The U.S. dollar continues to lose ground against a range of risk-sensitive assets, and this comes as no surprise.

Yesterday, Federal Reserve officials once again delivered coordinated messages, preparing the market for upcoming interest rate cuts. It's clear that lowering rates would be a logical step in response to slowing global growth and persistent uncertainty surrounding international trade relations among major powers. The Fed's goal is to stimulate investment, boost consumer demand, and support the U.S. labor market.

Further growth of the euro remains in question as markets await eurozone inflation data. Economists expect a modest increase in consumer prices. If inflation holds around 2.2%, it would likely satisfy the European Central Bank for now. However, a higher-than-expected reading could signal the need for the ECB to maintain its tight policy stance, which would lend support to the euro. Additionally, a speech from Joachim Nagel, President of the Bundesbank, could influence euro dynamics. His comments regarding inflation expectations, economic growth, and future ECB policy actions will be closely watched by the market.

As for the pound, no economic reports are scheduled for the U.K. today. Only speeches from MPC member Huw Pill and Financial Policy Committee member Sarah Breeden are expected. The market will pay close attention to their remarks, especially regarding the central bank's future monetary policy direction. Investors hope to gain insight into how the Bank of England assesses current inflation trends, weak economic growth, and the labor market, as well as what steps might be taken to return inflation to the 2% target.

If the data meets economists' expectations, the suggested approach is to use the Mean Reversion strategy. If the data deviates significantly—either positively or negatively—the Momentum strategy is more appropriate.

Momentum Strategy (Breakout Trading)

