There is yet another problem that could prove very costly for the dollar. Some economists are already warning that the upcoming reports on the U.S. economy are at risk of disruption. If the government shuts down, and with it most federal agencies, who will compile the data for economic indicators? And if the data are released, how much credibility will they have?

Confidence in the U.S. Bureau of Statistics has already declined sharply after the dismissal of its director, Erica McEntarfer, as many market participants now question the accuracy of the data. It is no secret that Trump has every reason to present the results of his policies in the most favorable light possible. If the statistics align with Trump, no one can accuse him of mismanaging the country. And what is statistics, after all? Just numbers. Numbers can be slightly adjusted to look more attractive.

Many in the market understand this, myself included. That is why I treat the latest U.S. GDP report with caution. On Friday, the Nonfarm Payrolls and unemployment reports are scheduled for release. Or perhaps they won't be released at all.

I must emphasize again: markets dislike uncertainty. In such a situation, many would rather sell the troubled dollar than speculate on when the shutdown will end, what the next economic reports will look like, and whether they can be trusted.

How the Federal Reserve will act over the next two meetings is an even bigger question than all the above. Jerome Powell and other policymakers have repeatedly said that rate decisions will depend on economic data. But if the Bureau of Statistics "goes on leave," who will provide the data? America could find itself in a situation where everything appears to be going well on paper, with Trump's "golden age" seemingly underway, while in reality, the country may be sliding toward an economic crisis and recession. Increasingly, market participants are expressing concerns about America's future, and central banks worldwide are reducing their dollar reserves.

Of course, the funding issue may be resolved at the very last minute. But the mere threat of a shutdown is already a valid reason to sell the dollar. In any case, the current wave count suggests the construction of an upward trend segment. That implies a decline in the value of the U.S. currency. And even without the shutdown, the dollar has plenty of reasons to weaken.

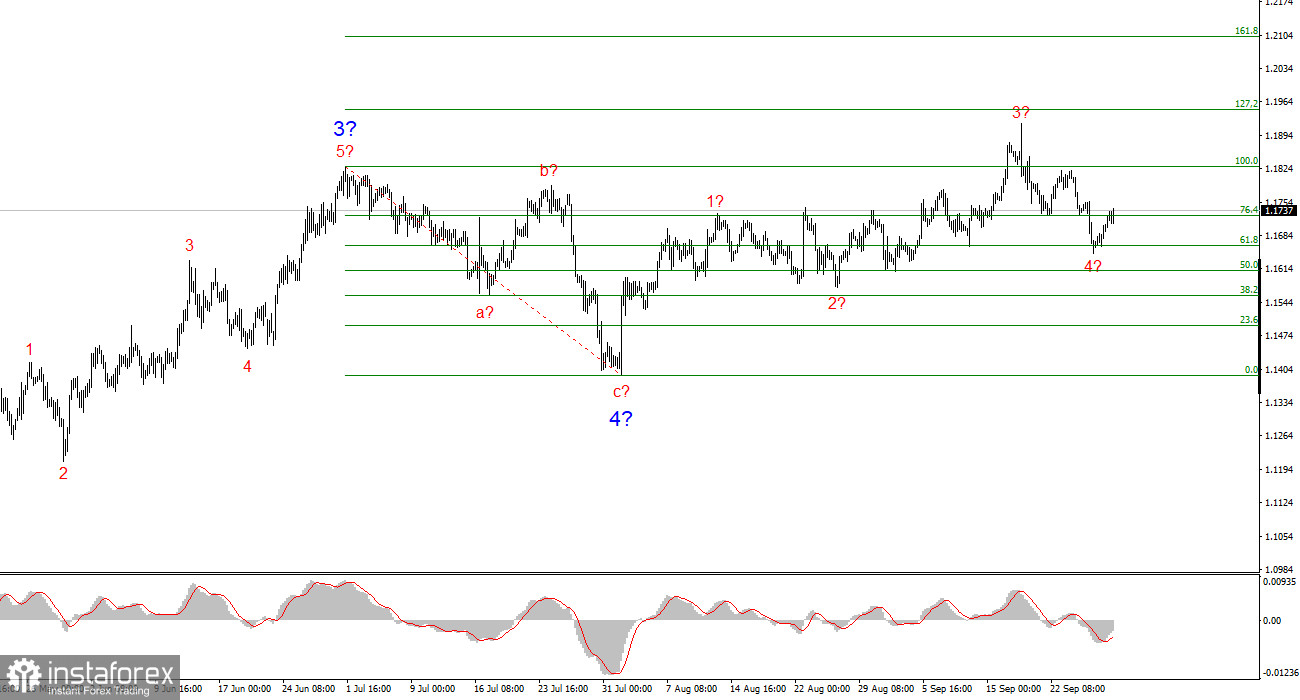

EUR/USD Wave Structure:

