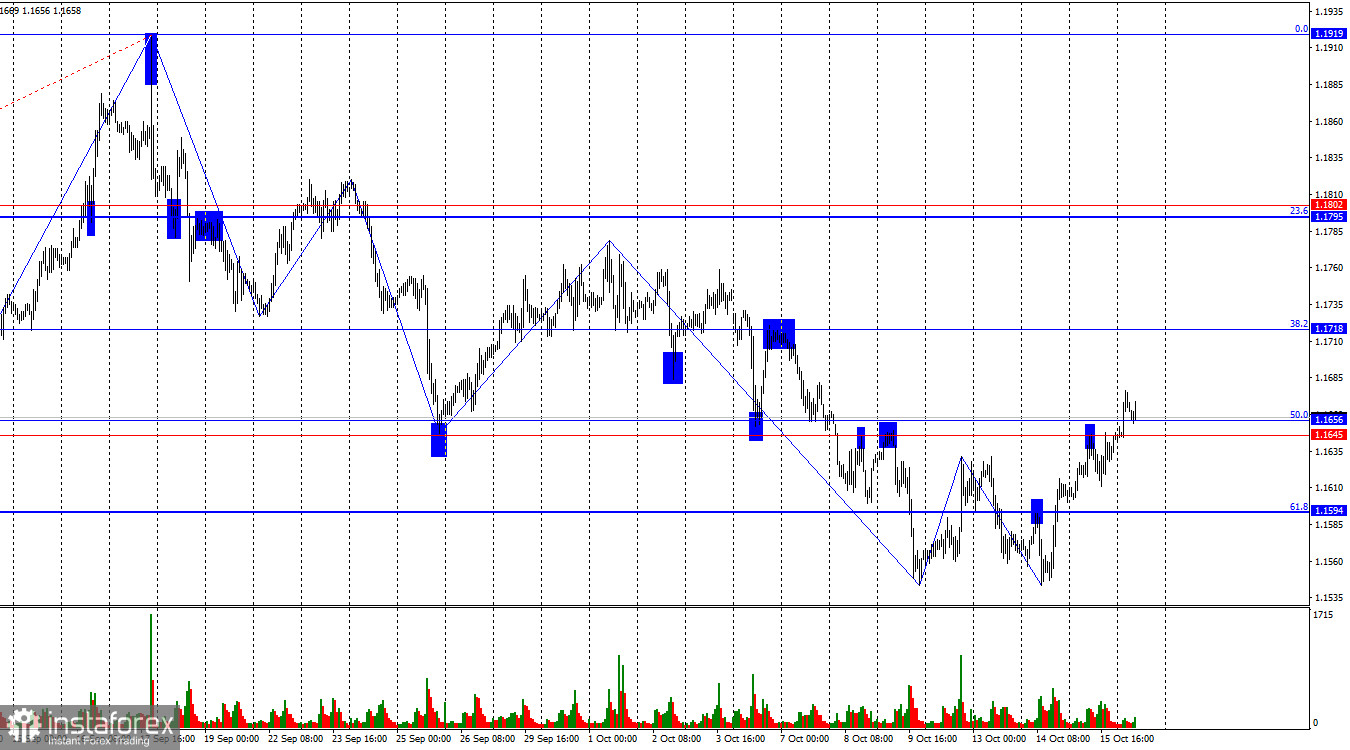

On Wednesday, the EUR/USD pair continued its upward movement after consolidating above the 61.8% retracement level at 1.1594 and closed above the 1.1645–1.1656 resistance level. Thus, the upward movement may continue today toward the next 38.2% retracement level at 1.1718. A consolidation below 1.1645–1.1656 would favor the U.S. dollar and lead to a decline toward the 1.1594 corrective level.

The wave pattern on the hourly chart remains simple and clear. The last upward wave broke the high of the previous wave, while the last completed downward wave did not break the previous low. Therefore, the trend is now turning bullish. Recent labor market data, the Fed's shifting monetary policy outlook, and Trump's renewed aggression toward China all support bullish traders.

On Wednesday, the bulls had few strong reasons for a new offensive. However, I want to draw traders' attention to the fact that since Jerome Powell's speech on Tuesday evening, only the bulls have been attacking, while the dollar keeps falling. I don't believe Powell's comments made most traders significantly more "dovish" regarding the FOMC's monetary policy outlook, but his speech itself may have acted as a trigger for the market.

In recent weeks, I've repeatedly wondered: why has the dollar been rising when Donald Trump continues to escalate trade aggression against many countries, the Fed is expected to further ease monetary policy, and the U.S. labor market keeps weakening? In my view, the bulls hold all the cards needed to continue pressing forward. It seems they deliberately stepped back a little to buy the euro and sell the dollar at better prices. Therefore, I expect a new bullish trend, which should prove fairly long-lasting. By the way, the U.S. government shutdown continues, and Powell understands that rate cuts will be necessary, as the labor market cannot survive without them.

