of the British economy's health. An increase in mortgage approvals often reflects optimism in the housing market and households' willingness to take on long-term debt obligations. Net lending to individuals highlights household borrowing activity. Rising loan volumes may indicate stronger consumer demand, but they also suggest a growing debt burden. Changes in M4 money supply offer insight into the overall liquidity of the economy. Growth in M4 may indicate increasing inflationary pressure, while a decline could signal slowing economic growth. Investors will carefully analyze these data to assess the current condition and potential future trajectory of the UK economy. If the readings come in above forecasts, the pound may strengthen. Conversely, weaker-than-expected figures could push the British currency lower.

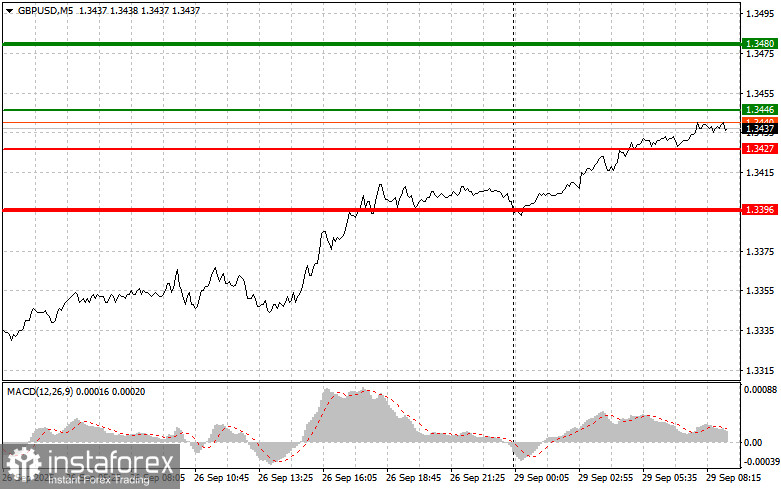

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

- Scenario #1: Today, I plan to buy the pound at an entry point around 1.3446 (green line on the chart), targeting 1.3480 (thicker green line on the chart). At 1.3480, I intend to exit long positions and immediately open shorts on a reversal (expecting a 30–35-pip move in the opposite direction). A continuation of the bullish trend after strong data may justify pound growth today. Important: Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

- Scenario #2: I also plan to buy the pound in case of two consecutive tests of the 1.3427 level, if the MACD indicator is in the oversold zone at that time. This would limit the pair's downside potential and trigger a reversal upward. Growth toward 1.3446 and 1.3480 could then be expected.

Sell Scenario

- Scenario #1: Today, I plan to sell the pound after the 1.3427 level (red line on the chart) is updated, which may lead to a quick decline in the pair. The key target for sellers will be 1.3396, where I intend to exit short positions and immediately open longs on a reversal (expecting a 20–25-pip correction in the opposite direction). Pound sellers could step in at any moment. Important: Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

- Scenario #2: I also plan to sell the pound in case of two consecutive tests of the 1.3446 level, if the MACD indicator is in the overbought zone at that time. This would limit the pair's upside potential and trigger a reversal downward, with targets at 1.3427 and 1.3396.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.