Trade Analysis and Tips for Trading the Euro

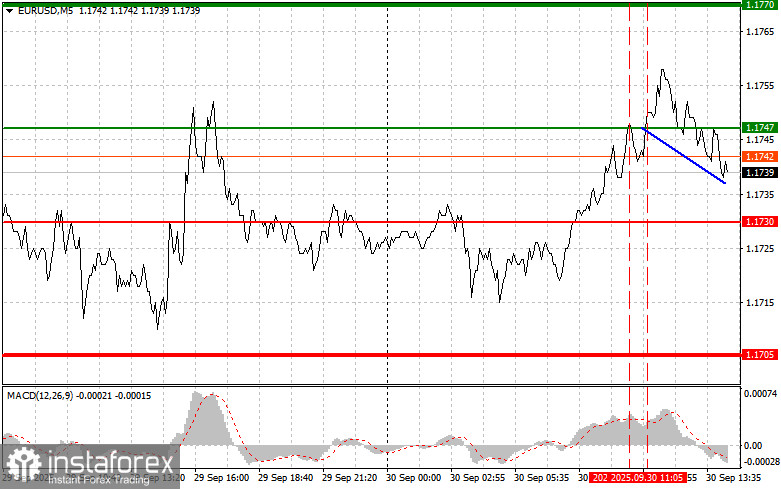

The test of 1.1747 occurred when the MACD indicator had already moved well above the zero line, which limited the pair's upward potential. For this reason, I did not buy euros. The second test of 1.1747, when the MACD was in the overbought area, allowed scenario No. 2 for selling to play out, but a major decline of the pair did not follow.

Despite the published data showing an increase in jobless claims in Germany, the euro continued to strengthen against the U.S. dollar. The stability of the unemployment rate, which held at 6.3%, was the main supporting factor for the euro. The stability of Germany's labor market was interpreted by investors as a sign of broader economic resilience in the eurozone.

Later today, the U.S. Consumer Confidence Index will be released. This is a key barometer reflecting public sentiment and willingness to spend, directly impacting economic expansion. An improvement in the index could strengthen the dollar, while a decline may indicate reduced consumer spending and a potential economic slowdown.

We also await the Job Openings and Labor Turnover Survey (JOLTS) report, which provides valuable insights into the U.S. labor market. A high number of job openings signals strong demand for labor and may foreshadow rising wages and inflation. In turn, higher turnover may point to instability in the labor market.

As for today's intraday strategy, I will focus primarily on implementing scenarios No. 1 and No. 2.

Buy Signal

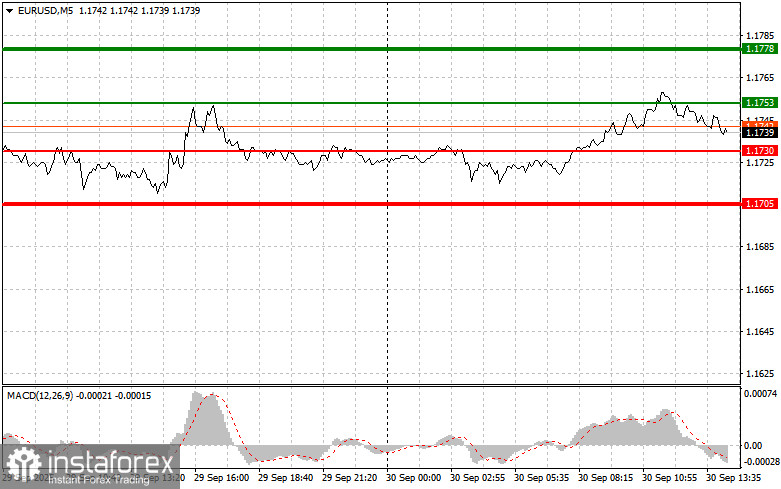

Scenario No. 1: Buy euros today when the price reaches around 1.1753 (green line on the chart) with a target of 1.1778. At 1.1778, I plan to exit the market and also sell euros in the opposite direction, targeting a 30–35-point move from the entry point. A euro rise today is likely after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I also plan to buy euros today if there are two consecutive tests of 1.1730, while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. Growth toward 1.1753 and 1.1778 can then be expected.

Sell Signal

Scenario No. 1: I plan to sell euros after the price reaches 1.1730 (red line on the chart). The target will be 1.1705, where I will exit and immediately buy in the opposite direction (expecting a 20–25-point move upward from the level). Downward pressure on the pair will return if U.S. data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario No. 2: I also plan to sell euros today if there are two consecutive tests of 1.1753, while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward 1.1730 and 1.1705 can then be expected.

What's on the Chart:

- Thin green line – entry price for buying the instrument.

- Thick green line – projected level for setting Take Profit or fixing profit, as further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – projected level for setting Take Profit or fixing profit, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when deciding to enter the market. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you do trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, such as the one I presented above. Spontaneous decisions based solely on the current market situation are an inherently losing strategy for intraday traders.