The British pound, Australian dollar, and Canadian dollar were traded today using the Mean Reversion strategy. I did not trade anything through Momentum.

As expected, in the absence of important statistics from the eurozone and the UK, the euro and the pound showed a slight recovery in the first half of the day. This pause in the continuous pressure that has haunted these currencies in recent weeks allowed some of the market nervousness to calm down. Traders cautiously welcomed the absence of negative news, which in turn pushed the euro and other currencies slightly higher against the US dollar. However, it should not be forgotten that this is only a temporary reprieve. Global economic uncertainty and the ongoing fight against inflation continue to put strong pressure on risk assets and the single currency.

Today we also await figures from the University of Michigan Consumer Sentiment Index and the University of Michigan Inflation Expectations. In addition, FOMC members Austan D. Goolsbee and Alberto Musalem are scheduled to speak. These events promise to add extra volatility to the trading session. The Consumer Sentiment Index is known to be an important barometer for assessing the overall state of the US economy. Positive data could strengthen confidence in the stability of consumer demand and, as a result, support the dollar. Particular attention will be paid to inflation expectations, which essentially shape the Federal Reserve's monetary policy.

The speeches of Austan D. Goolsbee and Alberto Musalem will be the key moment of the session. Traders will carefully monitor their statements, trying to catch any hints about the future trajectory of interest rates and their general view of economic prospects. Let me remind you that the chances of a rate cut in October of this year have decreased significantly this week.

In the case of strong statistics, I will rely on implementing the Momentum strategy. If there is no market reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout) for the second half of the day:

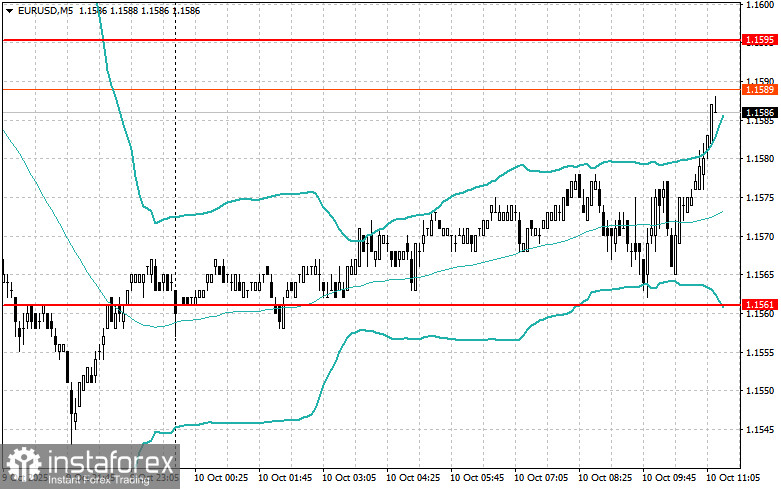

For EUR/USD:

- Buying on a breakout of 1.1590 may lead to euro growth toward 1.1627 and 1.1660;

- Selling on a breakout of 1.1565 may lead to a euro decline toward 1.1545 and 1.1520;

