Tensions between the U.S. and China remain unresolved. "If we don't get a deal, there will be a trade war," said Donald Trump. And if it weren't for a 100% tariff, he added, "America would be treated like a doormat." The president, as usual, made his statements after market close—but even without aggressive rhetoric like this, the S&P 500 had enough reasons to turn lower.

Any financial system relies not only on its largest players. While major institutions such as Goldman Sachs and Bank of America posted strong corporate earnings, mid-sized and smaller banks disappointed. Several regional institutions revealed issues with fraudulent lending activity, reawakening investor fears of bad loan losses and raising new questions about broader economic stability.

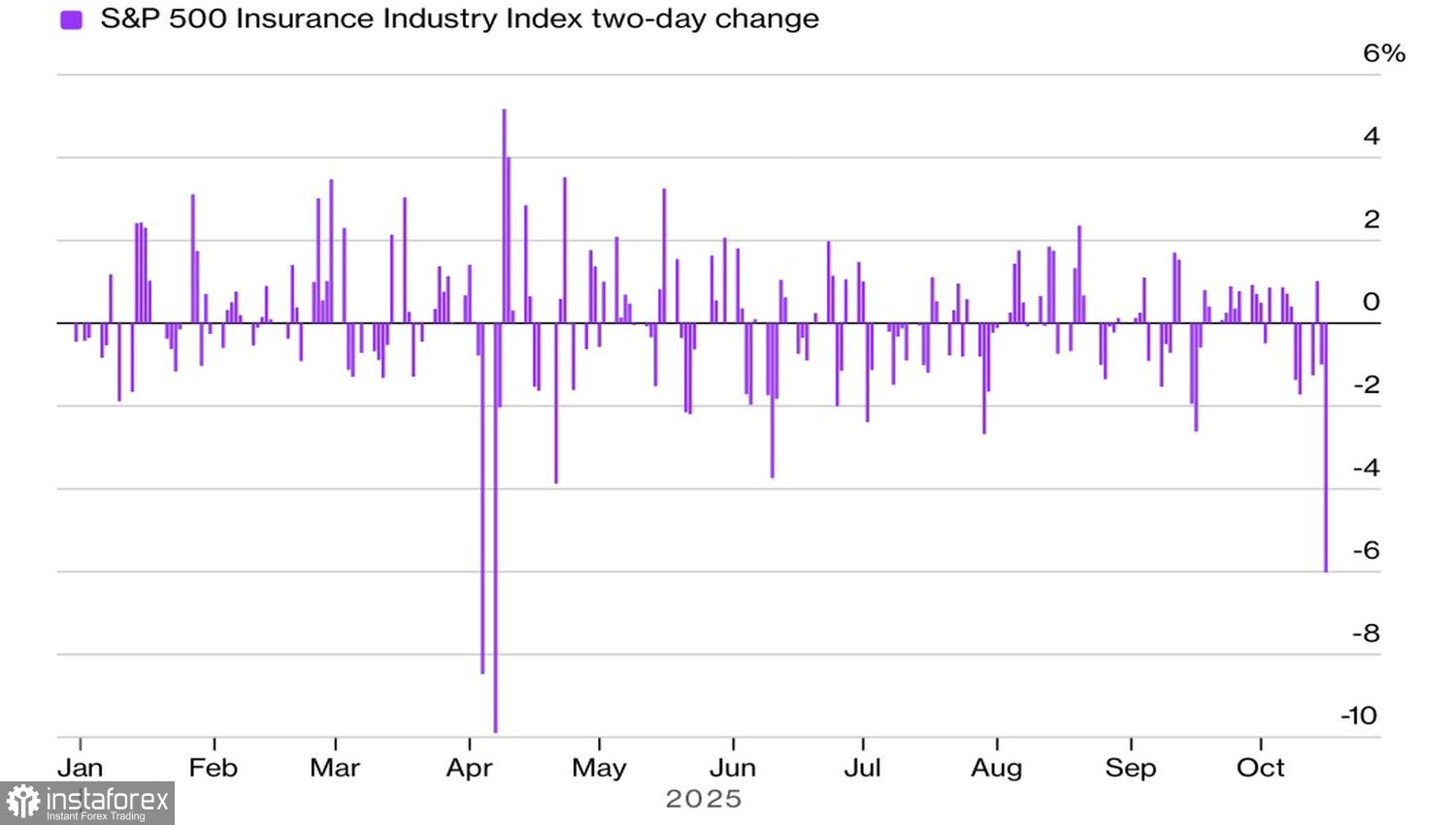

To make matters worse, disappointing earnings from insurance companies triggered the sharpest two-day sector decline since April's Patriot Day selloff.

Insurance Industry Index Performance

The combined weakness in banking and insurance is signaling signs of a broader economic cooling. However, those signals remain difficult to confirm, as the U.S. government remains partially shut down. As a result, the Federal Reserve is essentially flying blind in its current cycle of monetary expansion. Even the most dovish members of the FOMC are beginning to call for caution.

