The U.S. dollar regained ground against the euro, the pound, and other assets, but failed to do so against the yen.

The continued deterioration in trade relations between the U.S. and China, particularly due to the risk of new tariffs, continues to pressure risk assets. Many traders and investors worry that further escalation could lead to a slowdown in global economic growth, negatively impacting many national economies.

Today, attention turns to several important reports in the first half of the day: the ZEW Economic Sentiment Index for the Eurozone and the German Consumer Price Index (CPI). These indicators could influence the euro in the short term, though their long-term impact on the FX market should not be overestimated.

The ZEW Economic Sentiment Index is an important leading indicator for the euro area. If the data exceed expectations, it may reflect improving business sentiment, supporting the euro. The German CPI is a key inflation measure in the Eurozone's largest economy. If it surprises to the upside, it will increase pressure on the European Central Bank (ECB), possibly leading to gains in the euro.

For the British pound, today's labor market data are critical in assessing the overall health of the UK economy. Unemployment figures reflect labor demand, while changes in wages directly impact inflation. Strong data showing a decline in unemployment and rising wages are typically seen as signals of economic strength and could support the pound.

The speech by Bank of England Governor Andrew Bailey is also of interest to traders. Bailey is expected to address the current UK economic outlook, inflation prospects, and monetary policy direction. Markets will be on alert for any clues regarding possible changes in interest rates.

If the data come in line with economists' expectations, traders should consider using a Mean Reversion strategy. If the data significantly exceeds or misses expectations, a Momentum strategy may be more effective.

Momentum Strategy (Breakout-Based):

