Macroeconomic Report Overview:

Only one macroeconomic release is scheduled for Wednesday — Germany's industrial production data. We believe that most traders already understand that this report, even if it generates a short-term reaction, is unlikely to have any significant influence on the broader market trend.

The U.S. dollar continues to strengthen for reasons that defy fundamental and macroeconomic logic. We consider the current movement entirely illogical, and traders need to recognize and accept that.

Key Fundamental Events:

Despite a thin macro data calendar, several fundamental events are lined up.

In the Eurozone, European Central Bank President Christine Lagarde is scheduled to speak again. However, once again, we do not expect anything significant from her remarks. Lagarde has already made three public appearances last week and spoken twice this week, none of which provided any meaningful new information or policy insights.

In the United States, Federal Reserve officials Michael Barr and Neel Kashkari will also deliver remarks. These comments are also unlikely to move the market.

It's clear that FOMC's Michael Barr will continue to support the most aggressive path of interest rate cuts. Just yesterday, a newly appointed FOMC member stated that monetary policy should be eased because the "neutral rate" has decreased due to demographic shocks. He also remarked that overall uncertainty risks are diminishing. To this, we'll add that most Federal Reserve officials continue to pursue a "moderate approach" when it comes to easing monetary policy.

General Takeaways:

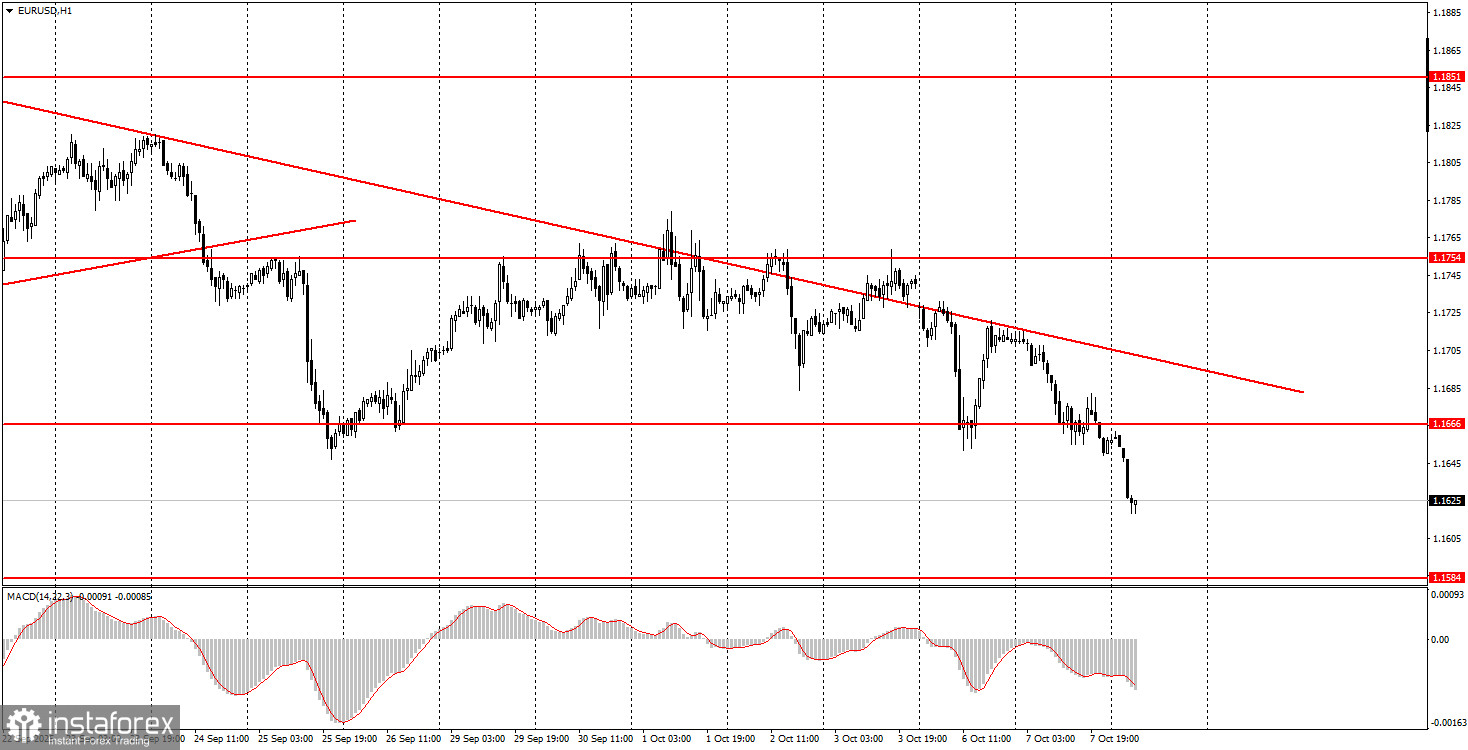

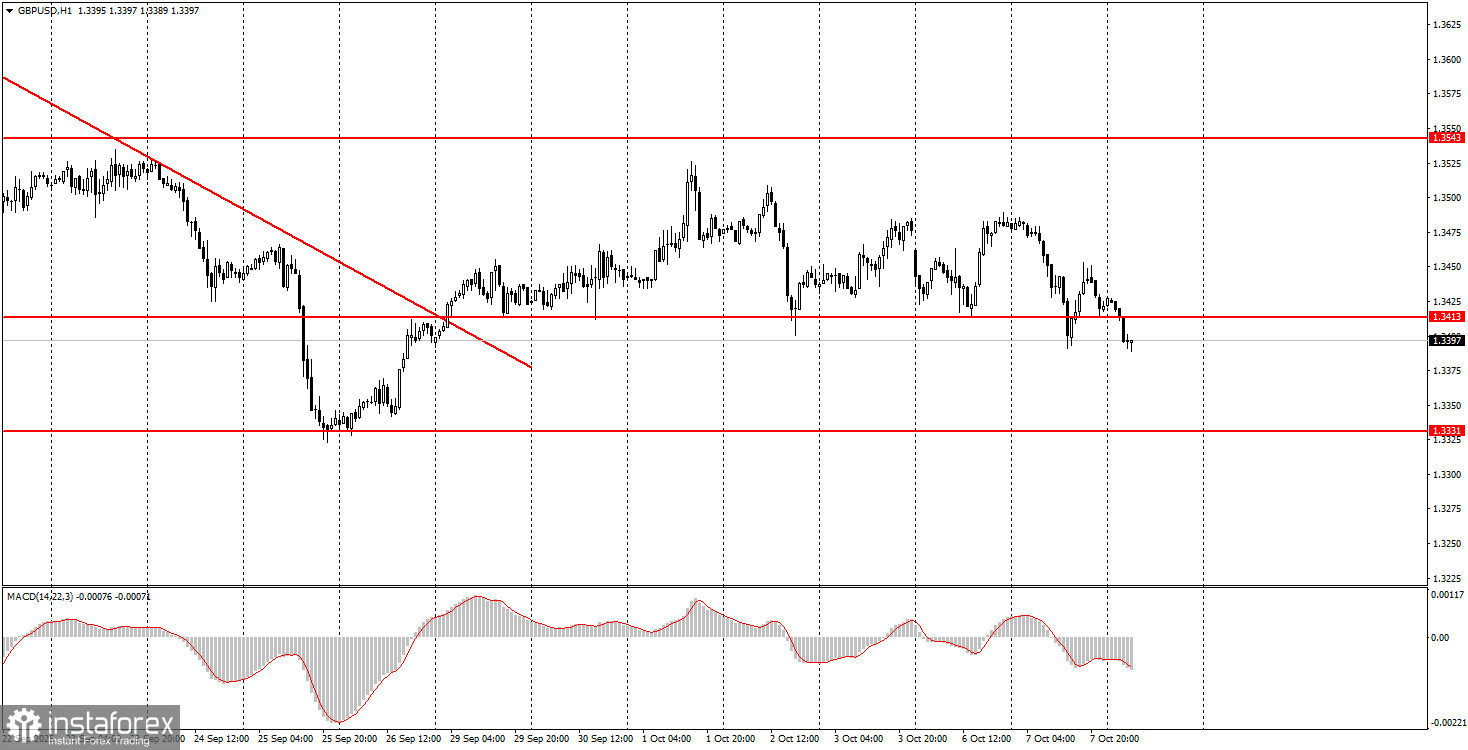

On this third trading day of the week, both EUR/USD and GBP/USD may continue to trade erratically and illogically. We saw unexplained declines yesterday and again overnight — and today, we could just as easily see upward movement that's equally difficult to justify. Therefore, novice traders should stick to trading from nearby levels or technical zones as usual, but be cautious — market behavior at the moment is far from rational or stable.

