On Tuesday evening, what may end up being the most closely watched event of the week took place—Jerome Powell's speech. Although, in my view, this event draws more attention out of habit rather than actual substance, at least at this stage. Powell rarely shakes the markets with bold statements or abrupt policy changes. As a result, 8 out of every 10 of his speeches offer little new information. In recent weeks, leading up to the next FOMC meeting, Powell has spoken multiple times, reiterating the same core message: any decision will depend on incoming economic data.

Yet therein lies his skill in message delivery. Powell never offers specifics, but like a skilled gardener, he carefully nurtures the narrative that suits his goals. On Tuesday, the FOMC Chair noted that the U.S. labor market remains stagnant, with low hiring and low levels of layoffs. What are market participants to make of this? Only one thing: the labor market continues to "cool," signaling the need for several more rounds of monetary policy easing.

Powell also stated that the government shutdown currently has no significant impact on the U.S. economy or the Fed's forecasts for key indicators. Meanwhile, Fed Governor Susan Collins said in a separate appearance that the Fed should continue easing — but not excessively, to ensure inflation remains under control. What "not excessively" means is, of course, anyone's guess.

At present, futures markets are pricing in a 97% probability of a rate cut in October and a 96% chance of two cuts—one in October and another in December. In simple terms, markets firmly expect two rounds of easing by year-end. If that's the case, then demand for the U.S. dollar over the past 24 hours has weakened surprisingly little. I would also caution against drawing firm conclusions until the government shutdown is resolved. And clearly, most market players are taking a similarly cautious stance. Demand for the dollar remains essentially intact.

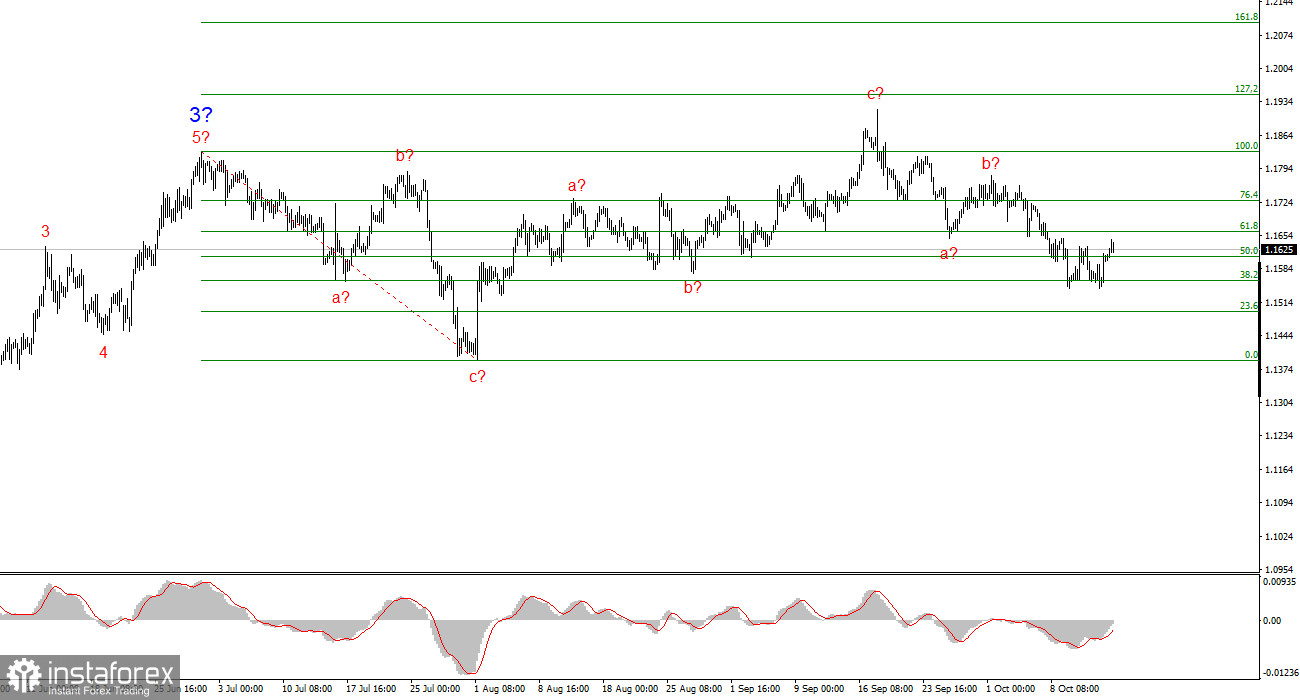

Wave Structure for EUR/USD:

