Trade Analysis and Recommendations for the Euro

The price test of 1.1578 occurred at the moment when the MACD indicator had just begun to move down from the zero mark, confirming a correct entry point for selling the euro. As a result, the pair fell toward the target level of 1.1558.

Weak data from eurozone countries triggered a drop in the euro. The ZEW Economic Sentiment Index for Germany and the eurozone turned out worse than economists' forecasts, which became a trigger for new short positions. Recession risks in the eurozone, reinforced by the ZEW data, caused a chain reaction in the financial world. The European Central Bank faces a difficult dilemma: on one hand, it needs to stimulate the economy; on the other, it must restrain inflation, which could easily rise above the target level.

During the U.S. trading session, only the NFIB Small Business Optimism Index will be of interest. The main focus is on the speeches of Federal Reserve Chair Jerome Powell and FOMC member Christopher Waller.

Market participants are eagerly awaiting statements from senior officials of the U.S. regulator—especially given the absence of key fundamental data due to the U.S. government shutdown. Will the Fed maintain its dovish stance on rate cuts to stimulate economic growth, or will it take a more cautious approach? The answers to these questions may significantly influence the behavior of financial markets in the short term. It is expected that Powell and Waller will clarify the Fed's position on the current inflation level, the labor market situation, and future economic prospects. Particular attention will be paid to any hints of potential changes in monetary policy.

As for the intraday strategy, I will rely primarily on Scenarios No. 1 and No. 2.

Buy Signal

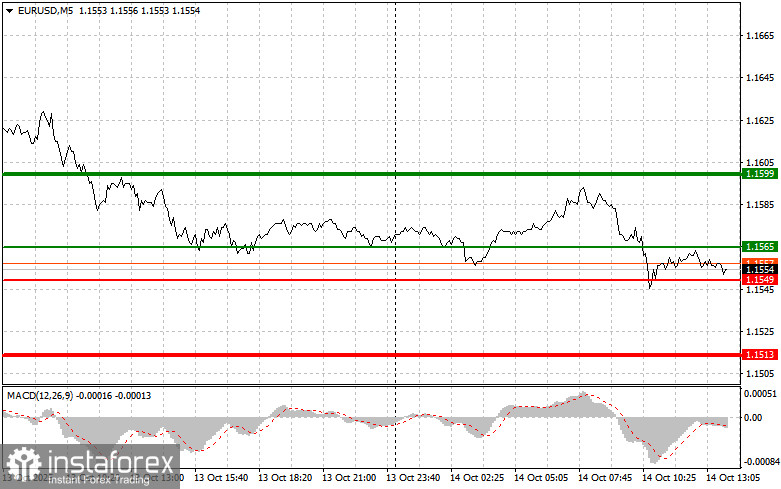

Scenario No. 1: Buy the euro today when the price reaches around 1.1565 (green line on the chart), aiming for growth toward 1.1599. At 1.1599, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. An upward movement in the euro today is likely only after dovish statements from Fed officials.Important! Before buying, make sure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro if the price tests 1.1549 twice in a row, at the moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.1565 and 1.1599 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the level of 1.1549 (red line on the chart). The target is 1.1513, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move in the opposite direction). Selling pressure on the pair may return at any time today.Important! Before selling, make sure that the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro if the price tests 1.1565 twice in a row, at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.1549 and 1.1513 can be expected.

Chart Legend:

- Thin green line – Entry price for buying the instrument;

- Thick green line – Estimated level for setting Take Profit or manually fixing profit, since further growth above this level is unlikely;

- Thin red line – Entry price for selling the instrument;

- Thick red line – Estimated level for setting Take Profit or manually fixing profit, since further decline below this level is unlikely;

- MACD indicator – When entering the market, it is important to consider overbought and oversold zones.

Important Note

Beginner Forex traders should make entry decisions with extreme caution. Before the release of important fundamental reports, it's best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on current market conditions are a losing strategy for an intraday trader from the start.