FOMC member Christopher Waller emphasized this concern, noting that after a federal funds rate cut in October, the central bank should think twice—maybe seven times—before making the next move. Waller pointed out the disconnect between strong economic growth and a softening labor market, a combination that "shouldn't coexist." He highlighted that either GDP will have to slow soon, or employment will pick up. The Fed, he stated, "must remain vigilant and be data dependent." But therein lies the fundamental problem: the necessary data isn't available.

This is the ironic twist. While Donald Trump demands aggressive rate cuts, the Fed cannot proceed with further easing without hard labor market data to fully support such a decision. On the other hand, any signs of labor market recovery would altogether kill the case for another rate cut in December.

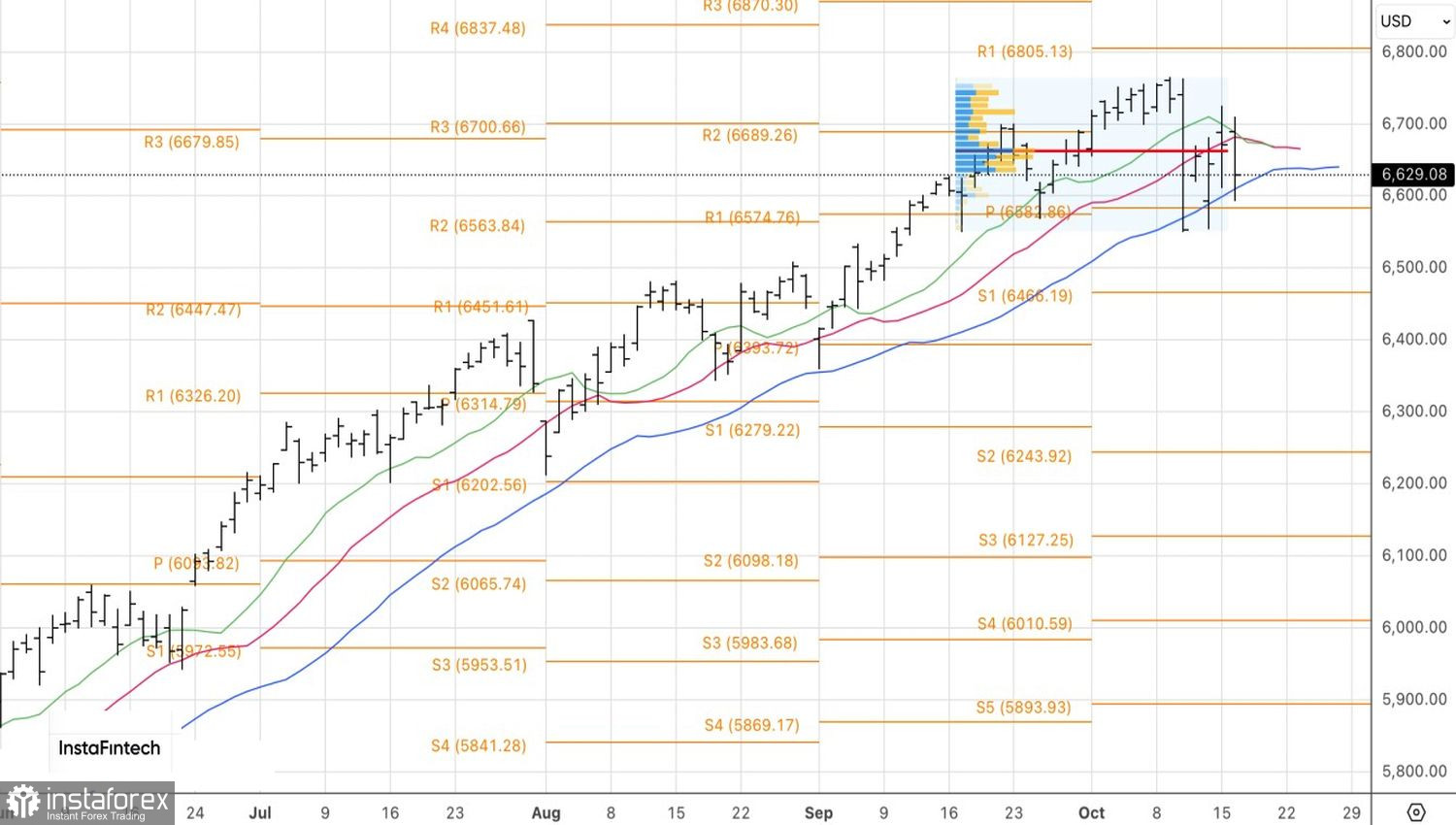

The Fed finds itself in limbo—and markets can no longer rely on aggressive monetary stimulus in the near term. This undermines the S&P 500's ability to push higher. Add in persistent trade war uncertainty, and the result is understandable investor anxiety. Until the outcome of the latest round of negotiations between Washington and Beijing becomes clear, expect continued nervousness. Uncertainty is elevating volatility levels, and the recent VIX fear index rally is likely to result in either further correction or consolidation in the broader stock market.

On the daily chart, the S&P 500 is clearly shifting from a trending phase to range-bound trading. As previously anticipated, the bulls' inability to sustain gains above the 6725 level is a sign of weakening buying power and a cue for sellers. A drop below the 6590 and 6570 support areas would open the door for further short positions and deepen the market correction.