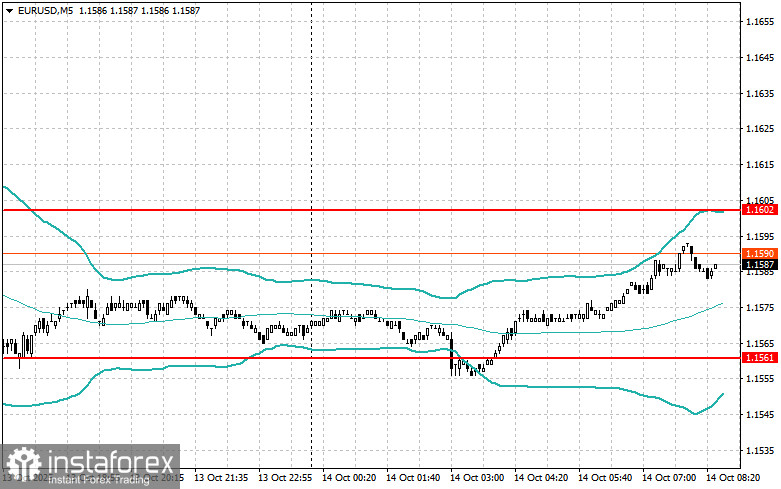

EUR/USD

- Buy on a breakout above 1.1601. Target levels: 1.1630 and 1.1660

- Sell on a breakout below 1.1575. Target levels: 1.1545 and 1.1520

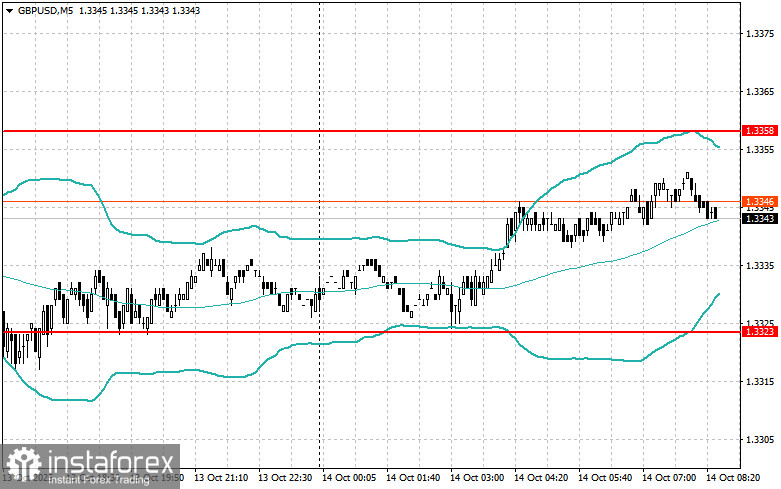

GBP/USD

- Buy on a breakout above 1.3360. Target levels: 1.3390 and 1.3424

- Sell on a breakout below 1.3325. Target levels: 1.3290 and 1.3265

USD/JPY

- Buy on a breakout above 152.10. Target levels: 152.40 and 152.80

- Sell on a breakout below 151.75. Target levels: 151.35 and 151.00

Mean Reversion Strategy (Reversion to the Mean):

EUR/USD

- Sell after a failed breakout above 1.1602, on return below the level

- Buy after a failed breakout below 1.1561, on rebound back to this level

GBP/USD

- Sell after a failed breakout above 1.3358, on return below the level

- Buy after a failed breakout below 1.3323, on rebound back to this level

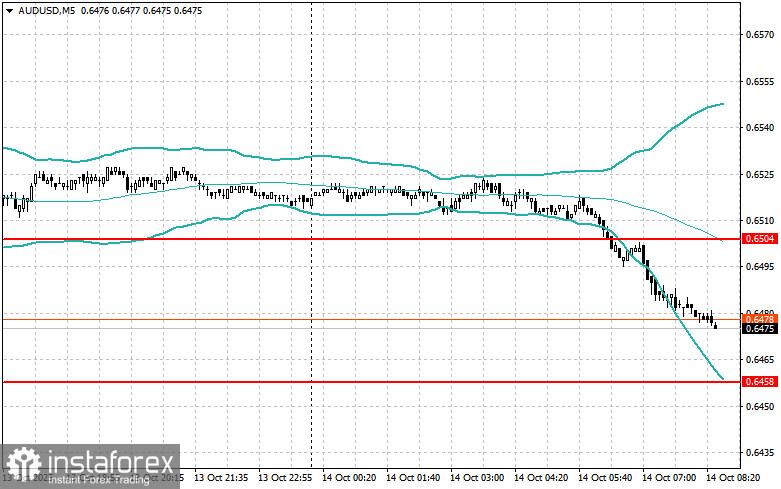

AUD/USD

- Sell after a failed breakout above 0.6504, on return below the level

- Buy after a failed breakout below 0.6458, on rebound back to this level

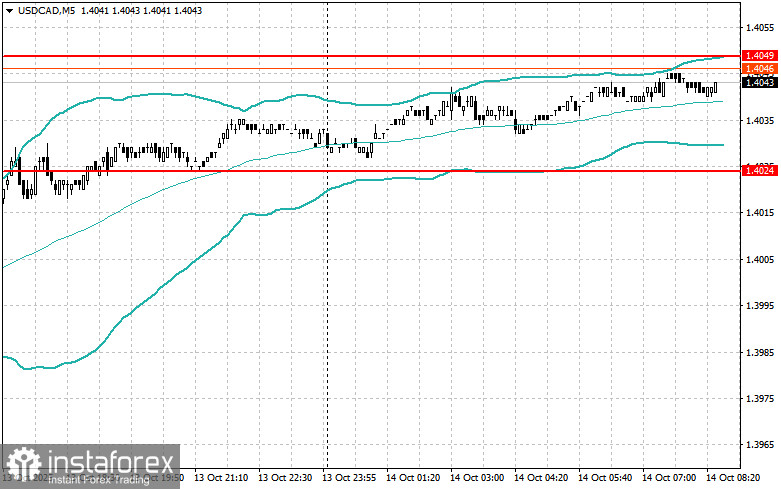

USD/CAD

- Sell after a failed breakout above 1.4049, on return below the level

- Buy after a failed breakout below 1.4024, on rebound back to this level