The stock market continues its upward climb despite multiple concerns. Overvalued fundamentals, trade tariffs, and a government shutdown — all of these typically spell trouble for the S&P 500. Yet the broad U.S. equity index continues to "find the good in the bad." It has now recorded its 32nd all-time high of the year, driven by optimism in artificial intelligence (AI) and expectations ahead of the upcoming corporate earnings season. Contributing to the rally was also a statement from the U.S. President regarding negotiations with the Democrats.

S&P 500 Corporate Earnings Outlook

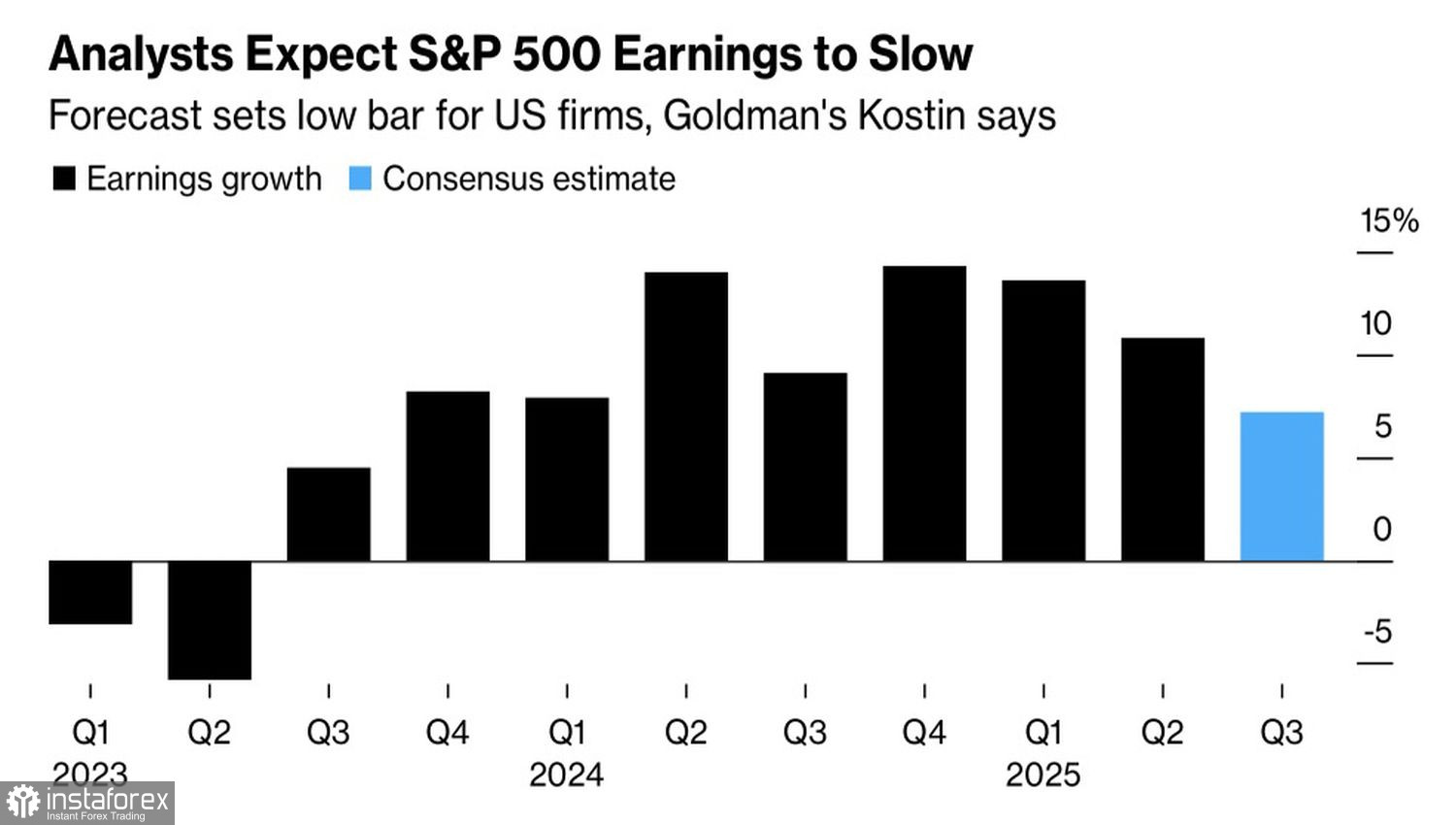

According to Bloomberg analysts, corporate earnings for S&P 500 companies are expected to grow by 7.2% in the July–September quarter, the smallest increase in two years. However, Goldman Sachs believes this consensus estimate is too conservative. In their view, the robust U.S. economy and promising developments in AI technologies suggest actual results will beat expectations. Goldman especially highlights the so-called "Magnificent Seven" tech giants as the primary performers of earnings.

