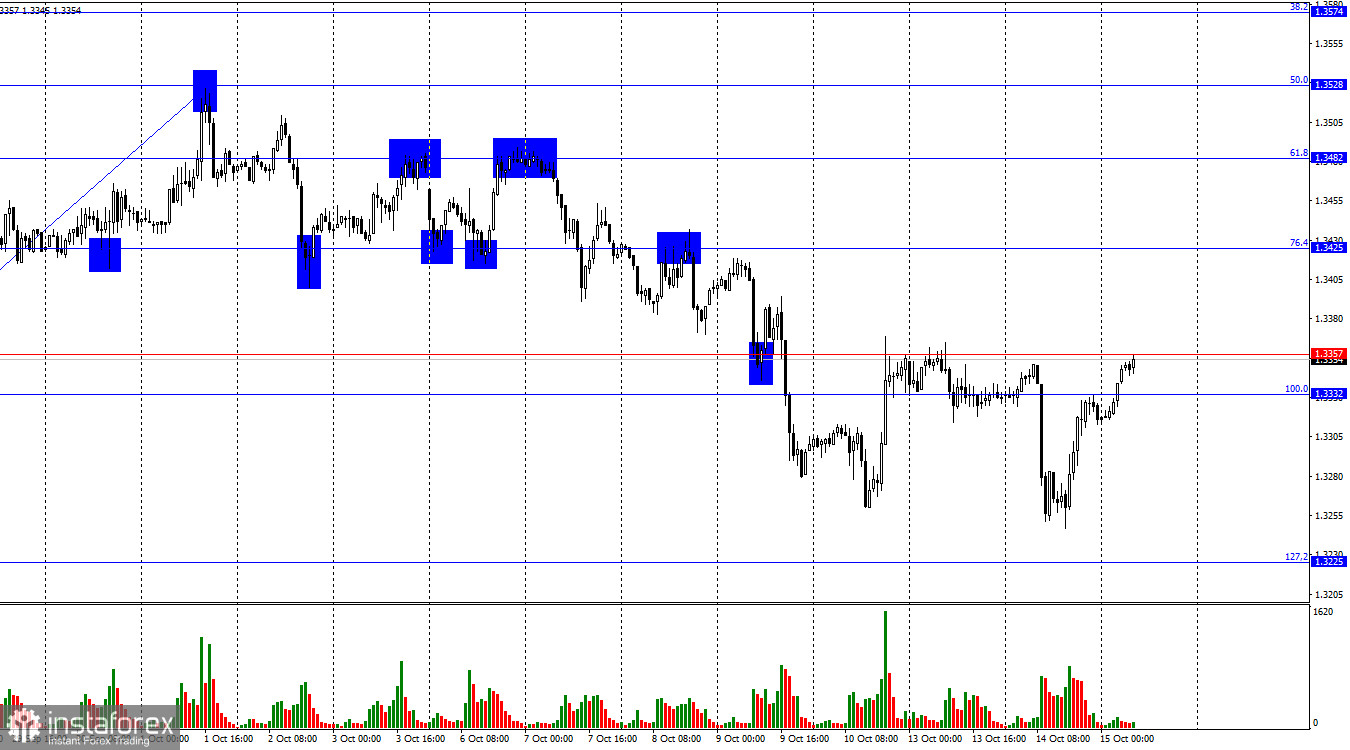

On the hourly chart, the GBP/USD pair on Tuesday rebounded from the 1.3332–1.3357 level and declined toward the 127.2% Fibonacci corrective level at 1.3225. However, in the second half of the day, the pair reversed in favor of the pound and returned to the 1.3332–1.3357 level. A firm move above this zone would support continued growth toward the next 76.4% Fibonacci level at 1.3425.

