The U.S. dollar slightly retreated in the second half of the previous day.

The Federal Reserve appears to be leaning toward further interest rate cuts this year, but whether a rate cut will happen at the October meeting remains uncertain.

Economic data continues to point to difficulties in growth across several sectors, while inflation remains above the Federal Reserve's 2% target. This creates pressure on the central bank to take action to stimulate the economy. Cutting interest rates is one of the Fed's most commonly used tools for that purpose. Lower rates make it easier for businesses and individuals to borrow, which should encourage higher spending and investment.

On the other hand, the Fed has reasons to proceed cautiously. As many policymakers noted in the latest FOMC minutes, overly aggressive rate cuts could lead to another surge in inflation.

What's on the Agenda Today?

In the first half of Thursday, Germany is expected to publish its trade balance data (exports and imports). Additionally, the European Central Bank will release the minutes of its most recent monetary policy meeting.

Traders will carefully review Germany's trade data to assess the health of the eurozone's largest economy, which has shown signs of weakness in recent months. A strong and consistent trade surplus is typically viewed as a sign of economic strength, indicating high export potential and competitiveness; however, achieving this may be challenging under current pressures from U.S. tariffs.

Meanwhile, the ECB's meeting minutes will provide deeper insight into the rationale behind recent policy decisions. Investors and analysts will be looking for clues about the likely future path of interest rates.

As for the British pound, the only notable event today is a speech from Bank of England Monetary Policy Committee member Catherine L. Mann. Her comments will be closely analyzed for hints about the Bank of England's outlook for interest rates and overall monetary policy.

Particular focus will be on her assessment of the UK's inflation outlook, labor market conditions, and broader economic prospects.

If key data and speeches are broadly in line with economists' expectations, the Mean Reversion strategy is better suited. If there is a significant deviation from expectations, consider using a Momentum (breakout) strategy.

Momentum Strategy (Breakout-Based):

