Trade Analysis and Tips for Trading the British Pound

The price test at 1.3456 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential.

The U.S. dollar resumed its decline against the British pound yesterday after Republicans and Democrats once again failed to reach a budget agreement, extending the government shutdown. Investors, exhausted by political uncertainty and concerned about its potential economic consequences, continued to abandon dollar-denominated assets, which immediately impacted the exchange rate against major global currencies.

As is well known, a prolonged shutdown erodes confidence in the U.S. economy, reducing the appeal of the national currency and prompting capital outflows.

In the first half of the day, Halifax is scheduled to release its UK House Price Index report. In the current macroeconomic environment, this data is especially significant.

Traders will pay close attention to changes in real estate prices relative to previous periods. A decline in housing prices could signal a cooling market due to high borrowing costs and reduced consumer purchasing power. On the other hand, even a slight rise in prices may indicate market resilience — possibly driven by limited housing supply or sustained demand for certain property types.

Additionally, the Halifax report typically includes analysis of contributing factors, such as employment levels, consumer confidence, and broader economic forecasts.

Today, I'll mainly rely on executing Buy Scenarios 1 and 2.

Buy Scenarios

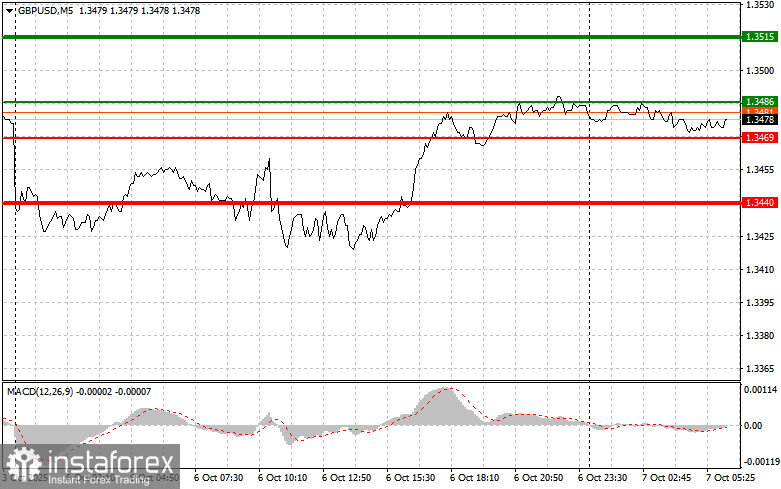

Scenario #1: Buy the British pound at an entry point near 1.3486 (thin green line on the chart), with an upside target at 1.3515 (thick green line). I plan to exit my long positions at 1.3515 and open short positions in the opposite direction, targeting a 30–35 pip pullback.

Important: Buy positions should only be considered after strong economic data is released. Before entering, ensure the MACD indicator is above the zero line and is just beginning to rise.

Scenario #2: I also plan to buy the pound following two consecutive tests of the 1.3469 level when the MACD indicator is in oversold territory. This would limit the pair's downside potential and likely trigger a reversal to the upside. Expected price targets in this case are 1.3486 and 1.3515.

Sell Scenarios

Scenario #1: Sell the pound after the price breaks below the 1.3469 level (thin red line). This will likely lead to a quick drop toward the 1.3440 level (thick red line), where I plan to exit sell positions and open long positions in the opposite direction — anticipating a 20–25 pip rebound.

Important: Before selling, ensure that the MACD indicator is below the zero line and is just beginning to decline.

Scenario #2: I also plan to sell the pound after two consecutive tests of the 1.3486 level while the MACD is in overbought territory. This would cap the pair's upside potential and likely lead to a bearish reversal. Anticipated downside targets in this case are 1.3469 and 1.3440.

What's on the chart:

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Proposed Take Profit level or manual profit-taking zone. Further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Proposed Take Profit level or manual profit-taking zone. Further decline below this level is unlikely.

- MACD Indicator: Always use MACD to identify overbought or oversold conditions when entering trades.

Important Note for Beginner Forex Traders

Beginner traders must exercise great caution when making entry decisions in the market—especially before major fundamental data releases. It's often best to stay out of the market during such events to avoid sharp market moves that go against active trades.

If you do choose to trade during news releases, always use stop-loss orders to minimize risk. Trading without a stop-loss, especially with large volumes or poor risk management, can lead to a rapid and complete loss of your trading account.

Remember: successful trading relies on having a clear plan, such as the one outlined above. Making trades based on emotion or reacting impulsively to market movements is a losing strategy, especially for intraday traders.