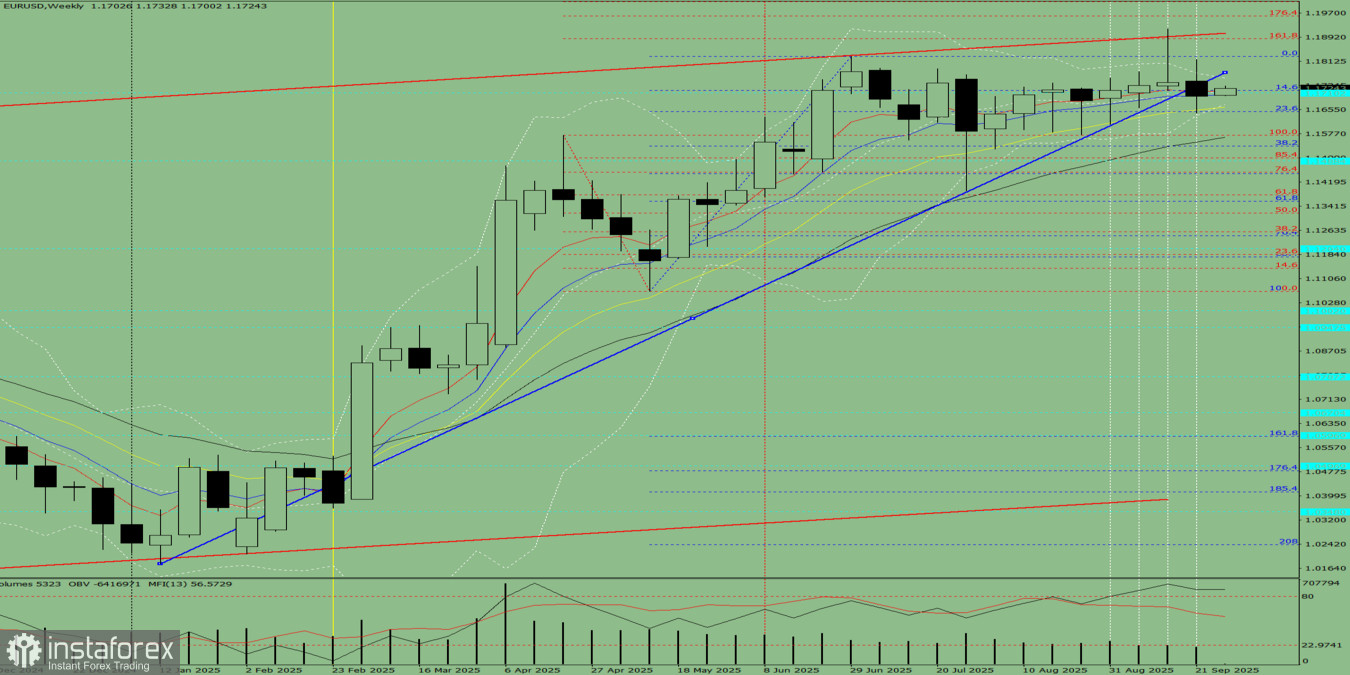

Trend analysis (Fig. 1).

This week, the market from the level of 1.1699 (close of the last weekly candle) may start moving downward with the target at 1.1536 – the 38.2% pullback level (blue dotted line). When testing this level, the price may retrace upward with the target at 1.1572 – the upper fractal (red dotted line).

Fig. 1 (weekly chart).

Comprehensive analysis:

- Indicator analysis – down;

- Fibonacci levels – down;

- Volumes – down;

- Candlestick analysis – down;

- Trend analysis – down;

- Bollinger Bands – down;

- Monthly chart – down.

Conclusion of the comprehensive analysis: downward movement.

Overall outcome of the weekly candle calculation for EUR/USD: during the week, the price will most likely show a downward trend, with the first upper shadow on the weekly black candle (Monday – upward) and the second lower shadow (Friday – upward).

Alternative scenario: the pair from the level of 1.1699 (close of the last weekly candle) may start moving downward with the target at 1.1488 – the historical resistance level (light blue dotted line). When testing this level, the price may then start moving upward with the target at 1.1536 – the 38.2% pullback level (blue dotted line).