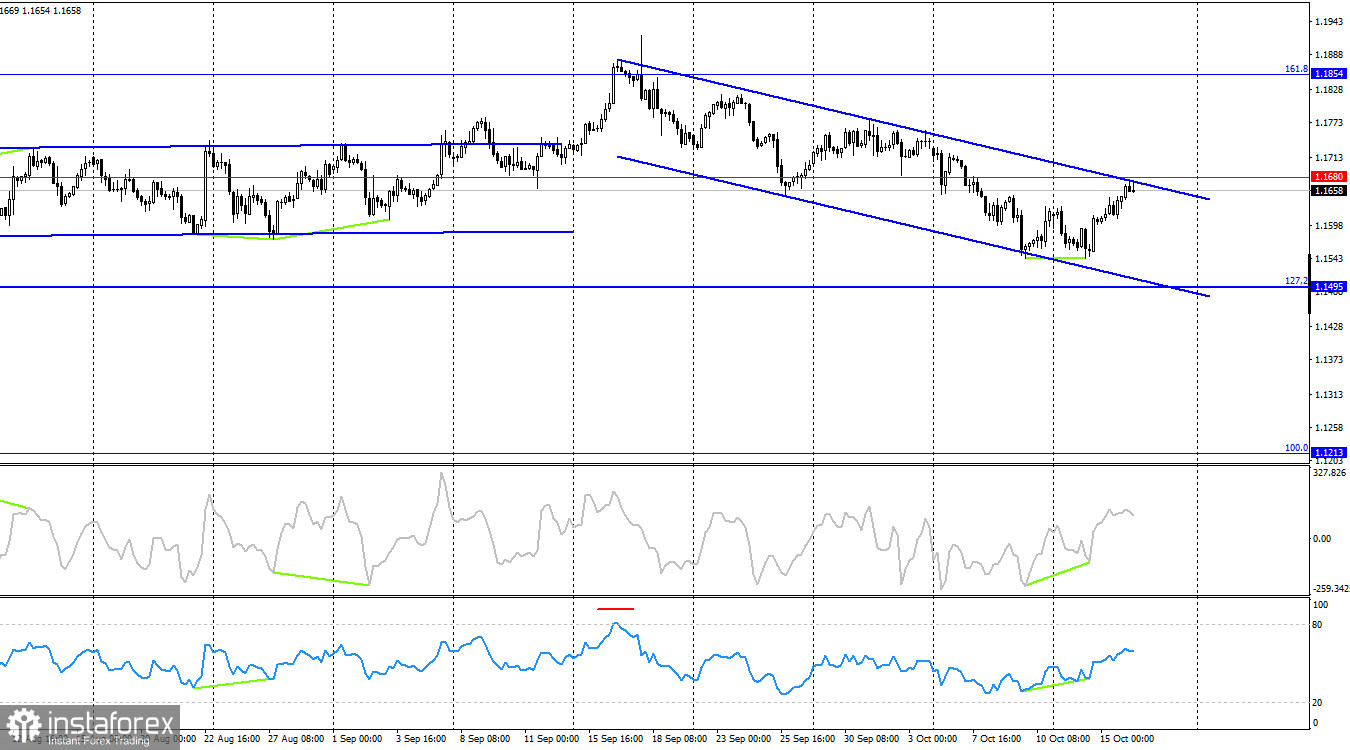

On the 4-hour chart, the pair consolidated below 1.1680, which allows traders to anticipate a continuation of the decline toward the 127.2% retracement level at 1.1495. However, a bullish divergence has formed on the CCI indicator, which halted the decline. A close above 1.1680 and the descending trend channel would favor the euro and signal a resumption of the bullish trend toward the 161.8% retracement level at 1.1854.

