In his latest display of geopolitical confrontation, U.S. President Donald Trump tightened oil sanctions against Venezuela, forcing Caracas to seek alternative suppliers of crude oil. Venezuela, one of the world's leaders in oil reserves, has been crippled by international sanctions, outdated infrastructure, and a chronic lack of investment, limiting its ability to develop the oil sector. Although the country does produce and sell some oil, its thick, viscous crude is not highly valued on global markets. Caracas must dilute it with lighter grades of oil before exporting. Until recently, that lighter oil came from the United States—but Trump decided to cut the flow due to Venezuela's flourishing narcotics trade.

As a result, the new sanctions pushed Venezuela to search for oil beyond U.S. borders. Initially, Caracas tried to strike a deal with China, but that effort faltered. At the same time, Russia had suffered a drop in oil exports to the European Union and was more than willing to redirect excess volumes to Venezuela. In the end, Russia easily found a buyer for its surplus crude, while Donald Trump, in his attempt to limit sales of Russian oil, ended up undermining his own efforts.

In my view, Trump will fail in his attempts to manipulate the Kremlin. Clearly, ending the conflict between Russia and Ukraine is a noble objective. But Trump's methods—well known to the global community—are limited to threats, ultimatums, sanctions, and tariffs. Such tactics may work on countries that depend on the U.S. market, but are ineffective against those with no significant trade ties to Washington.

Given this context, there is only one realistic path forward for Washington and Moscow: to sit at a real negotiating table rather than attempt to pressure one another. The same applies to relations between China and the United States. However, as long as Trump remains president, it is unlikely we'll see truly inclusive talks that consider the needs and interests of all parties involved.

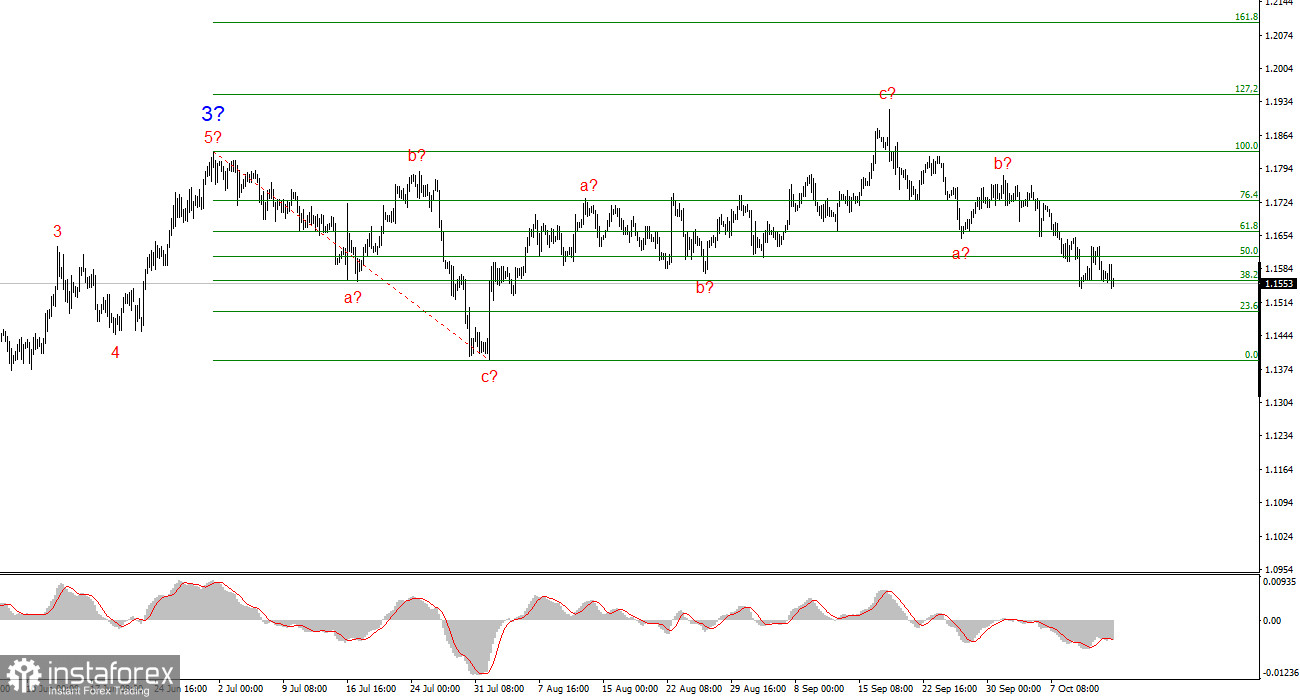

Wave Structure for EUR/USD:

Based on my analysis of EUR/USD, the instrument continues to develop an upward trend segment. The wave labeling remains entirely dependent on news flow related to Trump's decisions, both in foreign and domestic U.S. policy. The targets for the current trend segment could extend toward the 1.2500 area.