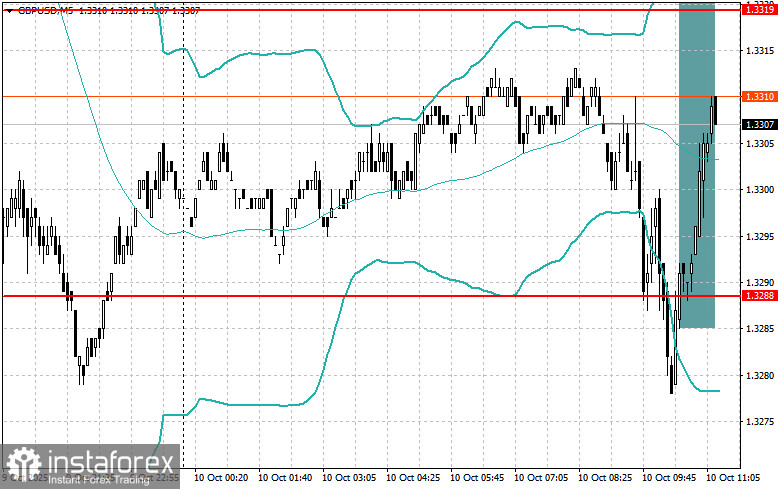

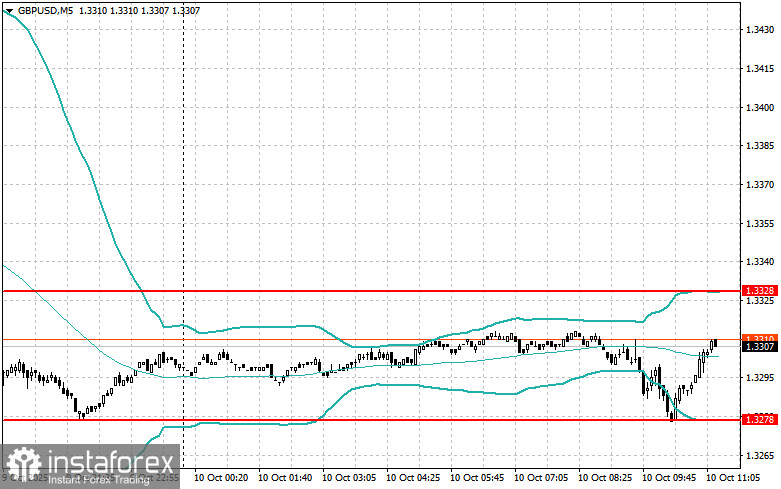

For GBP/USD:

- Buying on a breakout of 1.3310 may lead to pound growth toward 1.3335 and 1.3355;

- Selling on a breakout of 1.3280 may lead to a pound decline toward 1.3250 and 1.3226;

For USD/JPY:

- Buying on a breakout of 152.80 may lead to dollar growth toward 153.20 and 153.45;

- Selling on a breakout of 152.60 may lead to dollar sell-offs toward 152.10 and 151.70;

Mean Reversion Strategy (Pullback) for the second half of the day:

For EUR/USD:

- I will look for sales after a failed breakout above 1.1595 followed by a return below this level;

- I will look for purchases after a failed breakout below 1.1561 followed by a return above this level;

For GBP/USD:

- I will look for sales after a failed breakout above 1.3328 followed by a return below this level;

- I will look for purchases after a failed breakout below 1.3278 followed by a return above this level;

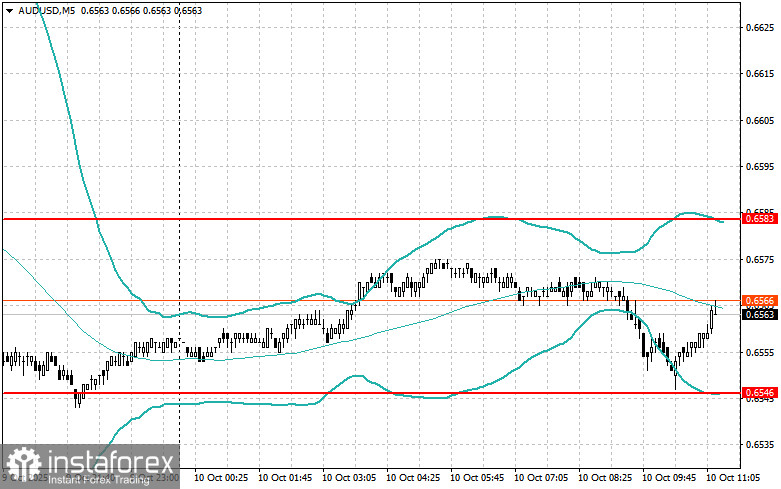

For AUD/USD:

- I will look for sales after a failed breakout above 0.6583 followed by a return below this level;

- I will look for purchases after a failed breakout below 0.6546 followed by a return above this level;

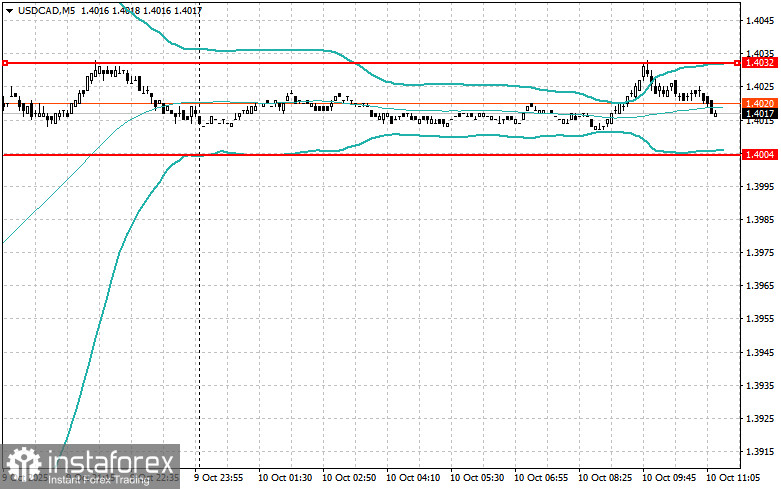

For USD/CAD:

- I will look for sales after a failed breakout above 1.4032 followed by a return below this level;

- I will look for purchases after a failed breakout below 1.4004 followed by a return above this level.