The U.S. dollar has once again come under pressure, this time due to another round of weak fundamental data, which triggered a rally in risk assets — including the euro, British pound, and Japanese yen.

The sharp drop in U.S. private-sector employment, as reported by ADP (down 32,000), led to an active sell-off of the dollar and strengthened the euro, pound, and yen. However, this disappointing labor market data was partially offset by a stronger-than-expected ISM manufacturing PMI, which limited the dollar's downside momentum.

These conflicting signals created an atmosphere of uncertainty in the market. On one hand, job losses highlight potential vulnerabilities in the U.S. economy and could prompt a more cautious approach from the Federal Reserve. On the other hand, a strong PMI shows resilience in the manufacturing sector and indicates continued economic growth. In the short term, the dollar is unlikely to attract strong institutional demand, but a major sell-off also appears unlikely for now.

Today, the only notable data expected in the first half of the day is the eurozone unemployment rate for August, which is unlikely to create major market volatility. However, seasoned traders know that even periods of apparent calm can be misleading. The market often conceals strong undercurrents beneath the surface, much like the deep ocean. A single unexpected data point — especially one that deviates significantly from forecasts — can lead to sharp, yet localized, price swings.

Moreover, the broader context remains relevant. Geopolitical tensions, changes in global growth forecasts, and surprising statements from central bank leaders continue to impact market sentiment and shape long-term trends. That's why even during quiet periods, it's essential to maintain a broad perspective and analyze the whole picture to avoid missing key signals.

In the UK, there are no economic reports scheduled today at all, which could cause the bullish trend in the British pound to transition into a more sluggish, sideways phase.

If the released data matches economists' expectations, it's better to stick to a Mean Reversion strategy. However, if the data significantly beats or misses forecasts, implementing a Momentum strategy is more appropriate.

Momentum Strategy (Breakout):

