With Donald Trump potentially interested in blocking labor market and unemployment data releases, it's critical to assess the Federal Reserve's position. Right now, the level of uncertainty is off the charts. In his recent speeches, Jerome Powell made it clear that rate decisions will depend on incoming economic data. However, the question remains: how will the FOMC make decisions if the data are not available? In my view, if the government shutdown doesn't end within a week or two, the Fed may choose not to adjust monetary policy at its October meeting as a precautionary measure.

It's worth mentioning that despite a dovish sentiment within the FOMC, most policymakers lean toward a "moderately dovish" approach. If economic reports indicate continued weakening of the labor market or signs that inflation is slowing, then the Fed will be willing to implement as many rate cuts as necessary. However, if the employment market stabilizes and inflation continues to rise, the central bank may opt to maintain steady interest rates.

Ironically, a continued slowdown in the job market may be to Trump's advantage, as it increases the chances of a policy easing. With no Non-Farm Payrolls or unemployment reports available—only the ADP report to rely on—worst-case assumptions may prevail. Perhaps that's exactly the scenario Trump is counting on. Still, I believe that in the absence of key economic data, the Fed will delay any policy moves altogether.

Among FOMC members, only three currently support cutting rates based on signs of labor market weakness. The rest remain focused on inflation. The Committee is effectively split into two camps: one ignoring the rising inflation, and the other concerned only about inflation. It's important to remember that the Fed has a dual mandate—and both components are equally important.

Austan Goolsbee, President of the Chicago Fed, believes that inflation won't resolve itself and that any easing of policy must be approached with extreme caution. Meanwhile, economist Stephen Miran suggests that the Fed should cut rates at every meeting until they reach around 2.5%.

At this point, the "moderate doves" are winning out in terms of numbers.

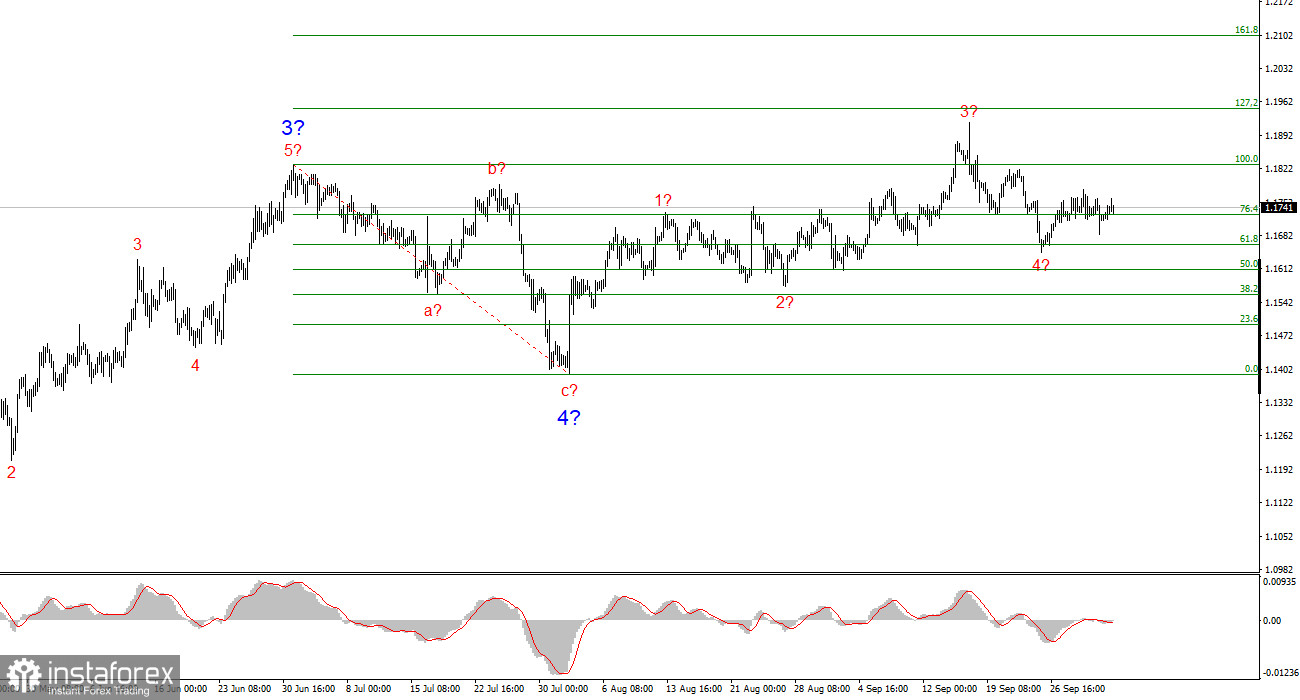

Wave Structure for EUR/USD:

