Trade Analysis and Trading Tips for the Euro

The test of the 1.1666 level occurred when the MACD indicator had already climbed significantly above the zero line, which limited the pair's bullish potential. For this reason, I did not open long positions on the euro.

Yesterday's statements from Federal Reserve officials confirmed market expectations of a key rate cut at the end of the month. Most analysts agree that such a move by the Fed is justified against the backdrop of slowing economic growth and continued labor market weakness.

Today's upward momentum in the euro may face resistance due to the release of eurozone inflation data. Forecasts suggest the annual inflation rate will remain at around 2.0%, matching ECB expectations. If inflation rises too quickly, it may signal the need for the ECB to maintain its restrictive stance, which would support the euro's value.

The euro will also be influenced by a speech from Joachim Nagel, President of the Bundesbank. His commentary on inflation expectations, economic growth prospects, and the ECB's policy outlook will be closely analyzed by market participants. A hawkish tone emphasizing strict inflation control could strengthen the euro. Conversely, unexpectedly low inflation figures or dovish remarks from Nagel may reduce market interest in the euro.

As for intraday trading, I will mainly rely on the execution of scenarios No. 1 and No. 2.

Buy Scenarios

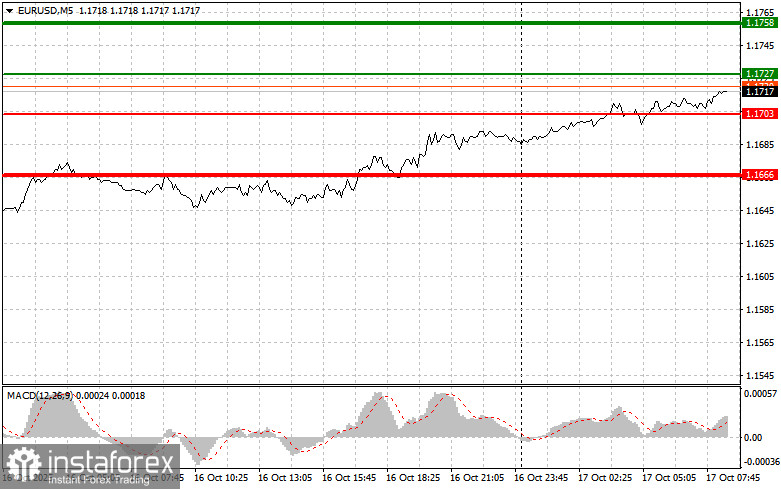

Scenario No. 1: I plan to buy the euro today if the price reaches the 1.1727 level (thin green line on the chart), targeting a rise toward 1.1758. Around 1.1758 (thick green line), I plan to exit long positions and possibly open a short position on the pullback, expecting a 30–35 pip move in the opposite direction. Buying is recommended only if the economic data is favorable. Note: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro in the event of two consecutive tests of the 1.1703 level, provided that the MACD indicator is located in the oversold zone. This would limit the downside potential and could trigger an upward reversal. In this case, a move toward 1.1727 and 1.1758 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the euro upon reaching the 1.1703 level (thin red line on the chart), targeting a decline toward 1.1666 (thick red line). I plan to exit the position there and open a long position on the rebound, aiming for a 20–25 pip reverse move. Selling would be justified in response to dovish comments from Nagel. Note: Before selling, make sure the MACD indicator is below the zero line and just starting its descent.

Scenario No. 2: I also plan to sell the euro if 1.1727 is tested twice while the MACD indicator is in the overbought zone. This would limit the upward potential and could lead to a reversal to the downside. A decline toward 1.1703 and 1.1666 is likely in this case.

What the Chart Shows:

- Thin green line: the entry price for opening long (buy) positions

- Thick green line: the anticipated price level where Take Profit can be set, or profit manually fixed, as further growth above this level is unlikely

- Thin red line: the entry price for opening short (sell) positions

- Thick red line: the anticipated level where Take Profit can be set, or profit manually fixed, as further decline below this area is improbable

- MACD Indicator: zone-based entry logic using overbought and oversold areas

Important Note for Beginners:

Beginner traders in the Forex market must be especially cautious when entering trades. It is best to stay out of the market during the release of important economic reports to avoid getting caught in sharp and unpredictable price swings.

If you choose to trade around news announcements, always place stop-loss orders to manage risk. Without a stop-loss, your entire account could be wiped out quickly—especially if you ignore money management principles and trade with oversized positions.

And remember: for successful trading, a clear plan—such as the one presented above—is essential. Spontaneous decision-making based on market noise is an inherently losing strategy for intraday traders.