The EUR/USD currency pair traded lower throughout Tuesday and Wednesday, declining steadily without major pauses, even overnight. This drop has been swift and persistent. So, let's ask an important question: do traders really understand that such a move requires major fundamental justification? And do they realize that it's not enough to isolate a single event—they need to consider the entire spectrum of macroeconomic and fundamental signals?

Reading various expert commentaries brings to mind the classic line from the film "Casablanca": "Round up the usual suspects." At the moment, the euro does not have any serious reasons to be falling, yet many analysts are pointing fingers at the political turbulence in France — which isn't even a full-blown crisis — and blaming everything on that.

Meanwhile, the U.S. labor market has delivered its fifth consecutive disappointing monthly report — and that's somehow been overlooked. The ongoing U.S. government shutdown has halted the publication of key economic reports, which are also not considered critical. Declining ISM business activity indices suggest an economic slowdown? Apparently unimportant too. The Federal Reserve's dovish messaging? Ignored. Trump's escalating tariff wars? Just a side note.

But the resignation of a fifth French prime minister in two years? That's somehow a "global shockwave." Let's be honest: while France is a major EU economy, it is still just one country. The serial turnover of prime ministers has already become routine. No elections have been called, Parliament has not been dissolved, Macron has not resigned — so why the panic?

This is why we believe that the euro's decline is not truly due to the French situation. And if that is the case, then the market is completely disregarding a wide array of fundamental factors that are negative for the U.S. dollar. If that's the case, then the current price movement is illogical — something we've been highlighting for days.

Of course, illogical movements do happen in markets. Consider the dollar's long and arguably unjustifiable decline in the first half of 2025. What we're seeing now is a move that lacks a clear rationale. It might be driven by something hidden from most observers. For instance, the Swiss National Bank is openly conducting forex interventions these days—perhaps the European Central Bank is doing so secretly?

It's also possible that large institutional players urgently need U.S. dollars for operational purposes and are hoarding them regardless of the macro outlook. After all, the FX market isn't just about trading for profit—it's a real economic tool, where banks and corporations obtain the currency they need to function.

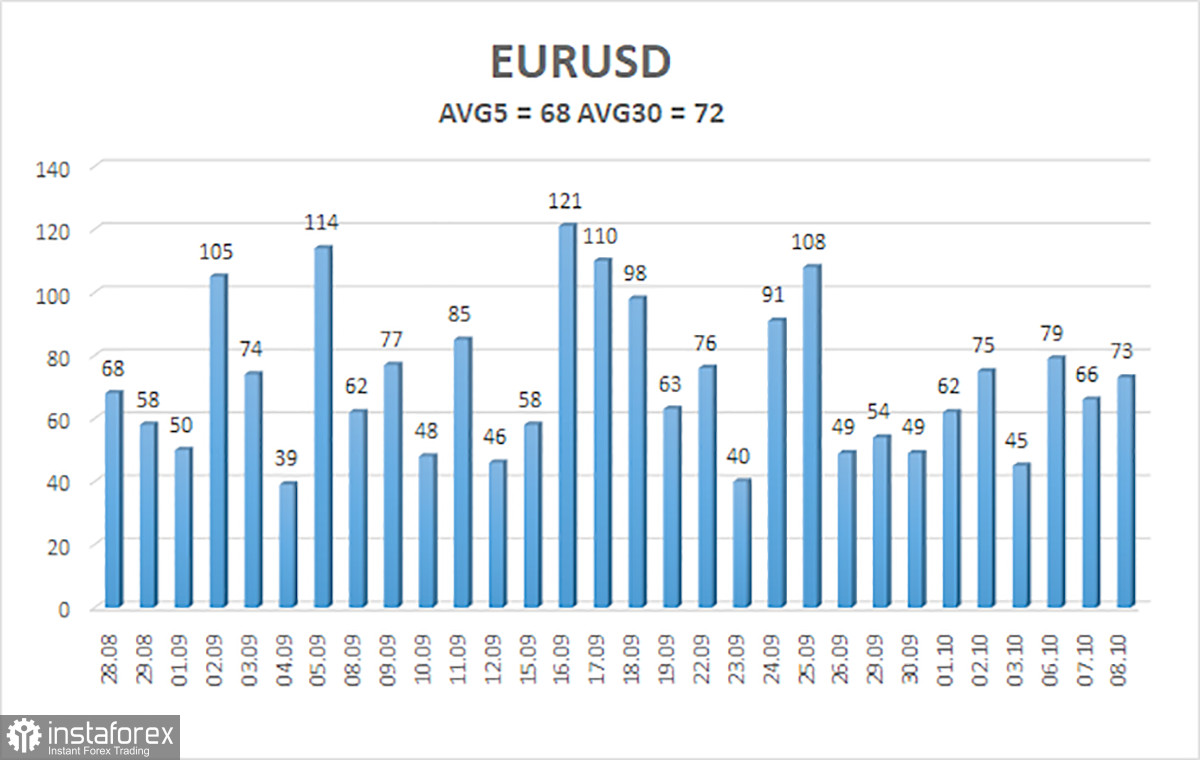

The average volatility of the EUR/USD pair over the last five trading days, as of October 9, is 68 pips, which is classified as "moderate." We expect Thursday's movement to remain between 1.1532 and 1.1668. The higher linear regression channel is still sloped upward, indicating a continued upward trend. The CCI indicator has entered oversold territory, which could trigger the next bullish wave.

Support levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1414

Resistance levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

EUR/USD continues to correct downward, but the broader uptrend remains intact, as evidenced on all higher timeframes. The U.S. dollar remains under the influence of Donald Trump's unpredictable trade and fiscal policies. The greenback's current rise is, at best, based on mixed reasoning.

If price remains below the moving average, small short positions may be considered toward technical targets at 1.1536 and 1.1532. If the price climbs above the moving average, long positions targeting 1.1841 and 1.1902 become relevant, continuing the dominant trend.

Commentary on Chart Indicators:

- Linear Regression Channels help identify the dominant trend. If both channels point in the same direction, the trend is considered strong.

- The Moving Average (20,0, smoothed) defines the short-term trend and suggests trade direction.

- Murray Levels present key pivot points for movements and corrections.

- Volatility Bands (red lines) outline the probable daily trading range, based on current volatility.

- The CCI Indicator signals potential trend reversals when entering overbought (above +250) or oversold areas (below -250).