Based on the analysis, EUR/USD continues to build a bullish trend segment. Wave structure still heavily depends on news flow, Trump's decisions, and geopolitical dynamics within the White House. The current trend phase may extend all the way to the 1.2500 level. At present, a corrective wave 4 appears to be forming—or already completed. The bullish wave structure remains valid, and therefore, I am looking only for buying opportunities in the near term. By year-end, I expect EUR/USD to reach 1.2245, which corresponds to the 200.0% Fibonacci.

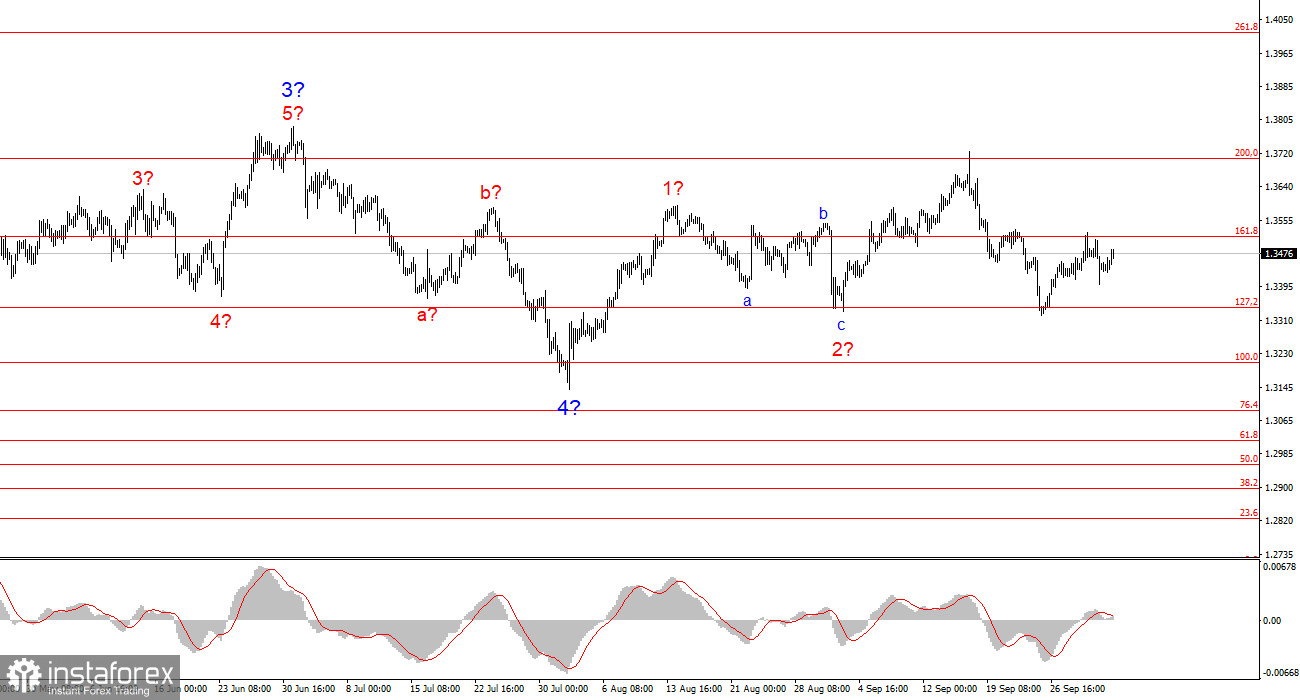

Wave Structure for GBP/USD:

The wave pattern for GBP/USD has evolved. We are still within an impulsive upward segment, but its internal structure has become unreadable. If wave 4 turns out to be a complex, three-wave formation, it will balance the structure—but it may also be significantly larger and longer than wave 2. In my opinion, the best reference level is 1.3341, which aligns with the 127.2% Fibonacci. Two failed breakouts of this level indicated that the market was poised for new buying opportunities. Price targets are still above the 1.3800 level.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and are often subject to change.

- If there is no confidence in market direction, it's better to stay out altogether.

- You can never be 100% sure of directional moves. Don't forget to use stop-loss orders.

- Wave analysis can be (and should be) combined with other types of analysis and trading strategies.