Bitcoin posted a notable decline yesterday, pulling back to more attractive buying levels around $121,000. Many traders are now wondering whether this drop will continue or if it's merely a temporary correction that could soon give way to a new bullish wave.

Recent data shows that inflows into spot BTC and ETH ETFs continue to rise—most notably into BTC ETFs. This in itself suggests that the crypto bull rally is not over. As a reminder, inflows into spot BTC ETFs are one of the strongest bullish drivers in the crypto market. Rising inflows reflect growing institutional interest in cryptocurrencies, as ETFs offer institutions a regulated and convenient way to gain exposure to BTC and ETH without requiring direct custody of digital assets.

These inflows also signal an improving market sentiment, which is further boosted by macroeconomic factors such as falling inflation and expectations of monetary easing by major central banks.

Another catalyst underpinning future upside is the ongoing U.S. government shutdown. Some experts believe the current deadlock could last through October, which would provide a compelling narrative for increasing long positions in bitcoin.

From an intraday strategy standpoint, the approach remains the same: buying into major pullbacks in Bitcoin and Ether with the expectation of a continued medium-term bullish market.

Below are updated short-term setups for both Bitcoin and Ethereum.

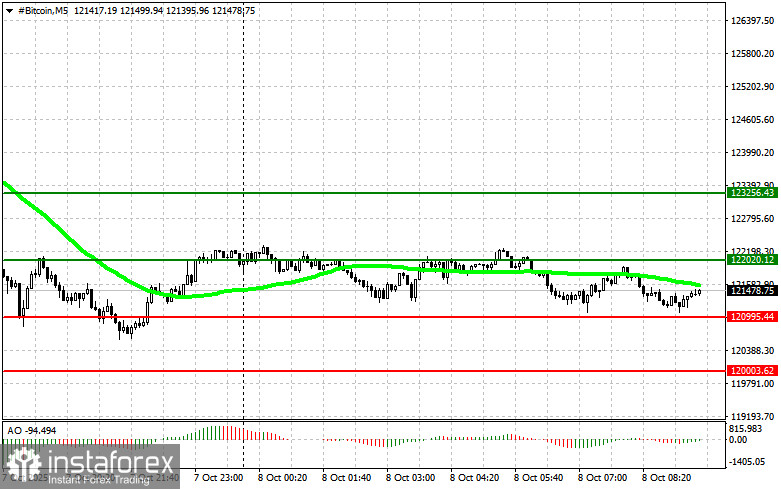

Bitcoin (BTC)

Buy Scenarios

Scenario 1: Plan to buy Bitcoin today if the price reaches the entry point around $122,000. The upside target is $123,200. At this level, I will close long positions and open shorts in the opposite direction, expecting a 30–35 pip retracement. Before entering a breakout buy, make sure the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario 2: Another option is to buy from the lower boundary at $121,000, if there is no significant bearish reaction to a break lower. The expected move is a return to $122,000 and $123,200.

Sell Scenarios

Scenario 1: Plan to sell Bitcoin if the price reaches $121,000, with a target of $120,000. At $120,000, I will close short positions and consider buying on a bounce. Confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory before entering.

Scenario 2: Selling is also possible from the $122,000 upper boundary if there is no bullish breakout and the price returns downward. The expected targets in this case are $121,000 and $120,000.

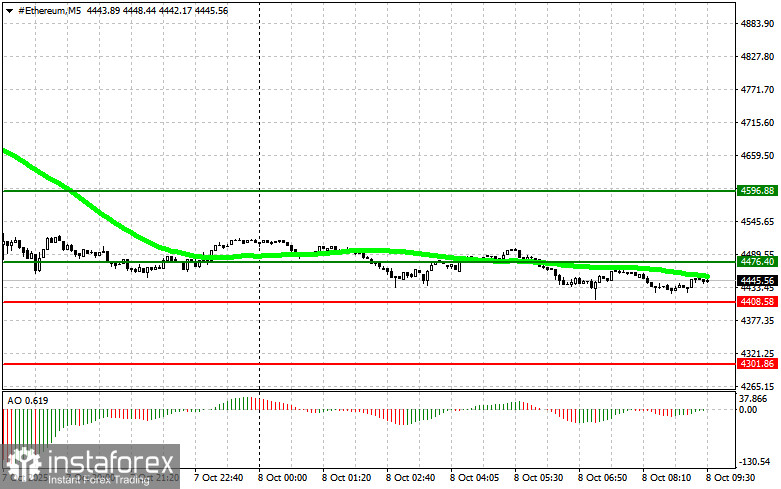

Ethereum (ETH)

Buy Scenarios

Scenario 1: Plan to buy Ethereum once the price hits the entry zone at $4,476 and aim for a rise to $4,596. I will close all long positions at $4,596 and consider opening short positions immediately for a pullback. Before entering a breakout buy, verify that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: Another buy opportunity is from the lower boundary at $4,408, assuming there's no bearish momentum below it. A return to $4,476 and $4,596 is the expected recovery path.

Sell Scenarios

Scenario 1: Plan to sell Ethereum at around $4,408 with a downside target of $4,301. I will exit short positions at $4,301 and look to buy on a bounce. Ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory before initiating a short position.

Scenario 2: Selling is also valid if ETH tests the $4,476 resistance and fails to break above it. In this case, I expect the price to return to the downside levels of $4,408 and $4,301.