Trade analysis and recommendations for trading the European currency

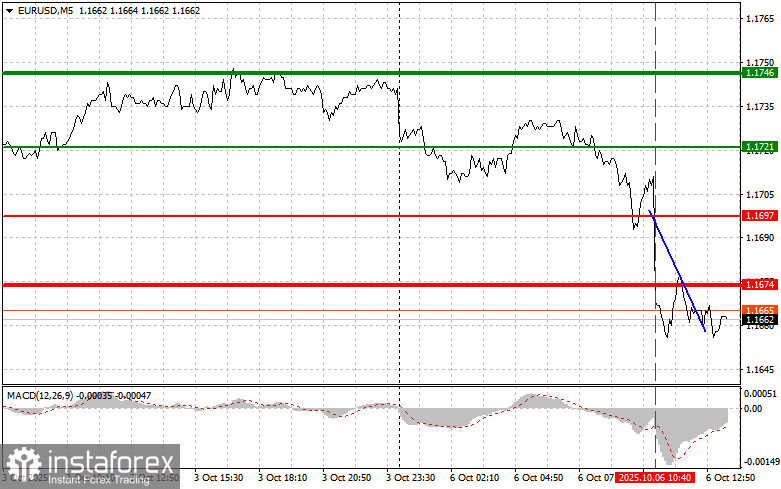

The test of the 1.1697 price level coincided with the moment when the MACD indicator had just started moving downward from the zero mark, which confirmed a correct entry point for selling the euro and resulted in a 30-point drop in the pair.

The resignation of yet another French prime minister and weak eurozone data led to a decline in the euro in the first half of the day. The current political situation raises many questions about the ability of politicians to agree on next year's budget, which is an additional concern for an already weak pace of economic growth in the country. At the moment, France's political forces are engaged in intensive negotiations on further actions. Early parliamentary elections are being considered as one of the most likely scenarios, but this decision is fraught with even greater destabilization of the political situation. Another option is the appointment of a new prime minister capable of forming a coalition government and ensuring the adoption of necessary laws.

Since no U.S. economic data is expected in the second half of the day, market participants will continue to focus on events in France. The geopolitical environment will also be an important factor when making trading decisions.

As for the intraday strategy, I will rely more on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, buying the euro is possible around the price level of 1.1684 (green line on the chart) with the target of rising to 1.1708. At 1.1708, I plan to exit the market and also sell the euro in the opposite direction, expecting a movement of 30–35 points from the entry point. A strong upward move in the euro today is unlikely. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting its upward movement.

Scenario #2: I also plan to buy the euro today if the 1.1653 price level is tested twice in a row, at the moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.1684 and 1.1708 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1653 level (red line on the chart). The target will be 1.1625, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move upward from that level). Selling pressure on the pair may return at any moment today. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting its downward movement.

Scenario #2: I also plan to sell the euro today if the 1.1684 level is tested twice in a row, at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 1.1653 and 1.1625 can be expected.

On the Chart:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – estimated price where Take Profit can be set, or profit can be taken manually, since further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – estimated price where Take Profit can be set, or profit can be taken manually, since further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to use overbought and oversold zones as guidance.

Important Note for Beginners:

Beginner traders in the Forex market should be very cautious when making decisions about entering the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading you must have a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.