GBP/USD

Brief Analysis: On the chart of the British pound major, the main trend throughout this year has been driving the pair upward. Over the past three months, the middle part (B) has been forming as a horizontal flat along the upper boundary of a powerful potential reversal zone. It remains unfinished.

Weekly Forecast: At the start of the week, a pullback of the British pound toward the resistance zone is likely. Afterward, a reversal can be expected. By the end of the week, the pair may resume its downward price movement. The support zone indicates the lowest expected weekly range for the pair.

Potential Reversal Zones:

- Resistance: 1.3520/1.3570

- Support: 1.3270/1.3220

Recommendations:

- Purchases: Possible during individual sessions with reduced volume size; upside is capped by resistance.

- Sales: Relevant after reversal signals appear near the resistance zone on your trading systems (TS).

AUD/USD

Brief Analysis: In the Australian dollar market, a corrective wave is developing within the dominant uptrend. This unfinished section has been in play since September 11. The wave structure lacks the final part (C). The price is currently near a strong support/resistance level.

Weekly Forecast: In the coming week, AUD/USD is expected to move within a channel between opposing zones. After possible pressure on the support zone early in the week, a reversal and rise to resistance may follow. A brief breakout below support cannot be excluded.

Potential Reversal Zones:

- Resistance: 0.6670/0.6720

- Support: 0.6550/0.6500

Recommendations:

- Purchases: Possible after confirmed reversal signals near support.

- Sales: Low potential, risky for the deposit.

USD/CHF

Brief Analysis: The upward wave that started in early April continues to dominate USD/CHF. Its structure develops as a shifting flat. Most of the time, the price has been moving near the boundaries of a large monthly reversal zone. The wave still lacks the final part (C).

Weekly Forecast: In the coming days, mostly sideways movement is expected. A pullback toward resistance is possible. A renewed decline is likely afterward. A breakout beyond the support/resistance boundaries is unlikely.

Potential Reversal Zones:

- Resistance: 0.8090/0.8140

- Support: 0.7860/0.7810

Recommendations:

- Purchases: Very limited potential, high risk of losses.

- Sales: Possible in fractional volumes after reversal signals near resistance.

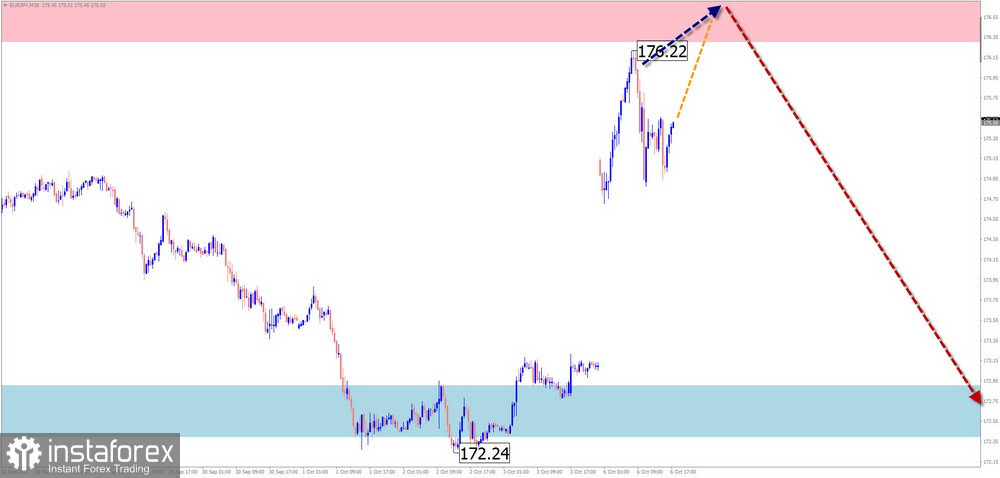

EUR/JPY

Brief Analysis: The current upward wave structure for EUR/JPY began in late February. Since last week, the final part (C) has been developing but remains incomplete. The price has reached the boundaries of a potential reversal zone on the weekly timeframe.

Weekly Forecast: At the start of the week, sideways movement with an upward bias is expected. Price growth is unlikely to exceed resistance. By the end of the week, a reversal and decline are probable.

Potential Reversal Zones:

- Resistance: 176.30/176.80

- Support: 172.90/172.40

Recommendations:

- Purchases: Possible intraday with fractional volumes; potential capped by resistance.

- Sales: Possible after confirmed reversal signals near resistance.

EUR/GBP

Analysis: The weekly EUR/GBP chart shows a descending flat forming since April. In recent weeks, price has been drifting sideways within a corridor formed over the past two months.

Forecast: Sideways movement is likely to continue in the coming days. A price rise is possible, with temporary pressure on resistance. A reversal and resumption of the downtrend toward support is expected afterward.

Potential Reversal Zones:

- Resistance: 0.8760/0.8810

- Support: 0.8600/0.8550

Recommendations:

- Purchases: Limited potential, reduce volume size.