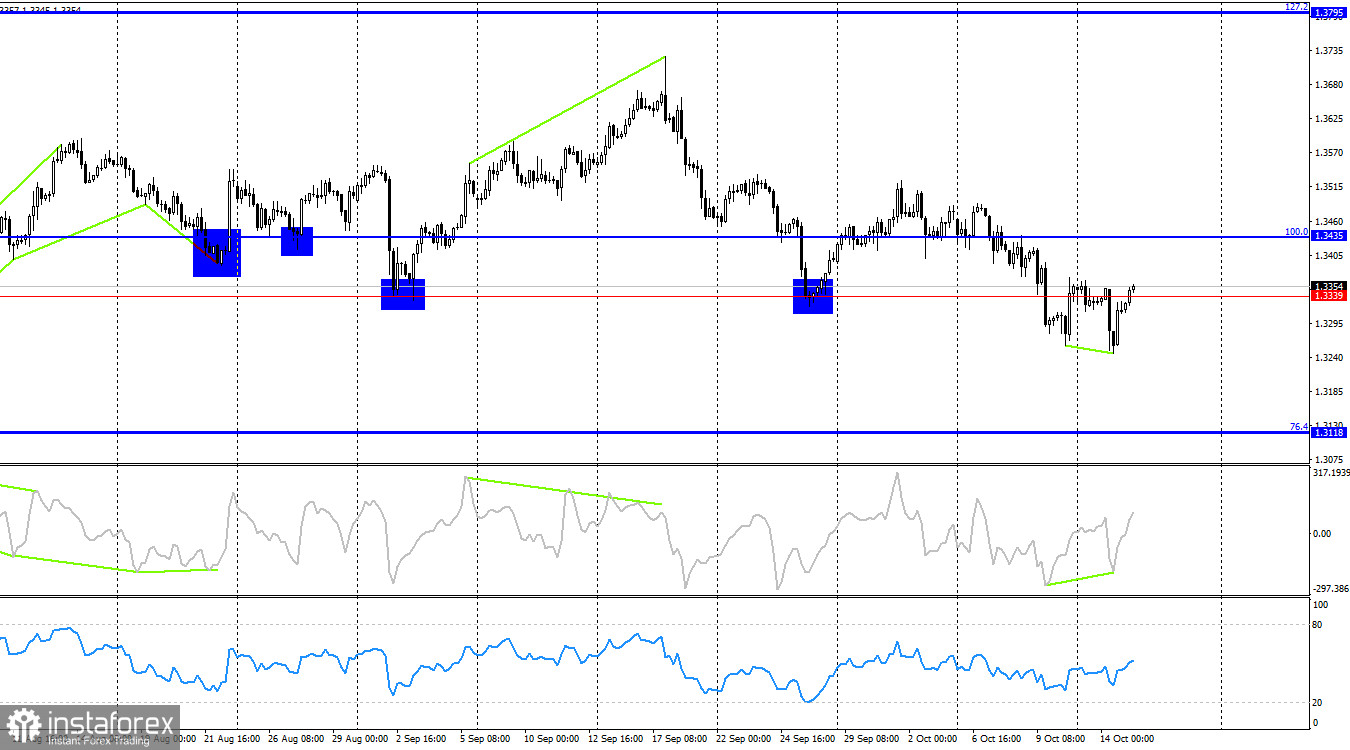

The wave structure still looks "bearish." The most recent upward wave failed to break the previous high, while the last downward wave broke the previous low. The news background in recent weeks has been negative for the U.S. dollar, yet bullish traders have not taken full advantage of these opportunities. To cancel the "bearish" trend, the pair needs to rise above 1.3528 or form two consecutive "bullish" waves.

If the pound is unwilling or unable to rise on its own, help always comes from U.S. news. In recent weeks, bears have launched confident attacks, often without a strong fundamental basis. However, yesterday's weak U.K. economic data gave them new momentum. Their pressure eased by evening, though, after Donald Trump threatened China with new tariffs and sanctions, and Jerome Powell emphasized that the Fed intends to make decisions solely based on economic data.

In fact, Powell's "tough" stance is generally good news for the dollar. If the data do not justify monetary easing, the Fed will likely refrain from cutting interest rates. However, current economic indicators do point to the need for monetary easing — which is why markets now expect another rate cut at the end of October.

As for Trump's statements, they once again highlight rising tensions between the U.S. and China — something that hardly supports bearish sentiment. In my view, a "bullish" trend could soon resume.

On the 4-hour chart, the pair consolidated below the 1.3339–1.3435 level, which allows for continued decline toward the 76.4% Fibonacci corrective level at 1.3118. However, the emergence of a bullish divergence on the CCI indicator also raises the possibility of a reversal in favor of the pound and some upward movement. A close above 1.3339 would also allow expectations of further pound growth.

