Trade Review for Thursday:

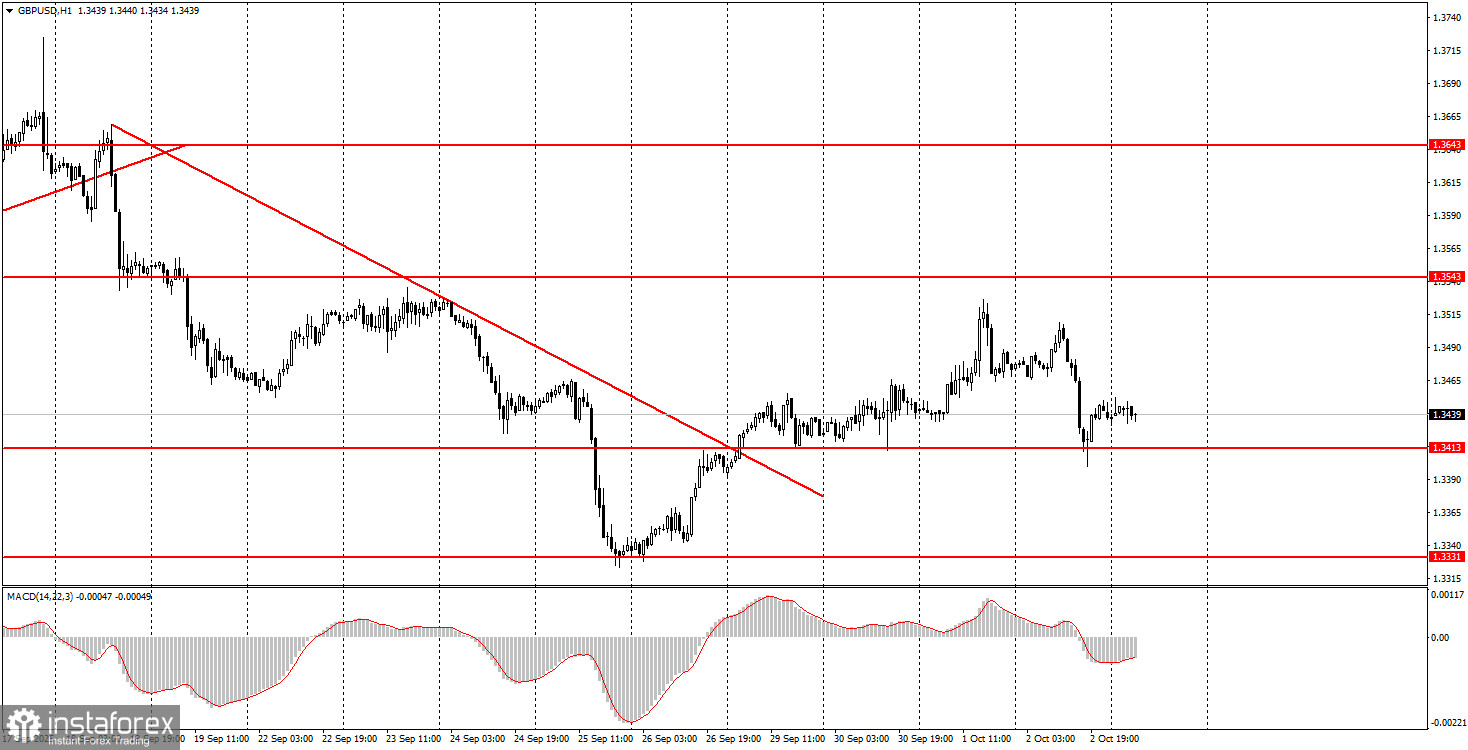

1H Chart of GBP/USD

On Thursday, the GBP/USD also showed a downward move, despite the British pound having no real reason to fall. As mentioned earlier, this week's movements in the FX market have been very strange and illogical. Such moves are not rare, and when they do not align with the fundamental or macroeconomic background, the best approach is to acknowledge their illogicality rather than trying to force-fit news or data to explain them.

There were no significant events in the UK or the U.S. yesterday, although earlier this week, at least two events could have triggered a major dollar sell-off—but didn't. That's the main "strangeness" of the current moves. The price failed to consolidate below 1.3413 yesterday, so the upward trend remains intact. Today, however, it's unclear what to expect from U.S. reports, which may not even be released.