Morgan Stanley also maintains a strongly bullish outlook—the firm projects even greater profits in 2026, supported by a decelerating U.S. inflation rate. The negative impact of tariffs will eventually be reflected in consumer prices, which are expected to rise at a slower pace.

Edwards Asset Management is even more optimistic, forecasting that the S&P 500 could reach the 7000 mark as early as 2025. The primary drivers of the rally include strong corporate earnings, a wave of stock buybacks, and the $7 trillion currently parked in U.S. money market funds. As the Federal Reserve reduces the federal funds rate, this liquidity is expected to flow into equities.

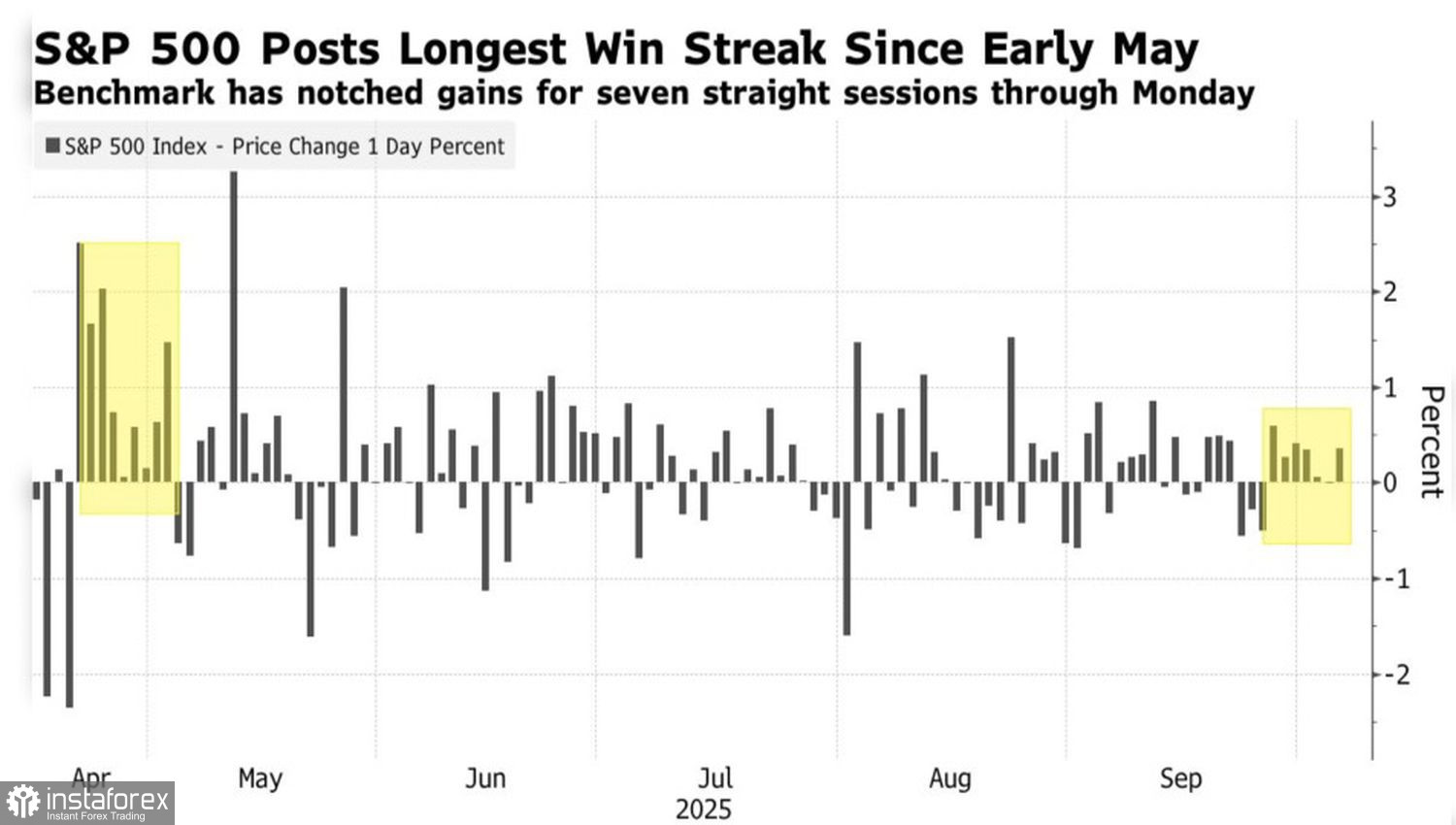

As such, the S&P 500 has essentially shrugged off the government shutdown, relying instead on its key tailwinds: artificial intelligence, a still-strong U.S. economy, the Fed's monetary expansion, and expectations of a favorable earnings season. This resulted in a 7-day winning streak — the longest streak since May.