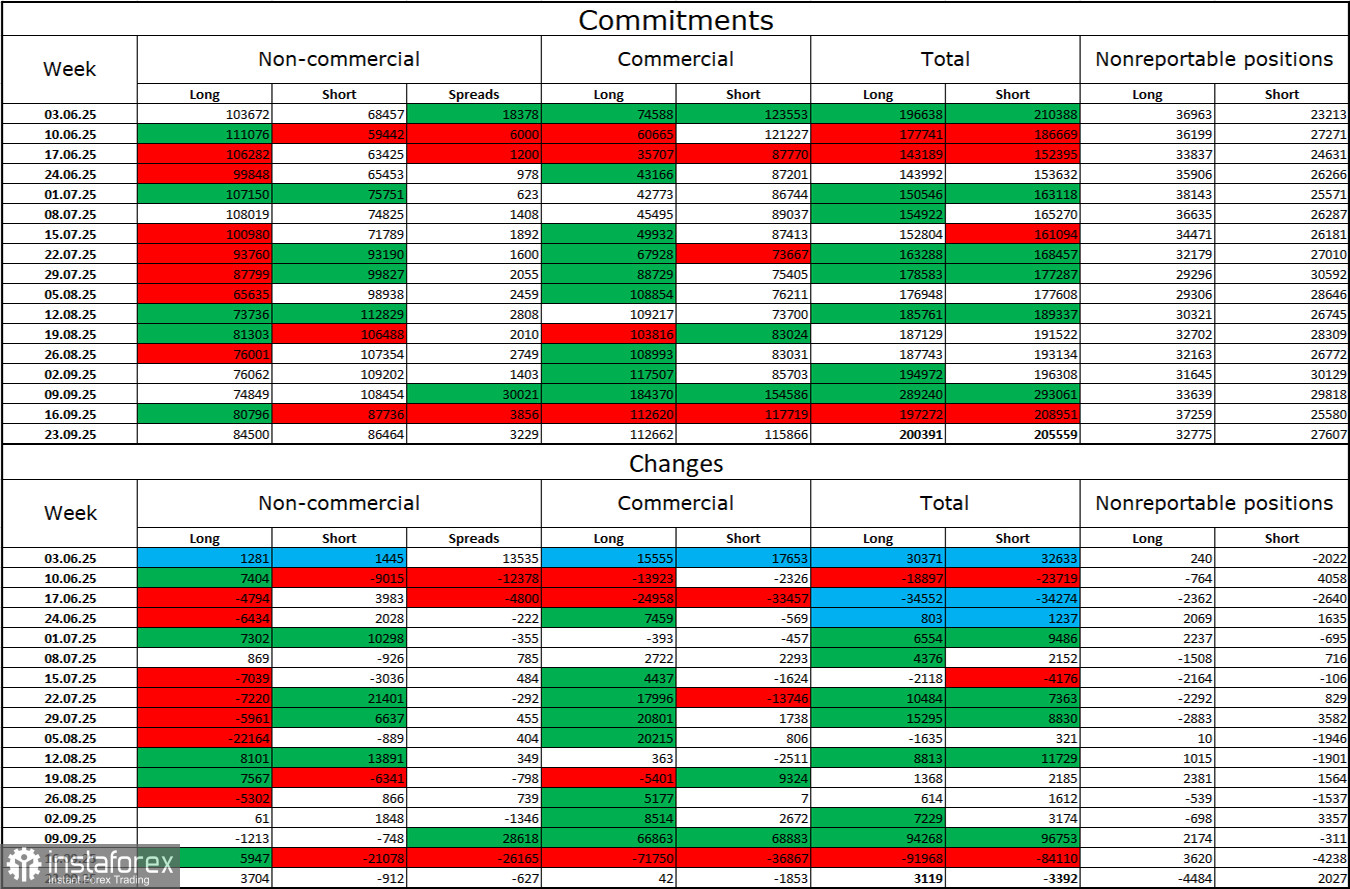

Commitments of Traders (COT) Report

The sentiment among non-commercial traders became more bullish during the last reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short positions now stands at roughly 85,000 vs. 86,000. Bullish traders are once again tipping the balance in their favor.

In my view, the pound still faces downward risks, but with each passing month, the U.S. dollar looks increasingly weak. Previously, traders worried about Donald Trump's protectionist policies without knowing their eventual outcomes — but now they are concerned about the consequences: a possible recession, the constant imposition of new tariffs, and Trump's ongoing pressure on the Fed, which could make the regulator politically dependent on the White House. As a result, the pound now seems far less risky than the U.S. currency.

Economic Calendar for the U.S. and the U.K.

For October 15, the economic calendar contains no significant releases. Therefore, news background is unlikely to influence market sentiment on Wednesday.

GBP/USD Forecast and Trading Tips

Sell positions are possible today if the pair rebounds from the 1.3332–1.3357 level on the hourly chart, targeting 1.3225. Buy positions can be considered if the pair closes above 1.3332–1.3357, targeting 1.3425.

Fibonacci grids are drawn from 1.3332–1.3725 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.