On Tuesday, the EUR/USD pair continues to rise for the third consecutive day. Earlier, prices rebounded from the 1.1645 level, last week's low, amid a weakening U.S. dollar driven by concerns over a potential government funding lapse that could occur on Wednesday, October 1. At the same time, negative market sentiment and weak economic data from the eurozone are limiting the euro's gains.

U.S. President Donald Trump's talks with congressional leaders from both parties on Monday ended, as expected, without concrete results. Vice President J.D. Vance confirmed that the government is indeed preparing for a shutdown. This would lead to delays in the release of key data from the U.S. Department of Labor and the Department of Commerce, including Nonfarm Payrolls — the crucial Friday jobs report, which could negatively affect economic growth.

In addition, on Monday Trump heightened market tensions by announcing a new round of tariffs. Beginning October 14, 10% tariffs will be imposed on imports of softwood lumber and 25% duties on foreign-made kitchen cabinets, vanities, upholstered furniture, as well as tariffs on trucks and patented pharmaceuticals, which will take effect the following day.

In the eurozone, German retail sales declined for the second consecutive month in August. Attention remains focused on German CPI (Consumer Price Index) data for September, to be released ahead of a speech by European Central Bank (ECB) President Christine Lagarde.

As for the U.S., the key events of the day will be the publication of job openings data, the consumer sentiment index for August, and a speech by Donald Trump.

From a technical standpoint, the pair is attempting to break through resistance at the confluence of the 9- and 14-day EMAs, aiming for the next barrier around 1.1770, above which lies the psychological 1.1800 level. Clearing this level would open the path toward the September high, though with some hurdles along the way.

Support for the pair is at the Asian session low around 1.1710, followed by the psychological 1.1700 level. Failure to hold this would mean bulls completely losing control to bears.

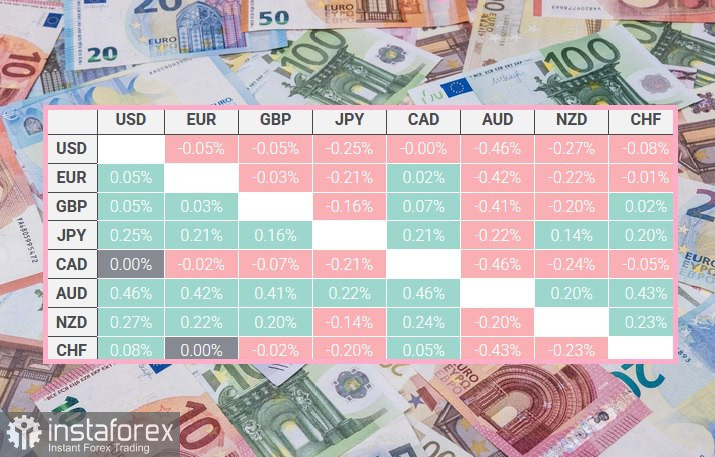

The table below shows percentage changes in the euro against major global currencies, where the euro recorded its largest gains against the U.S. dollar.