S&P 500 Price Momentum

U.S. President Donald Trump's recent speech added fuel to the bulls' fire. He spoke about ongoing negotiations with Democrats aimed at reaching a healthcare deal to reopen the government. Democrats responded that no talks are currently underway, but welcomed the President's willingness to make concessions.

If the government shutdown ends soon, the U.S. economy could gain momentum and provide the Federal Reserve with the necessary data to continue monetary stimulus. This scenario would bode well for U.S. equity markets. Investors are likely to keep "climbing the wall of worry," buying the dips along the way.

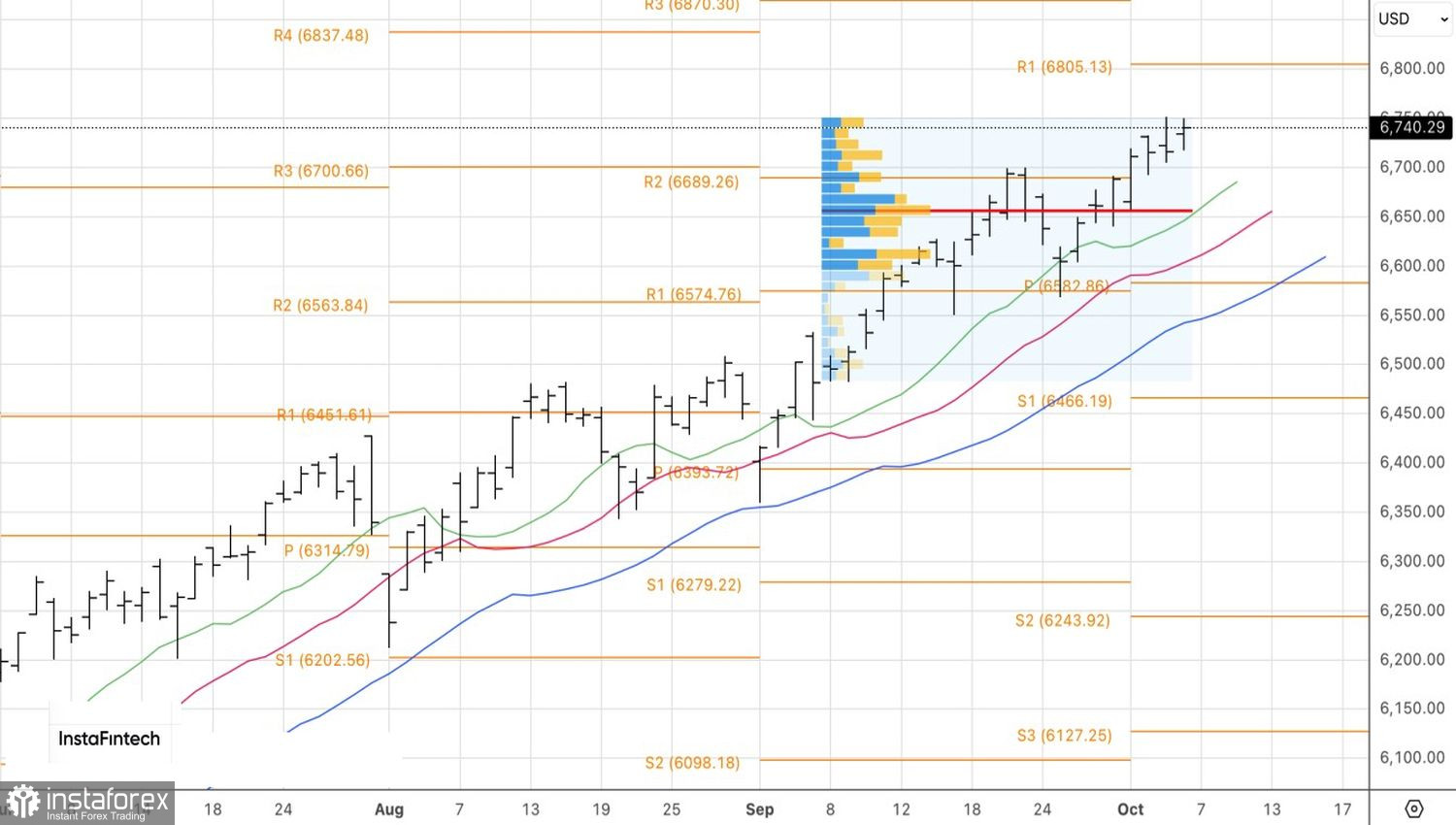

Technical View

On the daily chart, the S&P 500 has formed two consecutive doji bars with conflicting wicks. This signals growing market indecision and increases the risk of a pullback if prices fall below the 6720 level. Still, there is little doubt about the strength of the current uptrend. As such, short-term dips may be viewed as buying opportunities, with previously stated targets at 6800 and 6920.