Core Rules of the Trading System:

- The strength of a trading signal is based on how quickly it forms (either a bounce or a breakout). The less time required, the stronger the signal.

- If two or more trades from a specific level turn out to be false signals, all future signals from that level should be ignored.

- In a flat (sideways) market, many false signals may emerge, or no signals at all. In any case, if sideways conditions are detected, it's better to stop trading.

- Trades should be entered between the start of the European session and the middle of the American session. All open trades should be closed manually afterward.

- On the hourly chart, MACD-based signals should only be followed when volatility is high and a trendline or trend channel confirms a trend.

- If two levels are too close to one another (between 5 and 20 pips), they should be treated as a single support or resistance zone.

- Once a trade moves 15-20 pips in your favor, the Stop Loss should be set to breakeven.

Interpretation of Chart Elements:

- Support and resistance levels are the key targets for opening buy or sell positions. Take Profit levels can also be set around them.

- Red lines indicate channels or trendlines that represent the current market direction and the preferred trading vector.

- The MACD (14, 22, 3) histogram and signal lines are auxiliary indicators used to generate entry signals.

Final Notes for Beginners:

Major speeches and reports (always listed in economic calendars) can heavily affect currency pair movements. It's best to trade cautiously or stay out of the market during such events to avoid sudden reversals.

Beginner forex traders should always remember that not every trade will be profitable. Developing a clear trading strategy and sound money management are the cornerstones of long-term success.