Based on my analysis of EUR/USD, the instrument continues to build an upward trend segment. The wave markup still depends entirely on the news background linked to Trump's decisions and the policies of the new White House administration. Targets for the current trend may extend up to the 1.2500 area. At present, a corrective Wave 4 may already be complete. The bullish wave structure remains valid. Thus, in the near term, I am considering only buying. By year-end, I expect the euro to rise to 1.2245, corresponding to the 200.0% Fibonacci.

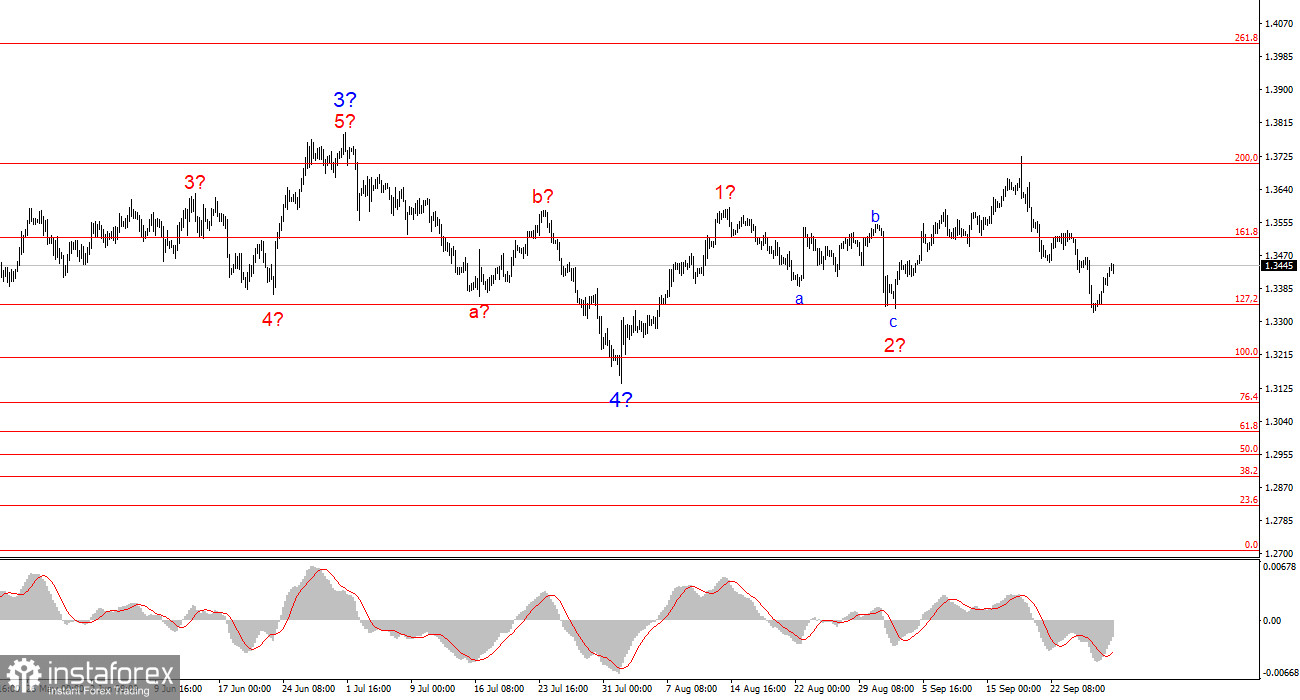

GBP/USD Wave Structure:

The wave picture for GBP/USD has evolved. The pair remains in an upward impulsive segment, but its internal structure has become less clear. If Wave 4 takes the form of a complex three-wave correction, the structure will normalize, though this would make Wave 4 significantly larger and more complex than Wave 2. In my view, the key reference point now is 1.3341 (127.2% Fibonacci). Two failed attempts to break above this level may indicate that the market is ready for renewed buying.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are more difficult to trade and are often subject to change.

- If the market situation is uncertain, it is better to stay out.

- Absolute certainty in market direction never exists—always use protective Stop Loss orders.

- Wave analysis can and should be combined with other types of analysis and trading strategies.