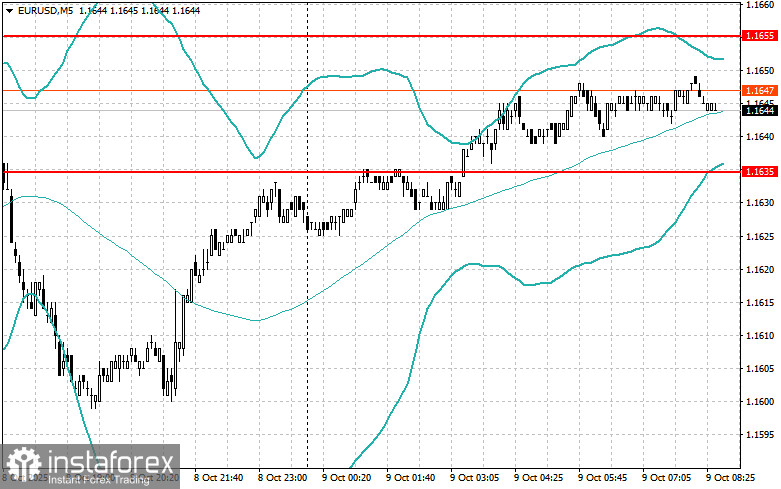

EUR/USD

Buy on breakout of 1.1646 with potential targets at 1.1681 and 1.1715

Sell on breakout of 1.1621 with potential targets at 1.1600 and 1.1570

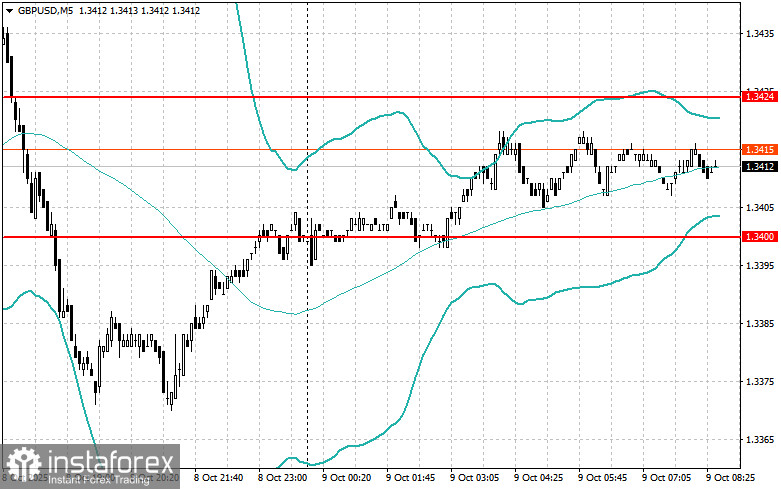

GBP/USD

Buy on breakout of 1.3410 with potential targets at 1.3430 and 1.3460

Sell on breakout of 1.3395 with potential targets at 1.3370 and 1.3325

USD/JPY

Buy on breakout of 152.80 with potential targets at 153.20 and 153.60

Sell on a breakout of 152.60 with potential targets at 152.30 and 152.00

Mean Reversion Strategy (Reversal-Based):

EUR/USD

Sell after a failed breakout above 1.1655, followed by a return below

Buy after a failed breakout below 1.1635, followed by a return above

GBP/USD

Sell after a failed breakout above 1.3424, followed by a return below

Buy after a failed breakout below 1.3400, followed by a return above

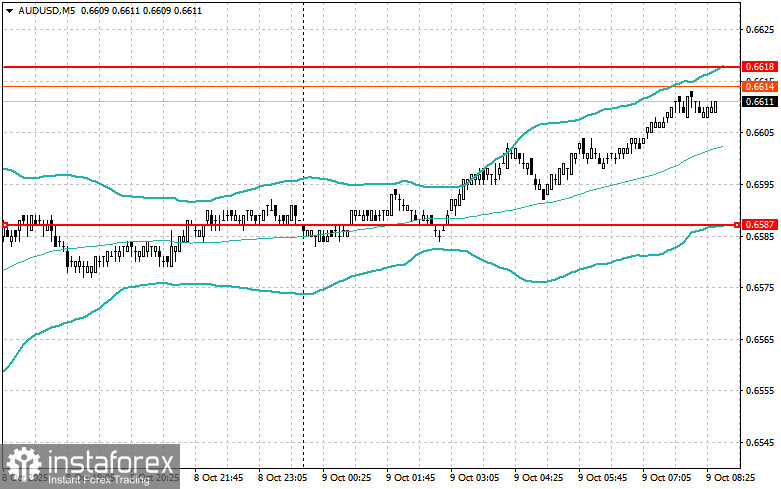

AUD/USD

Sell after a failed breakout above 0.6618, followed by a return below

Buy after a failed breakout below 0.6587, followed by a return above

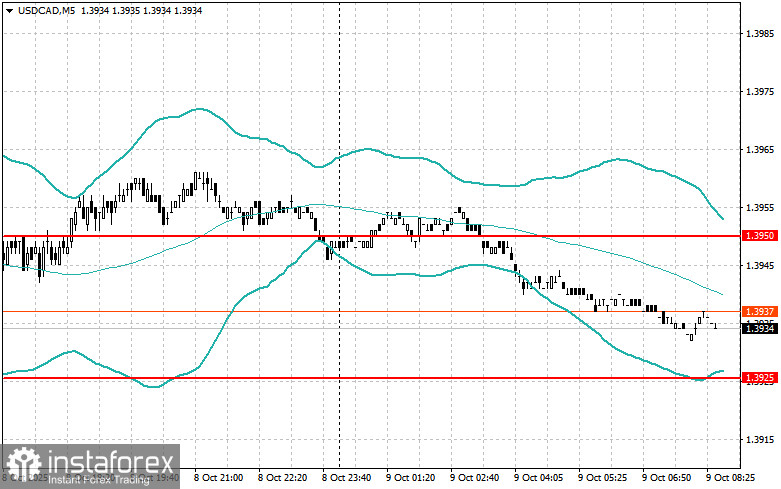

USD/CAD

Sell after a failed breakout above 1.3950, followed by a return below

Buy after a failed breakout below 1.3925, followed by a return above