Bitcoin and Ethereum continue to lose ground. It now appears likely that the scenario involving a move down to $106,000 for Bitcoin will play out in the coming days. All focus is now on this level. A breakout below $106,000 could lead to a decline toward the $100,000 area—a critical test for the long-term bullish trend. Ethereum has fallen below the $4,000 mark and could easily retreat to $3,500.

Meanwhile, Florida has withdrawn two state-level bills aimed at creating a strategic BTC reserve. With this, Florida joins other states such as Wyoming, Pennsylvania, and Oklahoma, where similar initiatives related to Bitcoin investment failed to pass legislative approval.

The reasons behind Florida's decision remain disputed. Some experts point to the inherent volatility in the crypto market, making such investments too risky for public funds. Others believe lawmakers failed to agree on the required legal framework for managing and securing digital assets. Despite Florida's move, crypto advocates continue to actively promote the creation of state-level BTC reserves, arguing that such reserves would diversify portfolios, hedge against inflation, and demonstrate a commitment to innovation.

Regarding intraday strategy, the focus remains on major dips in Bitcoin and Ethereum with the view that the medium-term bullish trend is still intact.

Below are scenarios for short-term trading:

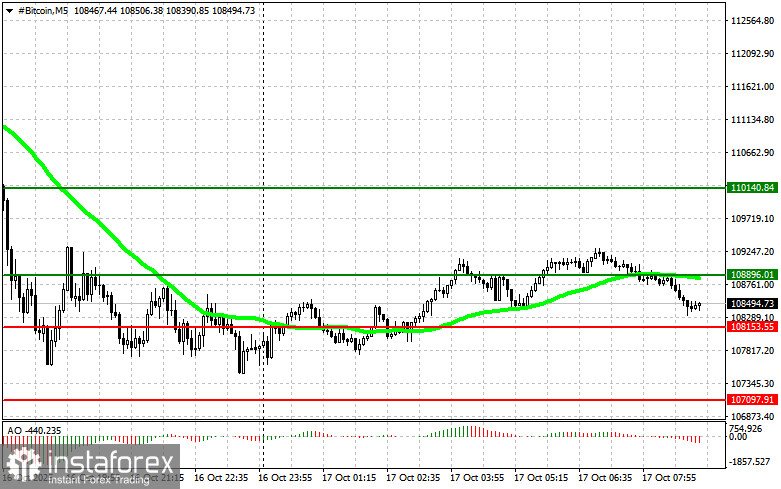

Bitcoin

Buy Scenario

Scenario 1: I will buy Bitcoin today upon reaching an entry point near $108,800, targeting a rise to $110,100. Around the $110,100 level, I will exit long trades and open short positions on the rebound. Before buying a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: I will also consider buying Bitcoin from the lower boundary at $108,100, provided there is no bearish market reaction to a breakout below this level. The targets will be $108,800 and $110,100.

Sell Scenario

Scenario 1: I will sell Bitcoin upon reaching the $108,100 level, targeting a decline to $107,000. Around $107,000, I will exit shorts and consider buying on a bounce. Before selling the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: I will also consider selling Bitcoin from the upper boundary at $108,800, provided there is no bullish reaction to the breakout. The downside targets will be $108,100 and $107,000.

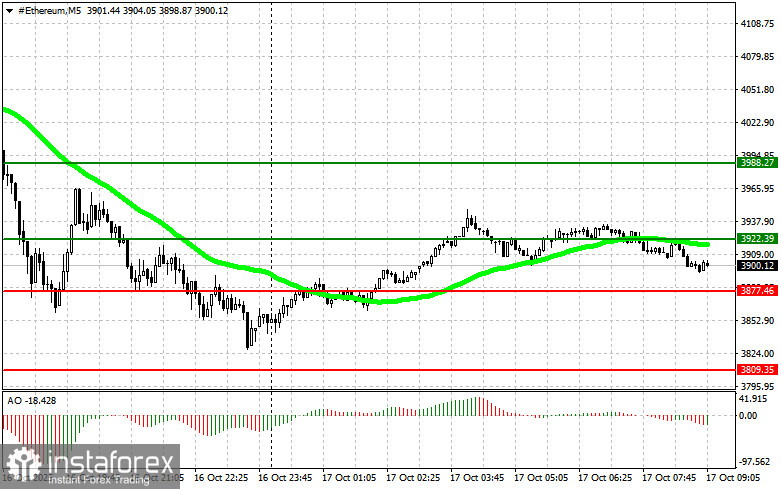

Ethereum

Buy Scenario

Scenario 1: I will buy Ethereum at the entry zone around $3,922 with an upward target at $3,988. At $3,988, I'll exit the long trade and look to sell on a rebound. Before entering a breakout buy, verify that the 50-day moving average is below the current price and the Awesome Oscillator is positive.

Scenario 2: Buying is also possible from the lower range at $3,877, provided no market reaction confirms a bearish breakout. The targets will be $3,922 and $3,988.

Sell Scenario

Scenario 1: I will sell Ethereum at an entry point near $3,877, aiming for a decline to $3,809. At $3,809, I'll exit short positions and consider buying on a rebound. Before selling, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: I will also consider selling from the upper level of $3,922 if no bullish reaction confirms a breakout. Downside targets: $3,877 and $3,809.