One of the most notable developments on Monday was the release of China's export and import statistics. The data revealed that in September, China's export volume not only increased but exceeded market expectations by a wide margin. What relevance does this have to EUR/USD and GBP/USD? Direct relevance—even though the U.S. dollar has been strengthening recently, which, to say the least, contradicts the news backdrop, though it partially matches the wave structure.

So, export volumes are rising. This means China is successfully exporting more goods to other countries—excluding the U.S. Exports rose by 8.3% in September, and the trade surplus reached $90 billion. For context, for over a month now, Chinese imports to the U.S. have been subject to a flat 30% tariff. Chinese goods in the U.S. have become a third more expensive, yet exports are still increasing. This is only possible if China redirects more of its trade toward other regions.

Essentially, China is carrying out a deliberate policy of risk diversification—namely, reducing reliance on U.S. markets amid an increasingly antagonistic trading environment under Donald Trump. Beijing understands well that Trump won't let it operate freely within the U.S. market. His stance boils down to: "If you want access to our market, comply with our list of conditions," which is constantly growing, often through ultimatums.

Ironically, export figures to the U.S. aren't just falling—they're collapsing. For six straight months, Chinese exports to the U.S. have dropped by double-digit percentages. Meanwhile, exports to the EU, Africa, and Latin America are rising. China is signaling that global demand for its goods remains robust. The U.S. market may be attractive, but it is not irreplaceable.

Ahead of upcoming negotiations with Washington, Beijing is significantly strengthening its hand. Recall that Trump announced a 100% tariff hike on Chinese goods starting on November 1. But by now, these tariffs may have lost their leverage—China's export flows and GDP may be minimally affected. If the U.S. doesn't want cheap Chinese goods, that's fine—China will sell them to other countries without the baggage of demands attached.

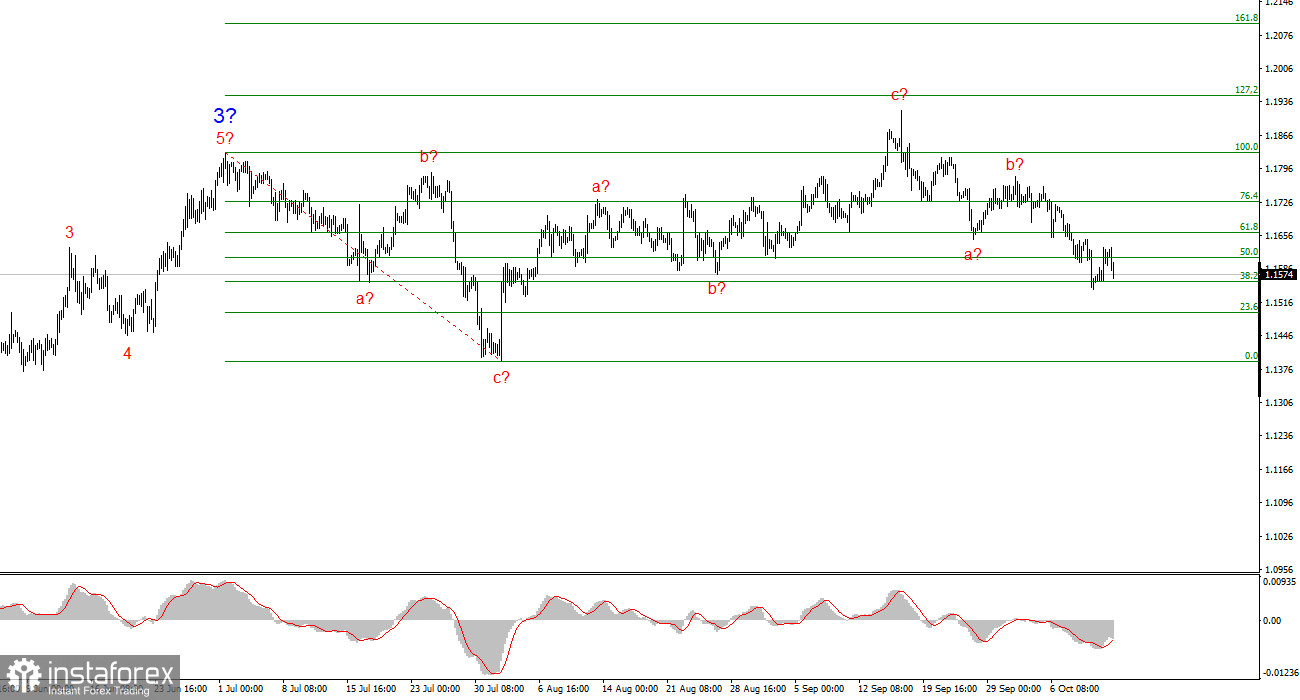

Wave Analysis for EUR/USD

According to the analysis of EUR/USD, the pair continues building an upward segment of the trend. The wave structure still depends heavily on developments aligned with Trump's decisions and the internal and foreign policy of the new U.S. administration.

