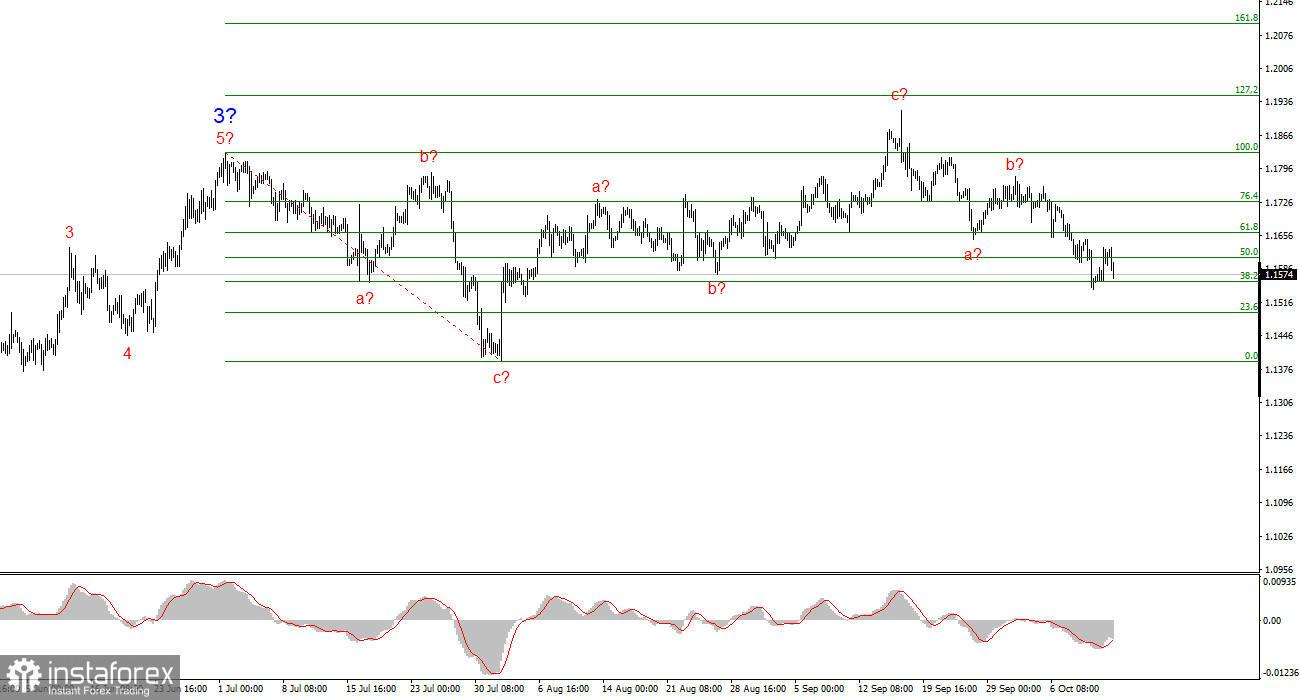

The wave pattern on the 4-hour chart for the EUR/USD pair has started to transform. It's still too early to conclude that the upward section of the trend has been canceled, but the recent decline in the euro has made it necessary to refine the wave count.

Now we can see a series of three-wave structures a–b–c. It can be assumed that they are part of the larger wave 4 within the upward trend segment. In this case, wave 4 has taken on an unnaturally extended form, but overall, the wave pattern remains coherent.

The construction of the bullish trend segment continues, and the news background continues to support mostly everything but the U.S. dollar. The trade war initiated by Donald Trump is ongoing. The confrontation with the Federal Reserve continues. The market's dovish expectations regarding the Fed's interest rate are rising. Meanwhile, the U.S. government shutdown is still in effect. The market evaluates Trump's first 7–8 months in office rather poorly, even though GDP growth in Q2 reached almost 4%.