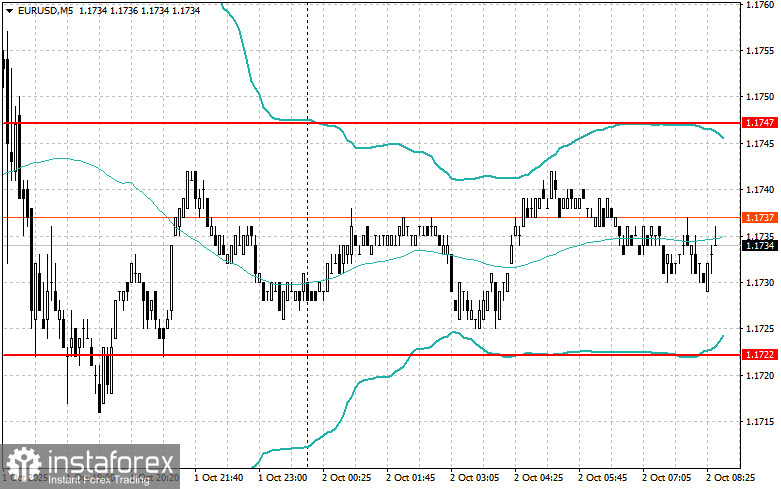

EUR/USD

Buy breakout above 1.1745 with potential targets at 1.1777 and 1.1817

Sell breakout below 1.1720 with potential targets at 1.1680 and 1.1650

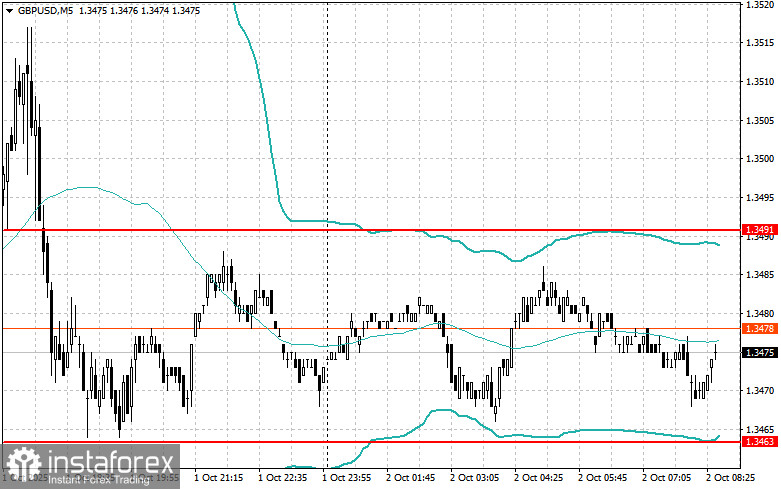

GBP/USD

Buy breakout above 1.3485 with potential targets at 1.3500 and 1.3532

Sell breakout below 1.3465 with potential targets at 1.3435 and 1.3400

USD/JPY

Buy breakout above 147.30 with potential targets at 147.61 and 148.00

Sell breakout below 146.96 with potential targets at 146.64 and 146.31

Mean Reversion Strategy (Pullbacks):

EUR/USD

- Sell on a failed breakout above 1.1747 with a return below the level

- Buy on a failed breakout below 1.1722 with a return back above the level

GBP/USD

- Sell on a failed breakout above 1.3491 with a return below the level

- Buy on a failed breakout below 1.3463 with a return above the level

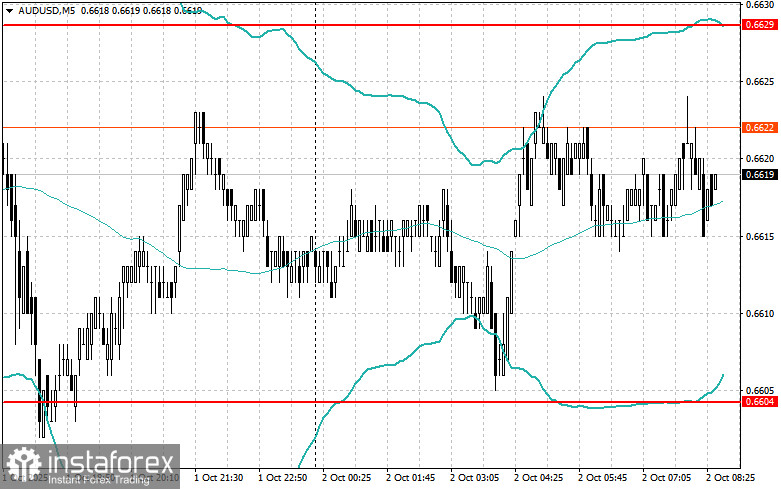

AUD/USD

- Sell on a failed breakout above 0.6629 with a return below the level

- Buy on a failed breakout below 0.6604 with a return above the level

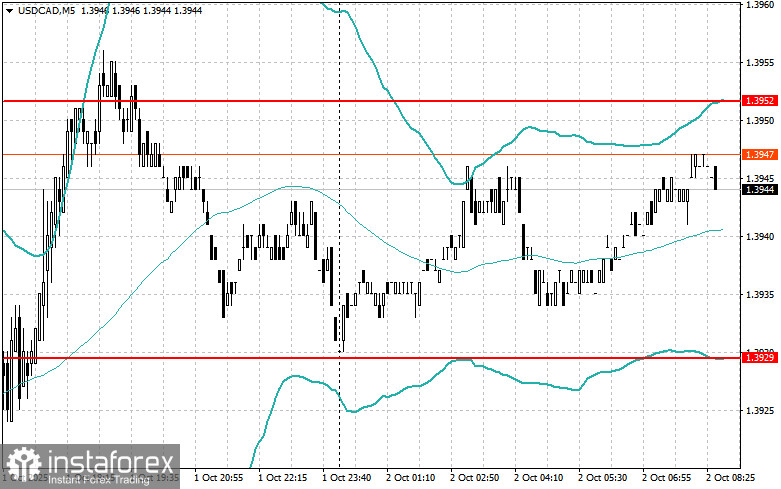

USD/CAD

- Sell on a failed breakout above 1.3952 with a return below the level

- Buy on a failed breakout below 1.3929 with a return above the level