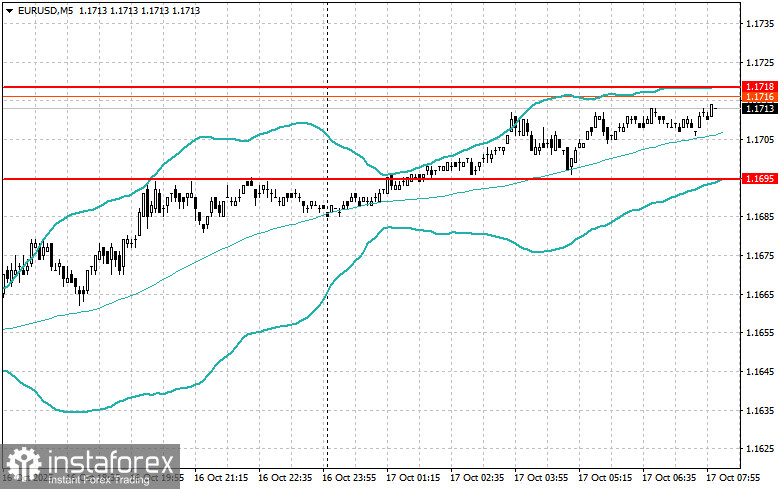

EUR/USD

Buy breakout above 1.1715, targeting 1.1746 and 1.1777

Sell breakout below 1.1700, targeting 1.1675 and 1.1644

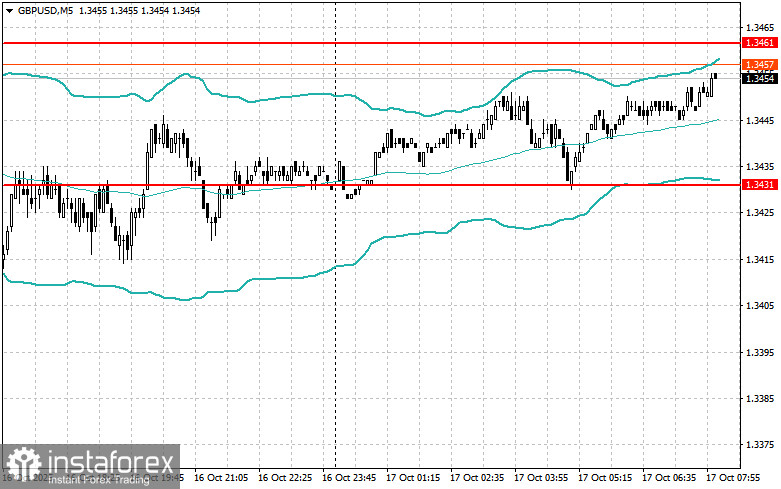

GBP/USD

Buy breakout above 1.3465, targeting 1.3490 and 1.3515

Sell breakout below 1.3435, targeting 1.3400 and 1.3371

USD/JPY

Buy breakout above 150.10, targeting 150.35 and 150.63

Sell breakout below 149.80, targeting 149.50 and 149.20

Mean Reversion Strategy (Reversal)

EUR/USD

Look to sell after a failed breakout above 1.1718 on a return below this level

Look to buy after a failed breakout below 1.1695 on a return above this level

GBP/USD

Look to sell after a failed breakout above 1.3461 on a return below this level

Look to buy after a failed breakout below 1.3431 on a return above this level

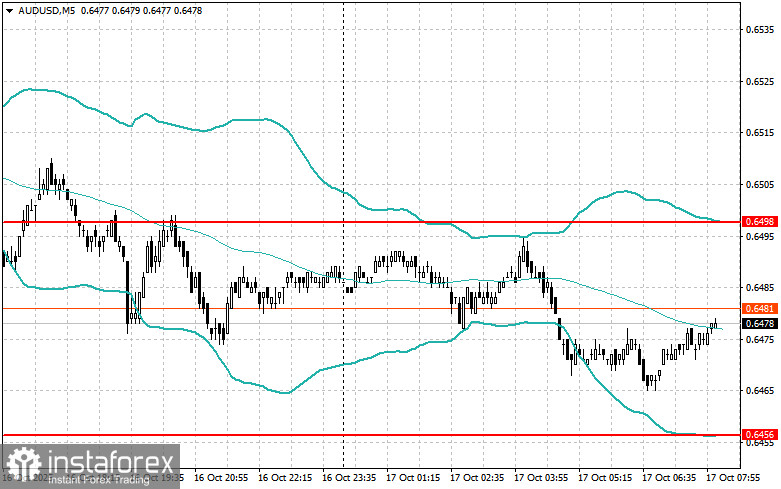

AUD/USD

Look to sell after a failed breakout above 0.6498 on a return below this level

Look to buy after a failed breakout below 0.6456 on a return above this level

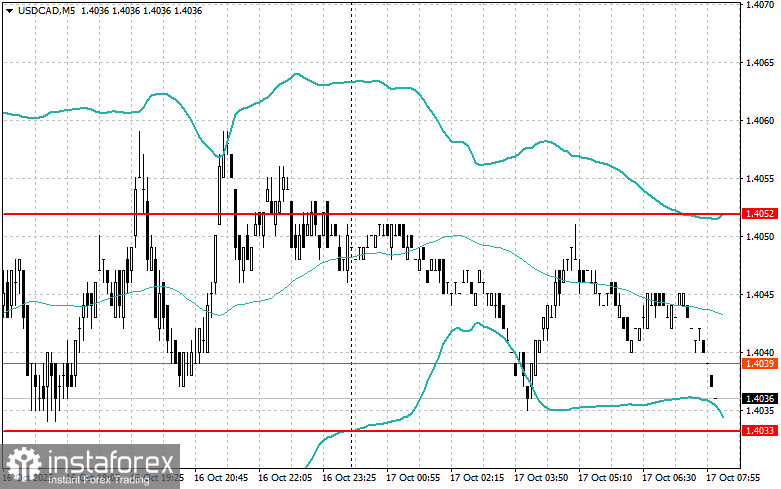

USD/CAD

Look to sell after a failed breakout above 1.4052 on a return below this level

Look to buy after a failed breakout below 1.4033 on a return above this level