Based on recent analysis, EUR/USD continues to develop a bullish wave sequence. The overall wave structure remains highly dependent on news flow—specifically, decisions from Donald Trump and the foreign and domestic policy of the current U.S. administration. The target for the current upward wave could reach as high as the 1.2500 mark. At this point, a complex corrective Wave 4 appears close to completion. Despite its extended and convoluted form, the broader upward wave remains valid. Thus, I continue to view the market with a long bias, even if the corrective a-b-c structure hasn't yet entirely played out. By year-end, I expect the euro to reach 1.2245, aligning with the 200.0% Fibonacci.

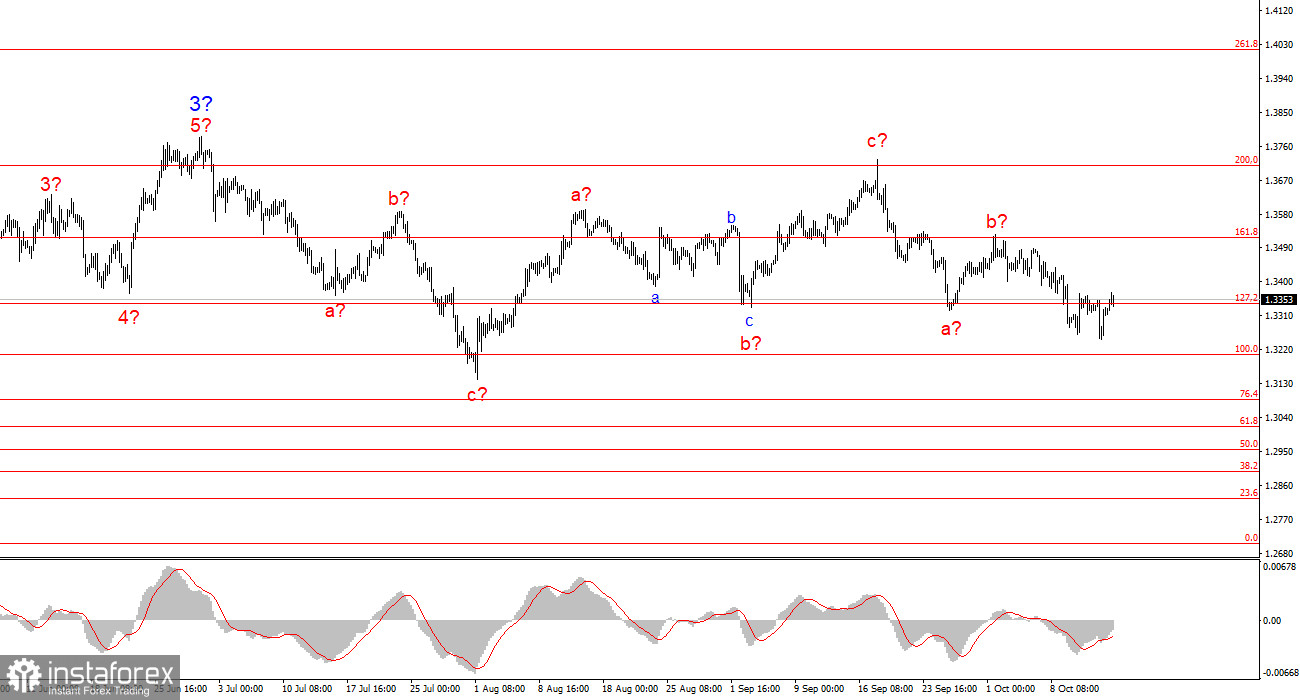

Wave Structure for GBP/USD:

The wave structure for GBP/USD has evolved. The pair remains within a broader bullish trend, but its internal wave composition has become more complicated. Wave 4 is forming as a complex three-wave correction, and its pattern is significantly more extended than that of Wave 2. As we are currently observing the formation of a presumed three-wave corrective structure, it may soon be complete. If confirmed, the pair may resume upward movement within the global wave pattern. The initial targets for the next bullish leg are located near the 1.3800–1.4000 (38 and 40 figures) area.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to interpret and often subject to frequent revisions.

- If market conditions are unclear, it's better not to enter positions.

- No trader can have 100% certainty about price direction. Always use stop-loss orders.

- Wave analysis can and should be used in combination with other methods of analysis and trading strategies.