One prime minister's resignation is already a big deal. But when four of them step down in quick succession, it can spark panic. That's precisely what is happening across French and European markets after Sebastien Lecornu announced that he does not intend to lead the French government. The reason is simple: an inability to reach a consensus with major political parties on the national budget. This unpleasant surprise from Paris knocked the EUR/USD pair off balance.

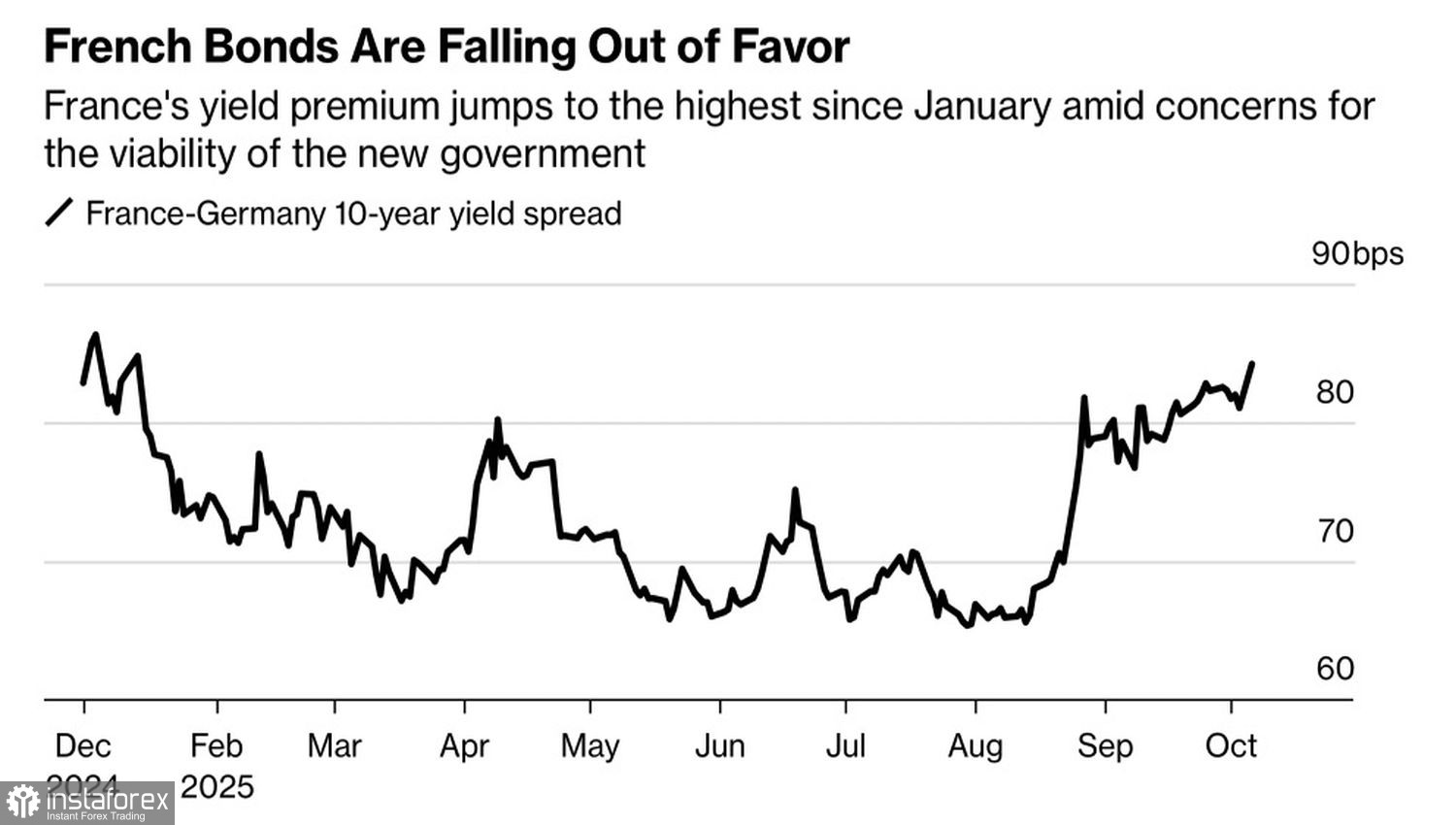

Yield Spread Between German and French Bonds Soars

The sell-off in French government bonds has pushed the yield spread between French and German securities — a key measure of political risk in Europe — to its highest since late 2024. Investors are now seriously concerned that replacing one incapable prime minister with another could eventually force Emmanuel Macron to resign as President of France. Such a development would be devastating for EUR/USD.