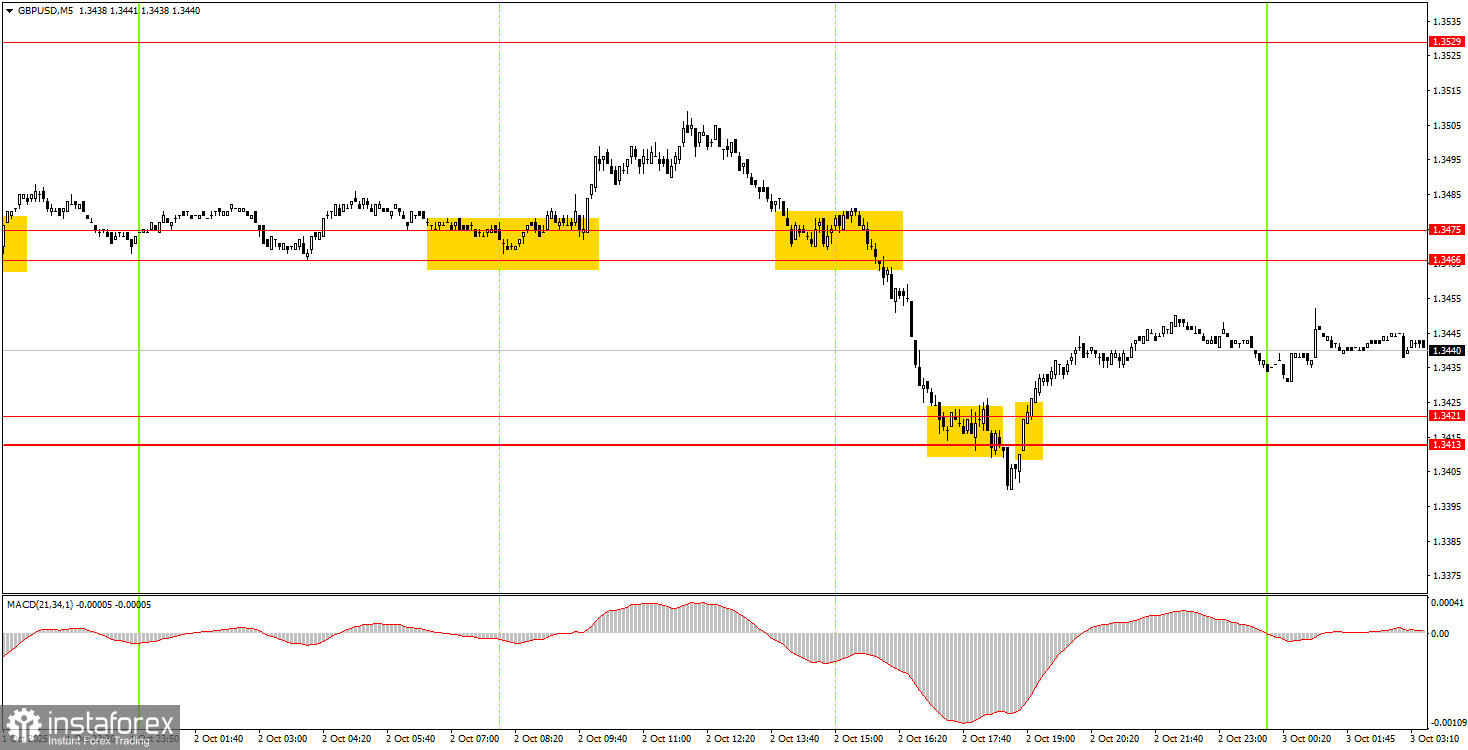

5M Chart of GBP/USD

How to Trade on Friday:

On the hourly chart, GBP/USD has completed the formation of its downtrend. As noted earlier, there are no reasons for prolonged dollar strength, so in the medium term, we expect only upward movement. Recent events in the UK and the U.S. have temporarily supported the dollar, but the global fundamental background remains negative for it, and the downtrend is already over.

On Friday, GBP/USD may continue its upward move. A rebound from 1.3413–1.3421 allows opening longs targeting 1.3466–1.3475 and higher. A consolidation below 1.3413–1.3421 would make shorts toward 1.3329–1.3331 relevant.

On the 5M chart, the following levels to trade from are: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, and 1.3763. No key events are scheduled in the UK on Friday. In the U.S., the ISM Services PMI will be released, while Non-Farm Payrolls and unemployment data are unlikely to be released.

Basic Rules of the Trading System:

- The strength of a signal depends on how quickly it forms (rebound or breakout). The less time needed, the stronger the signal.

- If two or more false signals form near a level, ignore subsequent signals from that level.

- In flat conditions, pairs may produce many false signals or none at all. At the first signs of flat, stop trading.

- Open trades between the start of the European session and the middle of the U.S. session; close all positions manually after that.

- On the 1H chart, trade MACD signals only when volatility is sufficient and the trend is confirmed by a trendline or channel.

- Levels close together (5–20 pips apart) should be considered a support or resistance zone.

- After the price moves 20 pips in the right direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support/resistance levels – targets for buy/sell trades, and potential Take Profit levels.

- Red lines – trendlines or trend channels indicating the current trend and trading direction.

- MACD (14,22,3) – histogram and signal line, used as an additional source of signals.

Important speeches and reports (always included in the news calendar) can have a significant impact on currency pair movements. Therefore, when they are released, it is recommended to trade with extreme caution or exit the market to avoid a sharp reversal of prices against the previous movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management are the keys to success in trading over a long period of time.