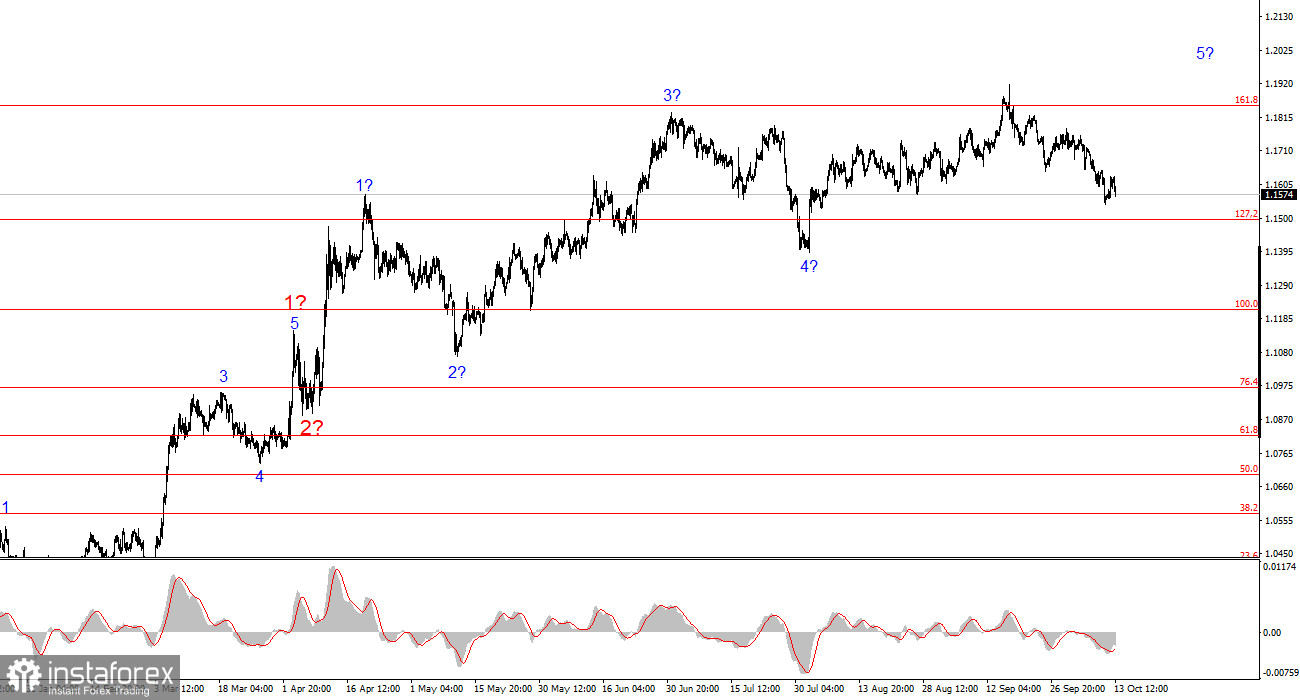

In my view, the formation of the upward trend is not yet complete. Its potential targets extend up to the 1.25 level. Based on this, the euro may continue to decline for some time, even without any strong fundamental reasons (as has been the case for the past two weeks). However, the wave count will still retain its internal logic.

The EUR/USD pair declined by 50 basis points on Monday, and it became clear — the movement isn't over yet. As noted in my previous reviews, the news background and the wave structure have not been aligning well lately. Now that the wave pattern has changed slightly, this conflict is gone. We are observing the formation of a third consecutive corrective three-wave structure, so the decline may continue within wave c, which itself belongs to a larger wave c of the major wave 4.

However, even in this case, the fundamental backdrop raises doubts about the dollar's ability to continue appreciating.

What news came out on Monday? Essentially, none. Over the weekend, Donald Trump reassured markets, saying that "everything will be fine" with China. On Friday, the U.S. president announced a 100% tariff on Chinese imports in response to Beijing tightening export controls on rare earth metals. Yet by Sunday, he claimed he had no intention of triggering a Great Depression for America's trading partner.

Trump's statement can be interpreted in two ways. On the one hand, he is giving China a chance to reconsider its decision and trying to ease tensions. On the other hand, he is making it clear that if China doesn't change its stance, new tariffs will follow.

Beijing officials have already warned the White House that tariffs are not the best solution in any dispute if the goal is long-term peace and trade stability. However, Trump knows no other negotiation tools. Therefore, in my view, the world has witnessed yet another Trump ultimatum, not an attempt at reconciliation. And how could reconciliation even be possible if Trump has been pressuring China for a second presidential term in a row?

General Conclusions

Based on the EUR/USD analysis, I conclude that the pair continues building an upward trend segment. The wave pattern still depends heavily on the news background — particularly Trump's decisions and the foreign and domestic policies of the new White House administration.

The targets of the current trend segment may extend up to the 1.25 level. At present, the market is forming a corrective wave 4, which is approaching completion, though it has taken on a complex shape. The bullish wave structure remains valid. Consequently, in the near term, I continue to focus only on long positions, even though the downward a–b–c pattern is not yet finished.

By the end of the year, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci extension.

On a smaller scale, the entire upward segment of the trend is visible. The wave pattern is not entirely standard, as corrective waves vary in size. For example, major wave 2 is smaller than internal wave 2 within wave 3 — though this occasionally happens.

I remind you that it's best to identify clear, recognizable structures on charts rather than trying to label every single wave. The current upward formation looks quite solid overall.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often undergo changes.

- If there is no confidence in what's happening in the market, it's better to stay out.

- There is never 100% certainty about price direction — always use Stop Loss orders.

- Wave analysis can and should be combined with other analytical methods and trading strategies.