Trade Breakdown and Strategy for the Japanese Yen

A test of the 152.71 level occurred just as the MACD indicator began moving downward from the zero line, confirming a valid sell entry. This strategy resulted in a decline of more than 25 pips in the pair.

It is expected that the Federal Reserve will continue its rate-cutting path as early as October, as clearly indicated by yesterday's FOMC meeting minutes, which put some minor pressure on the U.S. dollar. However, this did little to disrupt the bullish trend that USD/JPY has demonstrated since the start of the week.

Today's equipment orders data from Japan offered only brief support to the yen. While the growth suggests a gradual recovery in Japan's industrial sector following recent shocks, it has failed to significantly influence the forex market. The yen, trading at 152.75 against the U.S. dollar by the close of the Tokyo session, showed only a short-lived spike in strength, quickly giving way to global and political pressures that continue to support the dollar.

For intraday trading, I will mainly rely on implementing Buy and Sell Scenarios No. 1 and No. 2.

Buy Scenarios

Scenario 1:

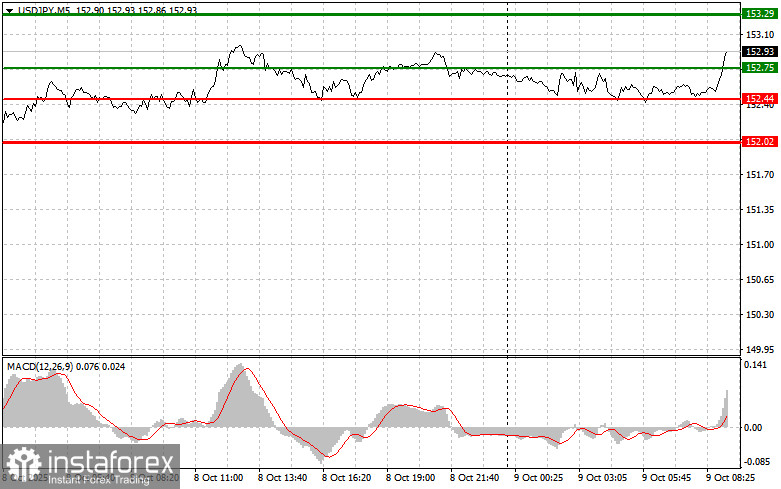

I plan to buy USD/JPY today at the entry level, around 152.75 (indicated by the thin green line on the chart), targeting an upside move to 153.29 (indicated by the thick green line). At the 153.29 level, I will exit long positions and open shorts on a reversal down, with an expected movement of 30–35 pips in the opposite direction. It's generally better to re-enter long positions on corrections and notable pullbacks in USD/JPY.

Important: Before buying, ensure the MACD indicator is above the zero line and is just starting to move upward.

Scenario 2:

I will also consider buying if the pair tests the 152.44 level twice while the MACD is in the oversold zone. This would limit the pair's downside and could lead to a bullish reversal. Targets in this case would be 152.75 and 153.29.

Sell Scenarios

Scenario 1:

I plan to sell USD/JPY only if the price breaks below 152.44 (thin red line on the chart), which could trigger a sharp decline. The key target for sellers will be 152.02 (thick red line), at which point I will exit short positions and consider reversing into long trades for a bounce worth 20–25 pips.

Important: Before selling, confirm that the MACD indicator is below the zero line and just beginning to move lower.

Scenario 2:

I will also sell the pair if it tests the 152.75 level twice and the MACD is in the overbought zone. This would cap the upside momentum and suggest a reversal toward 152.44 and possibly 152.02.

Chart Legend:

- Thin green line – entry price to consider long positions

- Thick green line – projected Take Profit level or area to manually exit longs, as further growth is unlikely above this level

- Thin red line – entry price to consider short positions

- Thick red line – projected Take Profit level or area to manually exit shorts, as further decline is unlikely below this level

- MACD Indicator – use overbought and oversold zones to time entries properly

Important Notes for Beginner Traders:

If you're new to the Forex market, approach all trades with caution. It's best to stay out of the market ahead of major economic reports to avoid getting caught in news-driven volatility. If you do choose to trade during such events, always use stop-loss orders to limit potential losses.

Trading without stop-loss protection can quickly lead to the full loss of your capital, especially when trading with large position sizes and no money management strategy.

And remember: successful trading always starts with a clear and well-defined plan — such as the one outlined above. Making spontaneous trading decisions based on short-term price action is a losing approach for intraday traders.