At present, we are likely witnessing the construction of corrective wave 4, which is nearing completion but shows a very complex and extended form. Accordingly, I continue to consider only buy positions. By year-end, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci level.

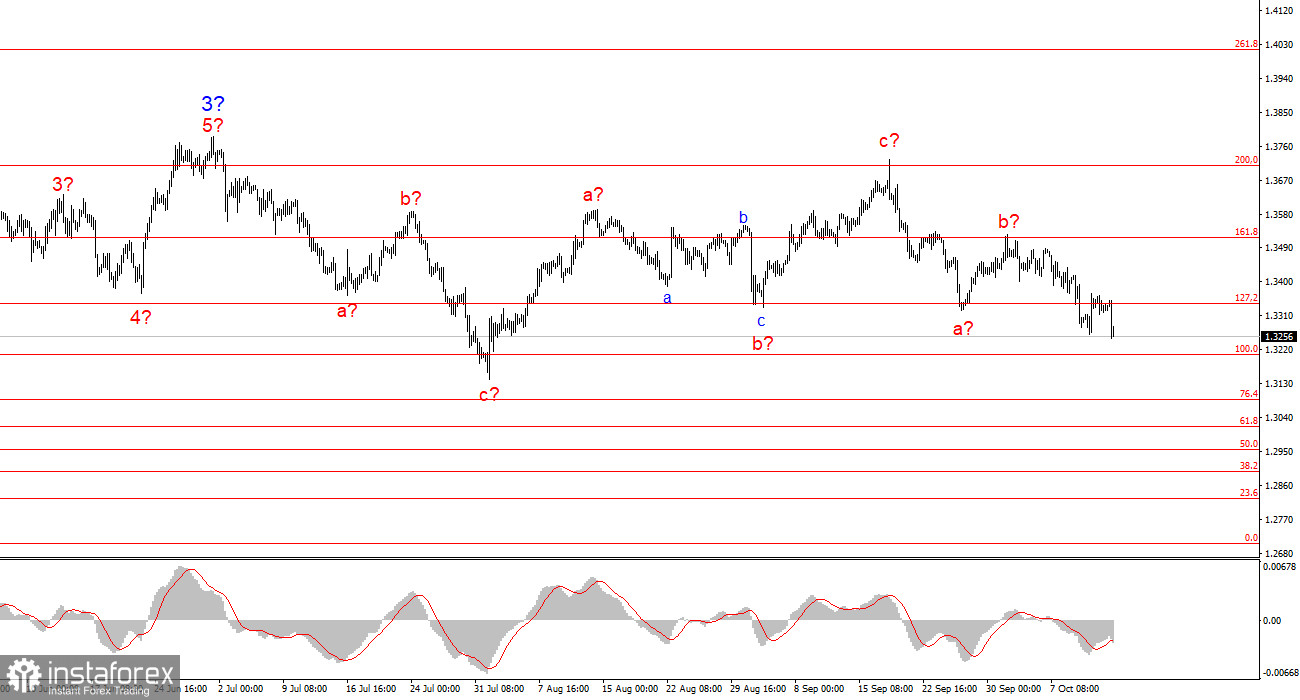

Wave Structure for GBP/USD:

The wave structure of GBP/USD has shifted. We are still dealing with a bullish impulsive wave segment, but its internal wave pattern has become more complex. Wave 4 is taking on a complicated three-wave structure, significantly longer than wave 2. Currently, the pair appears to be forming one final leg of this corrective phase, which may soon be complete. If confirmed, a renewed push higher within the larger wave structure may begin, with initial targets in the 1.3800 to 1.4000 region.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex formations are difficult to trade and often prone to revisions.

- If you're unsure of current market behavior, it's better to stay out.

- Absolute certainty in market direction does not and cannot exist. Always use protective Stop Loss orders.

- Wave analysis can and should be combined with other forms of analysis and trading strategies.