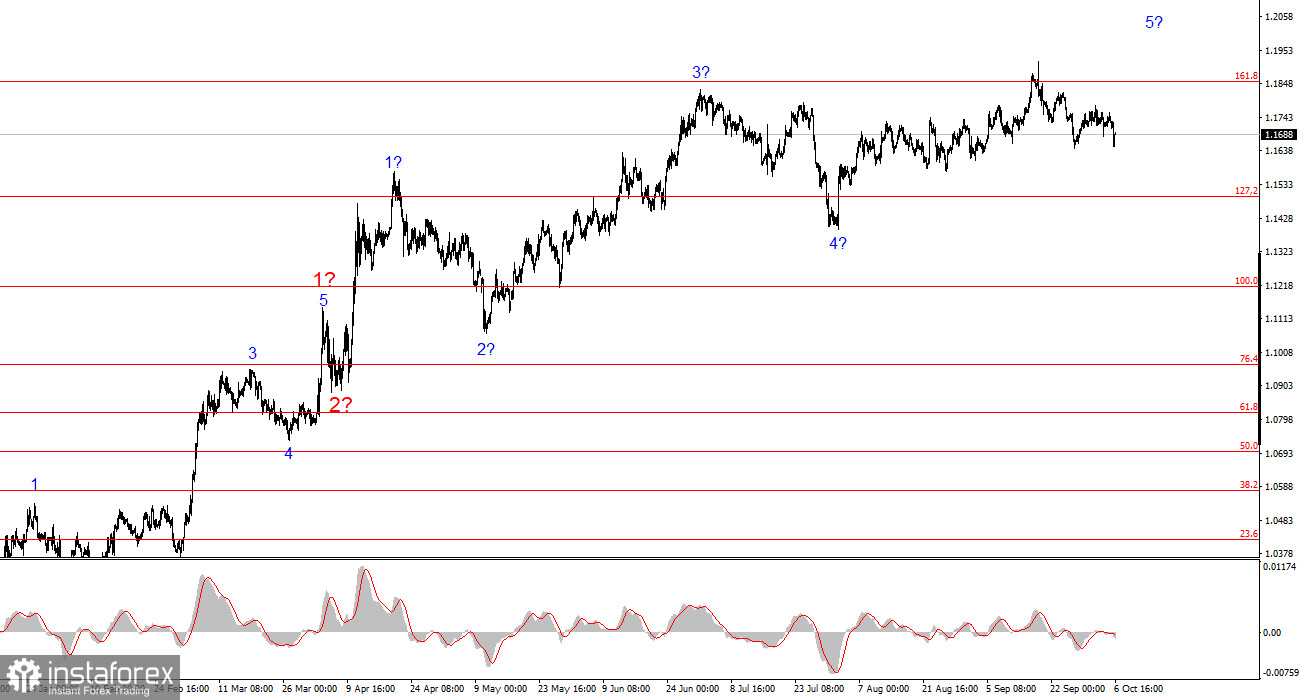

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months, but in recent weeks it has taken on a more complex form. It is still too early to conclude that the upward section of the trend has been canceled, but a new decline in the European currency would require adjustments.

The upward section of the trend continues to form, while the news background largely does not support the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. Market expectations for a dovish Fed rate policy are growing. A government shutdown has begun in the U.S. The market rates the results of Donald Trump's first 7–8 months in office quite low, even though GDP growth in the second quarter was nearly 4%.

At this point, it can be assumed that impulse wave 5 is still forming, with targets possibly reaching as high as the 1.25 level. Within this wave, the structure is rather complex and ambiguous, but on a larger scale it does not raise particular questions. At present, three waves upward are visible, which means the instrument is in the process of forming wave 4 within wave 5, taking the form of a three-wave structure that may already be complete.

The EUR/USD pair fell by nearly 100 basis points in the first half of Monday but quickly recovered with the U.S. session opening. In my recent reviews, I have regularly mentioned that neither the wave structure nor the news background implies a decline in the euro. Certainly, some reports or events provide support for sellers, and they try to take advantage of them from time to time. But overall, the circumstances work against the U.S. currency.

In recent weeks, the U.S. dollar has held up relatively well, considering the news flow that could have caused a new collapse. Let me remind you that a government shutdown is quite a significant reason for reduced demand for the dollar. The new "cooling" of the U.S. labor market (according to the ADP report) is a strong reason to expect monetary easing by the Fed in both October and December. Falling or low business activity points to an overall economic slowdown, since business activity indices are leading indicators.

