On Monday, the GBP/USD currency pair declined only slightly, in contrast to the EUR/USD pair. A new political crisis erupted in France, where the new Prime Minister resigned after holding the position for less than a month. The euro was likely under pressure from the market due to this event. However, the political crisis in France has nothing to do with the British pound. At the same time, the pound has plenty of its own problems.

Remember, just over the past couple of months, the British currency has crashed twice on news surrounding issues with the 2026 budget. In short, government spending has outpaced revenue, making it impossible to draft a workable budget proposal. The country's main Treasury official, Rachel Reeves, even broke down in tears in Parliament under a barrage of harsh criticism.

The pound has also fallen due to record-high government bond yields not seen in 27 years. Again, to simplify: the higher the yield, the more expensive borrowing becomes for the government, and the greater the strain on the national budget.

Thus, the British pound is far from being every trader's and investor's dream asset, and the UK is certainly not the most trouble-free country in the world. However, we've been saying this since the beginning of 2025, when Donald Trump returned for a second term. In 2025, it's the dollar that's been collapsing, while other currencies have risen—not necessarily due to the strength of their own economies, but because of the dollar's weakness. Currently, the U.S. is facing more issues than the UK.

This week, all eyes will be on a key event: a speech by Jerome Powell. But what exactly will the Federal Reserve chair have to say? This question is especially relevant in the current environment. Markets, in general, no longer know what to expect from Powell's appearances. And now, even Powell himself doesn't have much to talk about—because key labor and unemployment reports have not been published. Inflation data is likely to suffer the same fate.

That means the Fed will have to make its next interest rate decision based essentially on thin air. In such a case, we might even assume that the Fed will make no decision at all and leave rates unchanged. On what basis would they pursue monetary easing? Granted, there's a 90% chance that the labor market continues to weaken, and September's rate cut likely wasn't enough to revive it. However, Powell and his colleagues have repeatedly emphasized that decisions will be based only on macroeconomic data.

Therefore, Powell this week might answer the key question: Will the Fed even consider discussing another rate cut if the data is not published before October 29? For the record, the market is almost certain that rates will be cut again, both in October and in December. But those expectations are scarcely visible on charts of dollar movements.

In theory, demand for both the pound and the dollar may be waning simultaneously. But if that's the case, who then is the beneficiary when the two world's major currencies are falling together?

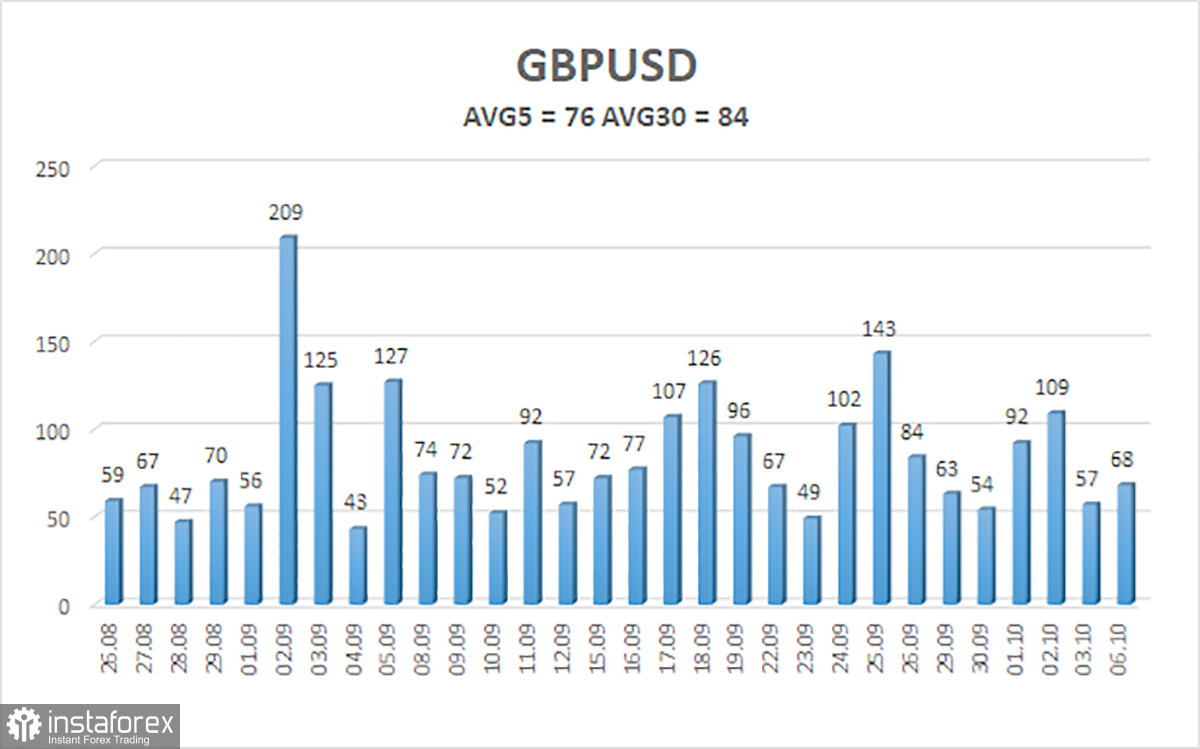

The average volatility of the GBP/USD pair over the past five trading days is 76 pips, which is considered "average" for this pair. On Tuesday, October 7, we therefore expect the pair to move within the range limited by the levels of 1.3403 and 1.3555.

The higher linear regression channel is pointing upward, indicating a clear upward trend. The CCI indicator has entered oversold territory, once again signaling the potential resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations

The GBP/USD currency pair is undergoing a correction, but its long-term outlook remains unchanged. Donald Trump's policies are likely to continue putting pressure on the dollar, so we do not expect growth from the U.S. currency. Therefore, long positions targeting 1.3672 and 1.3733 remain much more relevant if the price is above the moving average.

If the price is below the moving average, short positions become possible with technical targets at 1.3403 and 1.3367. From time to time, the U.S. currency shows signs of a correction, as it is doing now, but sustained strengthening requires concrete signs—such as the end of the trade war or other major positive developments.

Explanation of Illustrations:

- Linear Regression Channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The Moving Average Line (settings: 20.0, smoothed) indicates the short-term trend and trading direction.

- Murray Levels mark target levels for price movements and corrections.

- Volatility Levels (red lines) represent the expected price range for the pair over the next 24 hours, based on current volatility indicators.

- The CCI Indicator enters the oversold region below -250 or the overbought region above +250, signaling a possible trend reversal.