The targets for the current bullish wave may extend as far as the 1.2500 range. A complex corrective wave 4 is currently forming and nearing completion—although it's unfolding in a very intricate manner. The broader bullish framework remains valid.

Therefore, in the near term, I continue to consider only long positions, even though the corrective a-b-c wave structure has not fully concluded yet. By year-end, I expect EUR/USD to rise to 1.2245, which corresponds to the 200.0% Fibonacci.

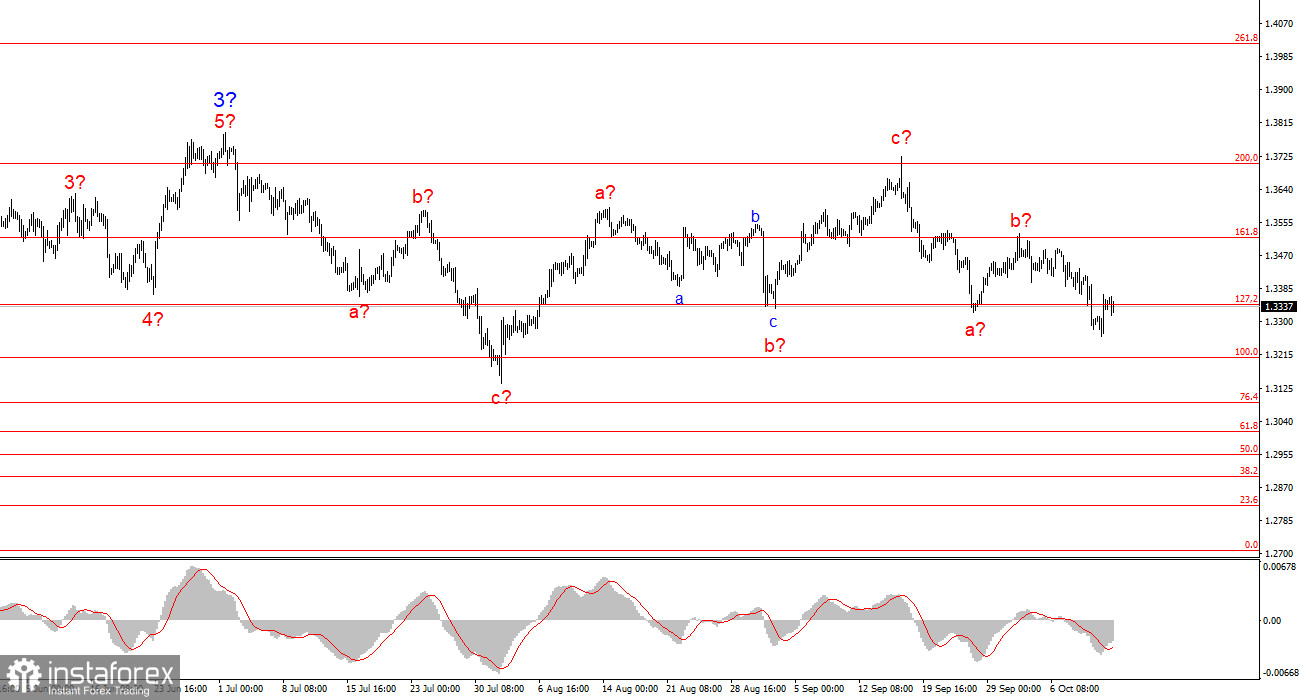

Wave Analysis for GBP/USD

The wave structure of GBP/USD has changed. The pair remains within a larger upward impulsive move, but its internal structure has become more complex.

Wave 4 is taking shape as a complicated three-wave correction—significantly longer in duration and range than wave 2. At present, we are witnessing the formation of another three-wave corrective structure, which may soon reach completion.

If confirmed, the broader uptrend may resume, with initial upside targets in the 1.3800 to 1.4000 range.

Core Principles of My Analysis:

- Wave structures should be simple and easy to interpret. Complex patterns are harder to trade and are more prone to change.

- If you're uncertain about the market's direction, it's better not to enter at all.

- There is no such thing as 100% certainty in market movement. Always use stop-loss orders.

- Elliott Wave analysis can be combined with other types of market analysis and trading strategies.