Today the British pound, the euro, and the Australian dollar were successfully traded using the Momentum strategy. I did not trade anything using Mean Reversion.

Weak data on German factory orders put pressure on the euro in the first half of the day. Traders took this as a signal of a possible slowdown in economic growth in the eurozone's largest economy and, consequently, in the region as a whole. Concerns were reinforced by the escalation of the political crisis in France, which in recent days has weighed heavily on risk assets. Against this backdrop, the U.S. dollar showed steady growth.

As for the second half of the day, much will depend on trade balance data and consumer credit figures. Favorable results, especially regarding a reduction in the trade deficit, could support the dollar by signaling a recovery in economic activity. Conversely, weak data would revive negative sentiment. In addition, FOMC members Raphael Bostic and Michelle Bowman are scheduled to speak. A dovish tone from policymakers would pressure the dollar. If Federal Reserve officials hint at the possibility of further rate cuts this month, it could significantly weaken the dollar's position. Hawkish statements, emphasizing the need for patience in the fight against inflation, would, on the contrary, strengthen the U.S. currency.

In the case of strong statistics, I will rely on implementing the Momentum strategy. If there is no significant market reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum Strategy (breakout trades) for the second half of the day:

For EUR/USD

- Buying on a breakout above 1.1680 could push the euro toward 1.1710 and 1.1743;

- Selling on a breakout below 1.1650 could push the euro down toward 1.1611 and 1.1576.

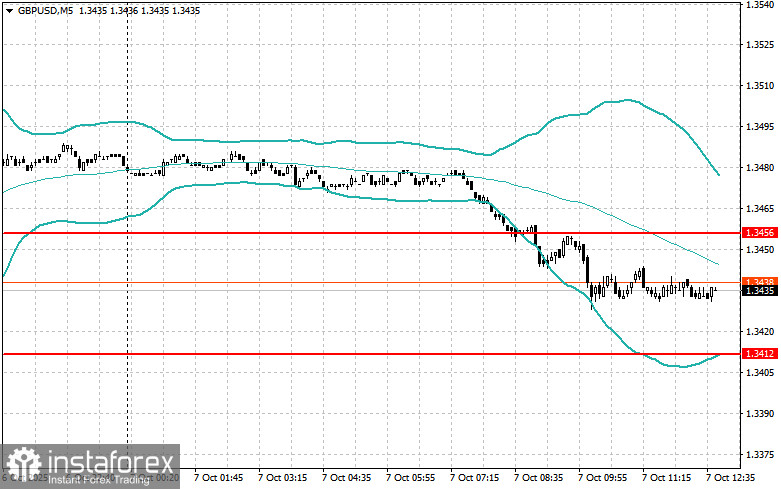

For GBP/USD

- Buying on a breakout above 1.3457 could push the pound toward 1.3506 and 1.3540;

- Selling on a breakout below 1.3420 could push the pound down toward 1.3400 and 1.3380.

For USD/JPY

- Buying on a breakout above 150.90 could push the dollar toward 151.25 and 151.65;

- Selling on a breakout below 150.65 could trigger dollar selling toward 150.35 and 150.00.

Mean Reversion Strategy (reversal trades) for the second half of the day:

For EUR/USD

- Look for selling opportunities after a failed breakout above 1.1690 followed by a return below this level;

- Look for buying opportunities after a failed breakout below 1.1651 followed by a return above this level.

For GBP/USD

- Look for selling opportunities after a failed breakout above 1.3456 followed by a return below this level;

- Look for buying opportunities after a failed breakout below 1.3412 followed by a return above this level.

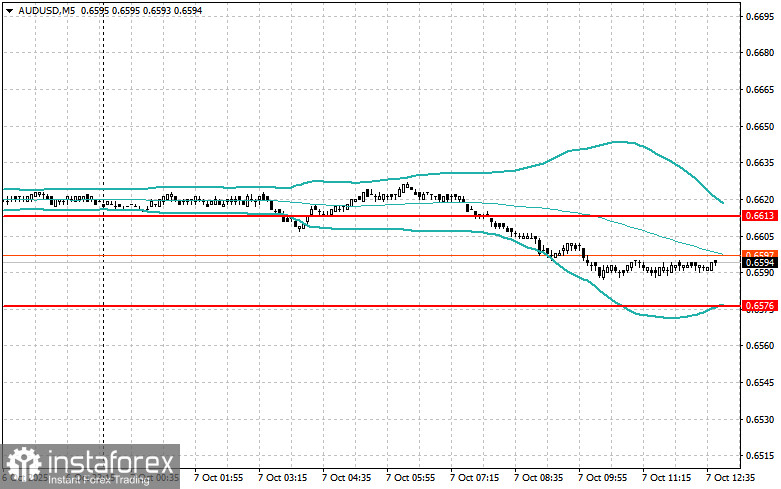

For AUD/USD

- Look for selling opportunities after a failed breakout above 0.6613 followed by a return below this level;

- Look for buying opportunities after a failed breakout below 0.6576 followed by a return above this level.

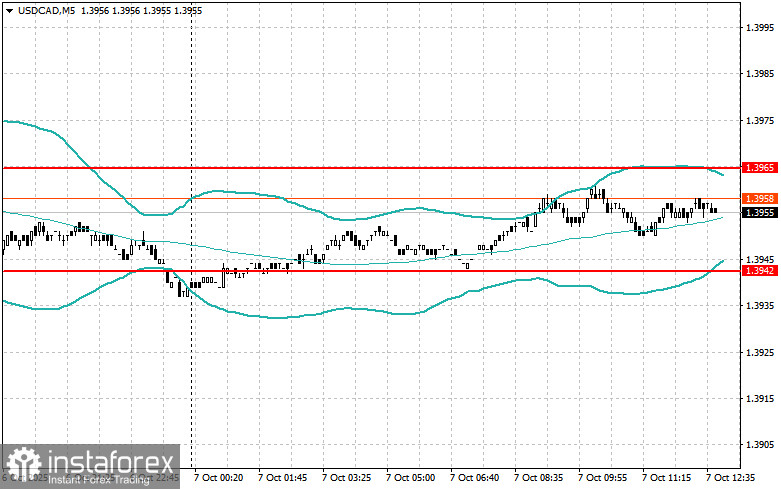

For USD/CAD

- Look for selling opportunities after a failed breakout above 1.3965 followed by a return below this level;

- Look for buying opportunities after a failed breakout below 1.3942 followed by a return above this level.