Based on all of the above, the euro's position looks quite stable, despite the new political crisis in France. However, it should be noted that a political crisis is not the same as a shutdown or an economic crisis, which have a direct and concrete negative impact on the economy. Therefore, the situation with the appointment of a fifth prime minister in France in the last two years is not a strong driver for a fall in the euro. I still remain inclined toward buying the euro.

General Conclusions

Based on the EUR/USD analysis, I conclude that the pair continues forming an upward section of the trend. The wave structure still depends entirely on the news background related to Trump's decisions, as well as the foreign and domestic policy of the new White House administration. The targets of the current trend section could extend up to the 1.25 level. At present, a corrective wave 4 is forming, which may already be complete. The upward wave structure remains intact. Therefore, in the near term, I consider only long positions. By the end of the year, I expect the euro to rise to 1.2245, which corresponds to 200.0% Fibonacci.

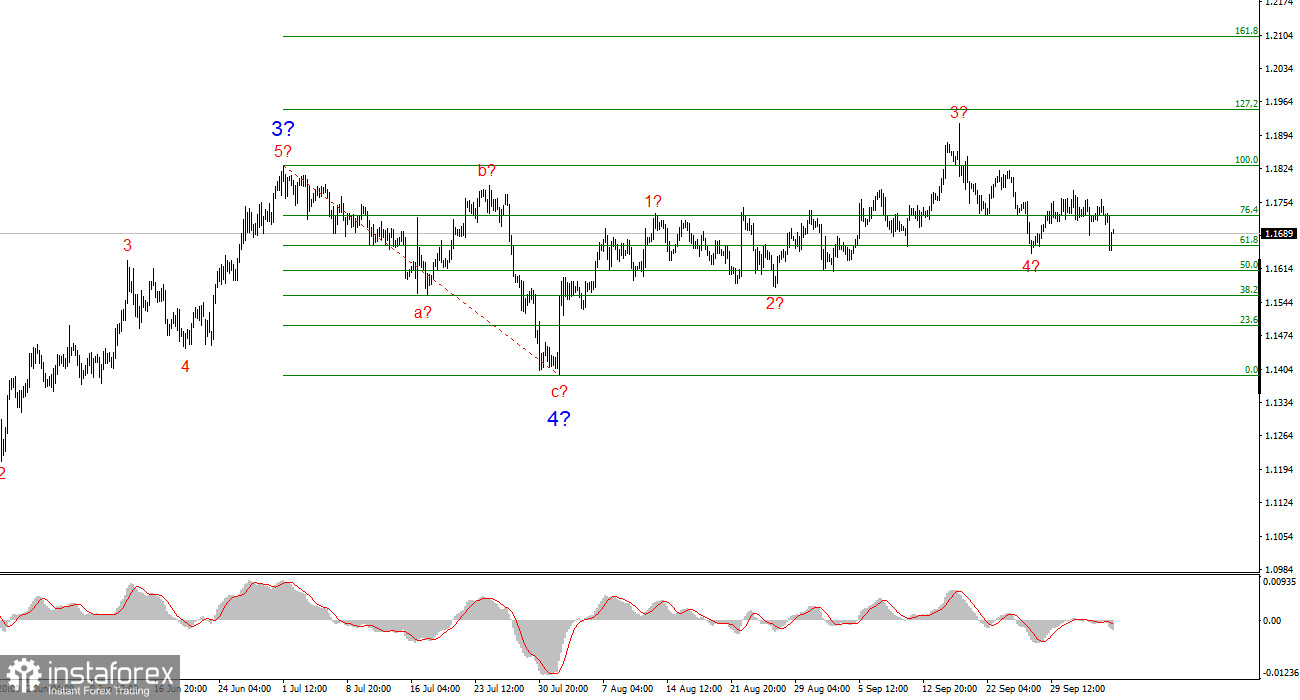

On a smaller scale, the entire upward section of the trend is visible. The wave structure is not the most standard, as the corrective waves vary in size. For example, the larger wave 2 is smaller in size than the internal wave 2 within wave 3. But such cases also occur. Let me remind you that it is better to highlight clear structures on the charts rather than force a label onto every wave. At this point, the upward structure raises almost no doubts.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in the market situation, it is better to stay out.

- There is never 100% certainty about market direction. Always remember protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.