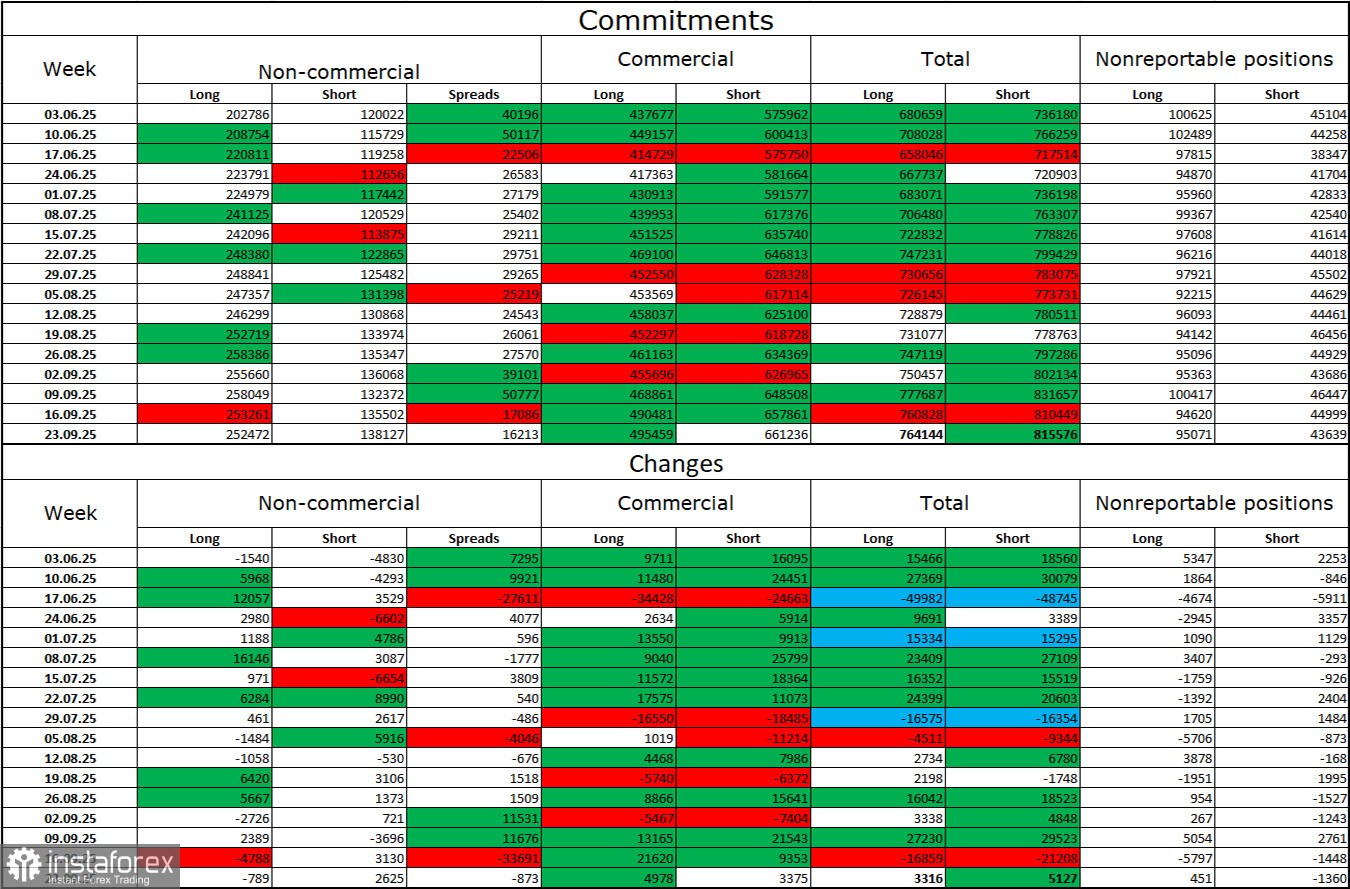

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 789 long positions and opened 2,625 short positions. The sentiment of the Non-commercial group remains bullish, largely thanks to Donald Trump, and continues to strengthen over time. The total number of long contracts held by speculators is now 252,000, while short positions amount to 138,000 — nearly a twofold difference.

In addition, note the number of green cells in the upper table, which indicate strong position-building in the euro. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For thirty-three consecutive weeks, large traders have been reducing their short positions and increasing their long ones. Donald Trump's policies remain the most significant factor for traders, as they may cause many long-term structural problems for the U.S. economy. Despite several important trade deals being signed, many key economic indicators continue to show weakness.

News Calendar for the U.S. and the Eurozone:

- U.S. – Philadelphia Fed Business Activity Index (12:30 UTC)

- Eurozone – ECB President Christine Lagarde's Speech (16:00 UTC)

On October 16, the economic calendar contains two entries, neither of which is particularly noteworthy. The influence of the news background on market sentiment on Thursday is expected to be weak.

EUR/USD Forecast and Trading Recommendations:

Sell positions may be considered upon a close below the 1.1645–1.1656 level on the hourly chart, targeting 1.1594. Buy positions could previously be considered upon a close above 1.1594, with a target of 1.1645–1.1656, which has already been reached. Today, a consolidation above 1.1645–1.1656 allows for new buy trades with a target of 1.1718.

Fibonacci grids are drawn from 1.1392–1.1919 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.