- Sales: Main trade direction after reversal signals near resistance.

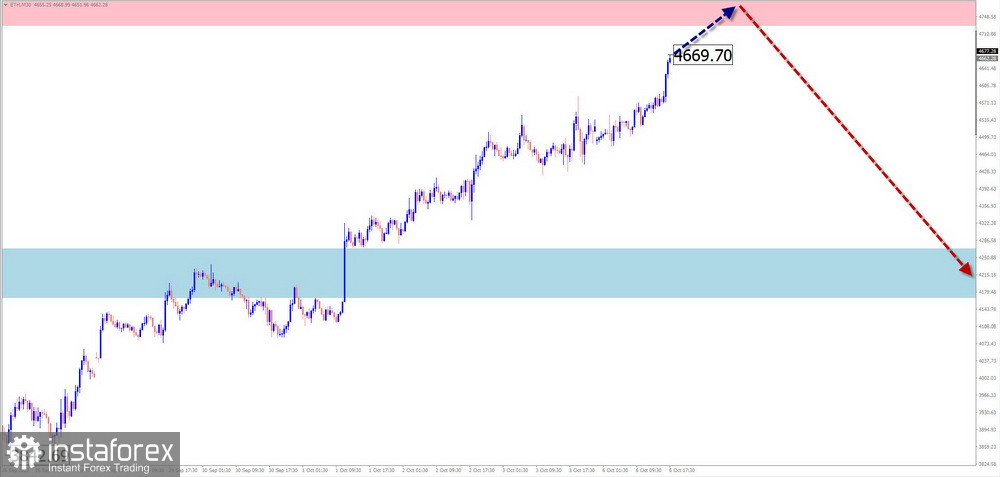

#Ethereum

Analysis: Since late August, Ethereum has been in a downward wave forming a shifting flat. Its potential already exceeds the retracement of the previous trend segment. The current unfinished section is bullish and started on September 25. Price is moving in a narrow corridor between two opposing zones.

Forecast: At the start of the week, an upward move is expected. Near resistance, a halt and reversal conditions may form. By the end of the week, increased volatility and renewed decline are likely.

Potential Reversal Zones:

- Resistance: 4730.0/4830.0

- Support: 4270.0/4170.0

Recommendations:

- Purchases: Risky, may lead to losses.

- Sales: Possible with reduced volume size after reversal signals appear near resistance.

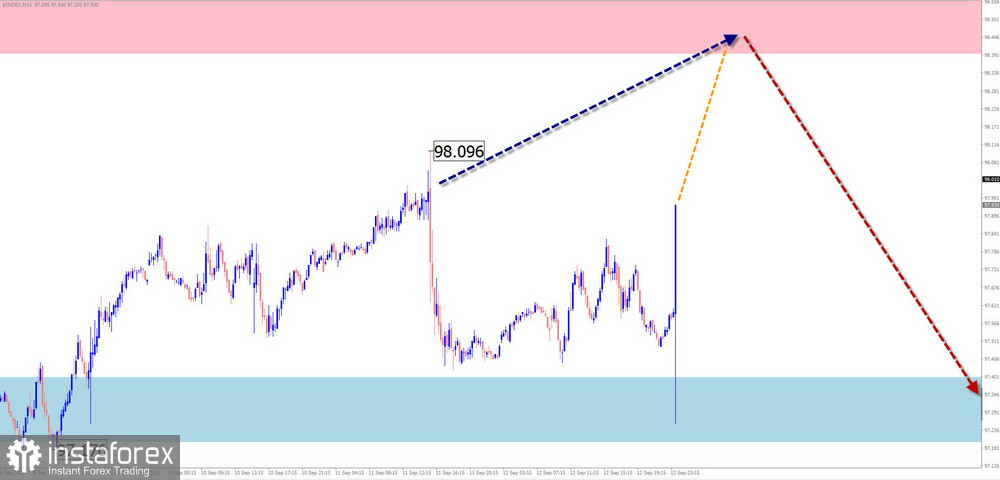

US Dollar Index

Brief Analysis: The short-term bearish trend of the U.S. Dollar Index, which began in early August, continues. Price has broken through intermediate support, which has now become resistance. The wave structure is in the middle part (B). Before continuing its decline, the index needs to complete this correction.

Weekly Forecast: In the first half of the week, sideways movement is most likely. An upward move toward resistance is possible. Afterward, the dollar's decline should resume.

Potential Reversal Zones:

- Resistance: 98.40/98.90

- Support: 97.40/96.90

Recommendations: The dollar's decline is expected to continue in the coming weeks. Betting on the growth of majors carries risks. It is optimal to remain in short positions on major pairs until reversal signals for the Dollar Index appear.

Notes: In Simplified Wave Analysis (SWA), all waves consist of 3 parts (A-B-C). On each timeframe, the last unfinished wave is analyzed. Dashed lines show expected movements.

Attention: The wave algorithm does not account for the duration of movements over time!