Bitcoin has finally broken above the $118,000 mark, consolidated at this level, and yesterday set a new monthly high around $121,000. Ethereum also saw a gain of over 4% in just one day.

So far, Bitcoin has not posted a single red day for October, reinforcing the historical pattern indicating that traders and investors typically return to the crypto market following a weak September. This year appears to be no exception.

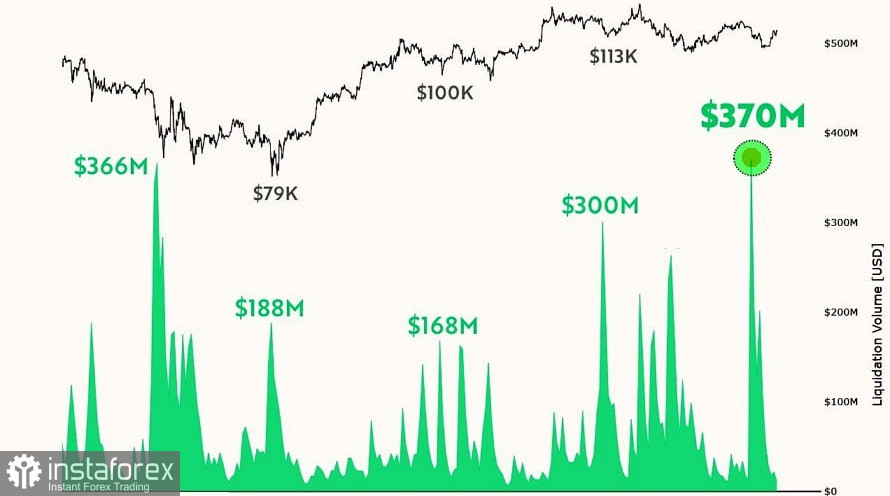

An interesting piece of news surfaced yesterday: in late September, one of the largest long liquidations in Bitcoin history occurred, totaling $370 million. This event is historically considered bullish. Contrary to the intuitive assumption that such events are catastrophic, mass long liquidations often signal the start of an upward trend. The shakeout of weak hands helps cleanse the market, remove excess leverage, and reduce volatility.

Furthermore, these events are often triggered by big players who intentionally crash the market to gather liquidity and accumulate positions at more attractive prices. It's a form of "market cleanup" that clears the path for sustainable growth — exactly what we're witnessing now.

For intraday strategies, I will continue to look for significant pullbacks in Bitcoin and Ethereum as opportunities to buy, expecting the broader medium-term bull market to persist.

Below are my short-term trading strategies and conditions for today.

Bitcoin

Buy Scenarios

- Scenario 1: I will buy Bitcoin today at the entry point near $120,300, targeting a rise toward $121,300. I plan to exit long positions around $121,300 and sell immediately on a bounce.

- Before buying a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive (above-zero) zone.

- Scenario 2: An alternative buying opportunity would be from the support level at $119,700, if there is no bearish reaction to its breakdown. I'll then target moves back toward $120,300 and $121,300.

Sell Scenarios

- Scenario 1: I will sell Bitcoin today at the entry point near $119,700, aiming for a move down to $118,800. Around $118,800, I'll exit the short trade and buy immediately on the rebound.

- Before initiating a breakout short, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative (below-zero) zone.

- Scenario 2: Alternatively, I can also sell from the resistance area near $120,300 if there's no follow-through in the breakout attempt, targeting a risk reversal back to $119,700 and $118,800.

Ethereum

Buy Scenarios

- Scenario 1: I will buy Ethereum today at the entry point near $4,513, and aim for a move up to $4,581. At around $4,581, I plan to exit my long positions and sell immediately on a bounce.

- Before buying a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in a positive area.

- Scenario 2: Alternatively, I may buy from $4,480 support if there is no downward follow-through. The target move would be back toward $4,513 and $4,581.

Sell Scenarios

- Scenario 1: I will sell Ethereum today at the entry point near $4,480, targeting a drop to $4,422. At $4,422, I plan to exit short positions and buy immediately on the rebound.

- Before selling a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

- Scenario 2: I may also sell from the $4,513 resistance level if the market shows no continuation above it, targeting a reversal move back down to $4,480 and $4,422.