At this point, President Macron faces the same options as before: appoint a new prime minister, call for snap parliamentary elections, or resign himself. Each scenario brings its own set of risks. Right- and left-wing parties smell weakness and now have even more reasons to reject any proposed budget, regardless of who holds the premiership. Meanwhile, the deadline to adopt a new fiscal plan is fast approaching, which increases the likelihood of emergency measures being implemented.

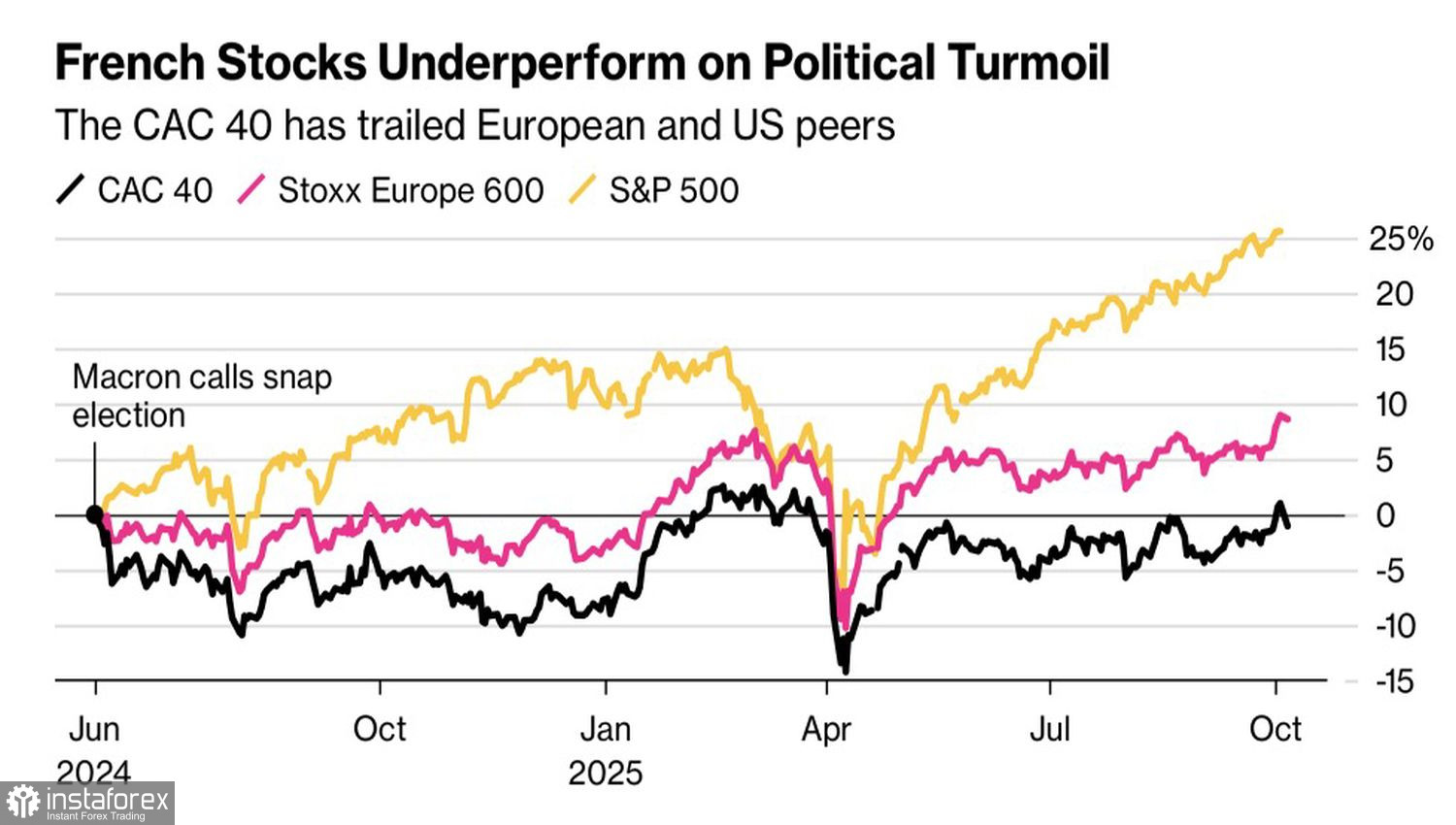

It's not just bonds that are being dumped — French equities are suffering too. The CAC 40 has been one of the worst performers among major European indices in 2025, trailing behind the EuroStoxx 600, let alone the far more resilient U.S. S&P 500. This outperformance by U.S. markets has triggered capital outflows from Europe, dampening bullish momentum for EUR/USD and hindering the pair's ability to reclaim its upward trend.

