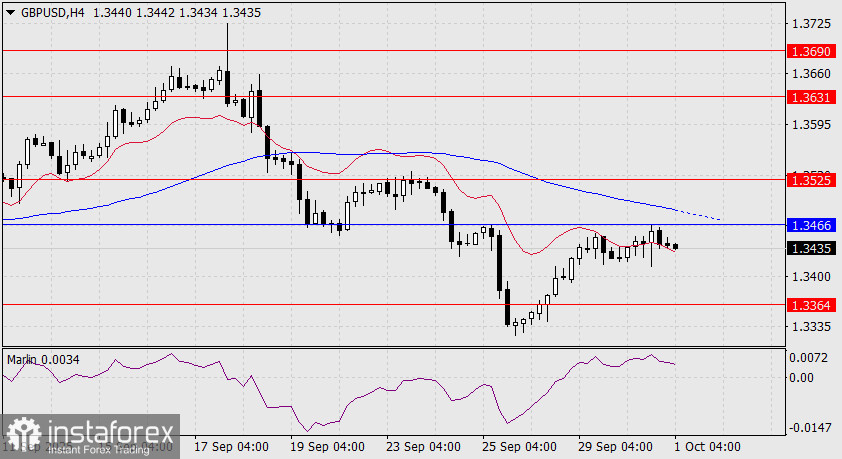

On the daily chart, the price is approaching the convergence point of the balance indicator line (red) and the MACD line (blue). If today's potential shutdown of the U.S. government does not trigger a spike in demand for anti-dollar currencies (as we expect), the pound may fail to break through this magnetic level at 1.3466.

A pullback toward the support level at 1.3364 (June 23 low) is possible. A firm move below this level would open the path toward the target at 1.3253. Meanwhile, the Marlin oscillator shows little optimism and is currently signaling a potential downturn.

If the price manages to gain a foothold above the MACD line (1.3466), the next target would be 1.3525, with a further upside toward 1.3631 becoming possible.

On the H4 (four-hour) chart, the 1.3466 resistance level is reinforced by the MACD line. The Marlin oscillator is neutral, moving sideways. A downward reversal toward the support level at 1.3364 remains possible. For now, the bearish scenario is the primary outlook — we await the market's reaction to the U.S. government shutdown.