Political Uncertainty and a Weakened Euro

Escalating political turmoil in France, skepticism surrounding Germany's fiscal stimulus under Friedrich Merz, Europe's poor performance in its trade conflict, and ongoing geopolitical instability tied to the war in Ukraine — all of these factors contribute to growing doubts that the euro can reach the 1.20 level in 2025, despite diverging monetary policies.

Indeed, senior ECB officials, such as Chief Economist Philip Lane and Vice President Luis de Guindos, have made it clear that the central bank's easing cycle has come to an end. According to them, the risks to inflation — whether upward or downward — are now balanced. They assert with confidence that consumer price growth has anchored around the 2% target. Meanwhile, the Fed plans to continue cutting rates, which should weigh on the U.S. dollar overall.

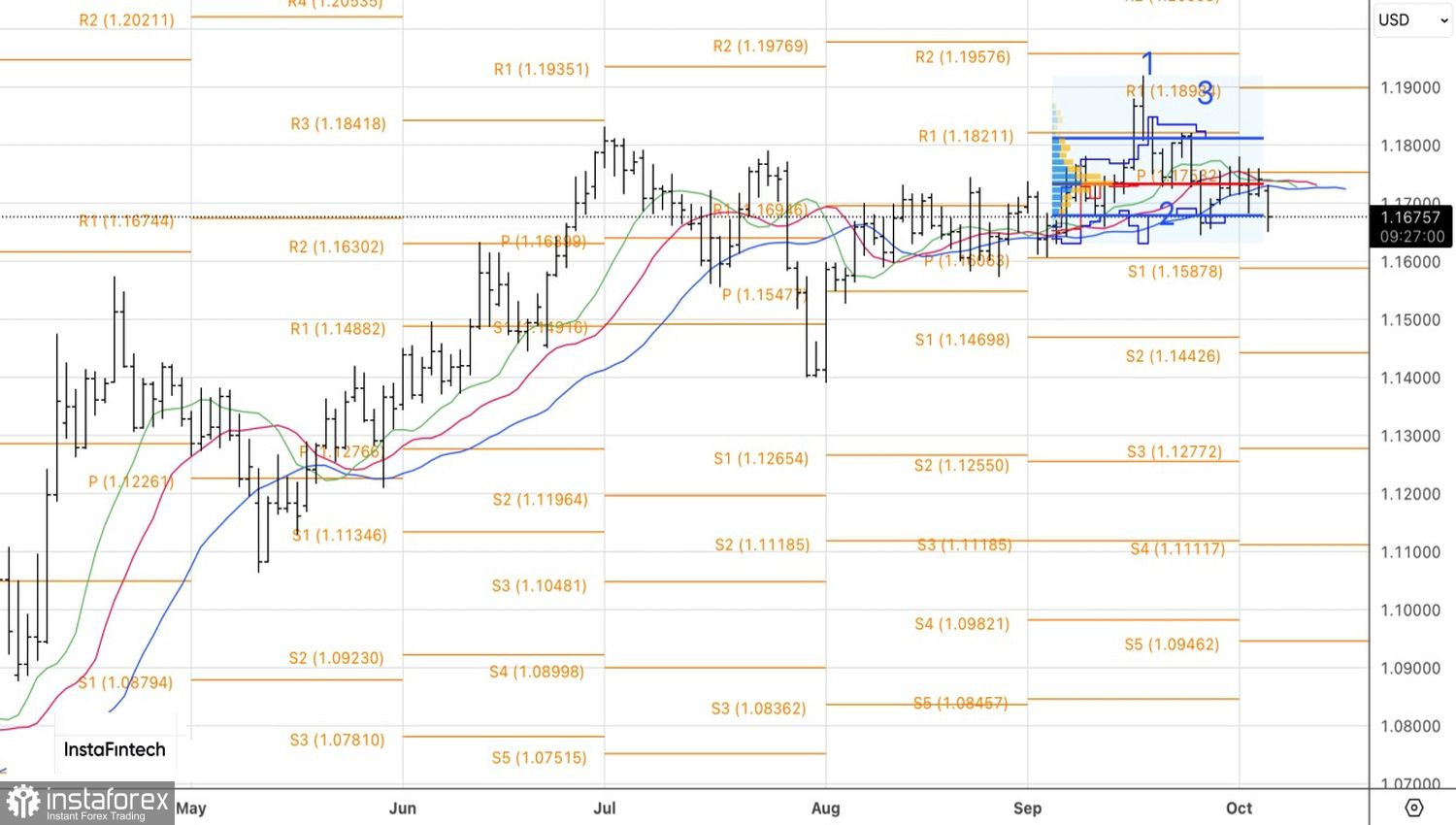

Technically, the daily EUR/USD chart shows a correction unfolding within a classic 1-2-3 reversal pattern. Short positions opened on the break below the consolidation zone near 1.171 should be held, as the pattern suggests continued downside for the pair.